Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 1, 2021, Red Green Company (RGC) purchased 6% bonds having a maturity value of $100,000 for $103,585. The bonds provide the bondholders

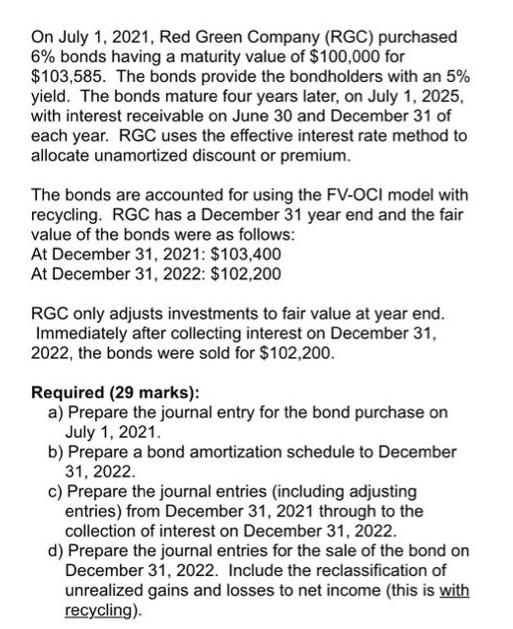

On July 1, 2021, Red Green Company (RGC) purchased 6% bonds having a maturity value of $100,000 for $103,585. The bonds provide the bondholders with an 5% yield. The bonds mature four years later, on July 1, 2025, with interest receivable on June 30 and December 31 of each year. RGC uses the effective interest rate method to allocate unamortized discount or premium. The bonds are accounted for using the FV-OCI model with recycling. RGC has a December 31 year end and the fair value of the bonds were as follows: At December 31, 2021: $103,400 At December 31, 2022: $102,200 RGC only adjusts investments to fair value at year end. Immediately after collecting interest on December 31, 2022, the bonds were sold for $102,200. Required (29 marks): a) Prepare the journal entry for the bond purchase on July 1, 2021. b) Prepare a bond amortization schedule to December 31, 2022. c) Prepare the journal entries (including adjusting entries) from December 31, 2021 through to the collection of interest on December 31, 2022. d) Prepare the journal entries for the sale of the bond on December 31, 2022. Include the reclassification of unrealized gains and losses to net income (this is with recycling).

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Required 1 Date Account Dr Cr 20210701 Investment In Debt Securities 103585 Cash 103585 To record purchase of 6 bonds wuth face value 100000 at a prem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started