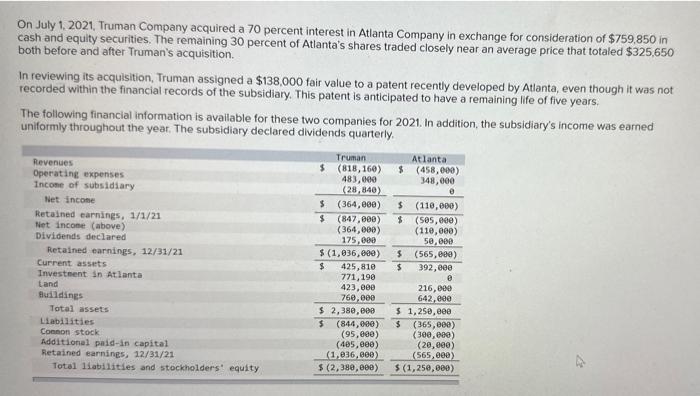

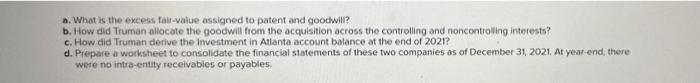

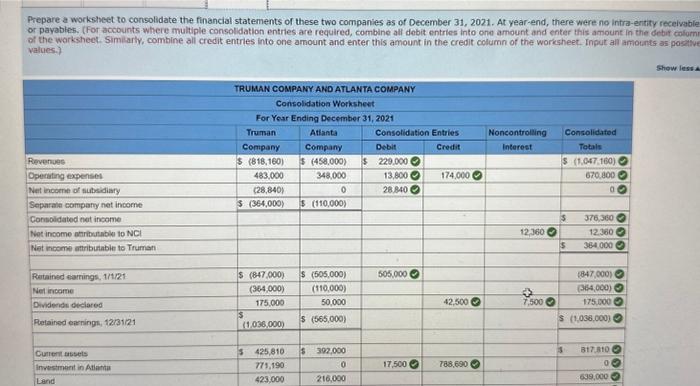

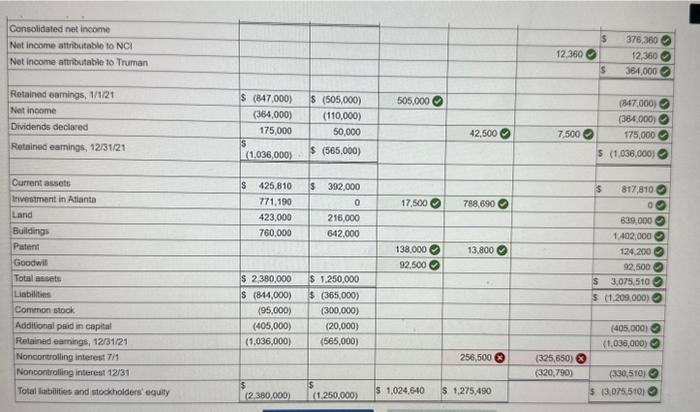

On July 1, 2021, Truman Company acquired a 70 percent interest in Atlanta Company in exchange for consideration of $759.850 in cash and equity securities. The remaining 30 percent of Atlanta's shares traded closely near an average price that totaled $325,650 both before and after Truman's acquisition. In reviewing its acquisition, Truman assigned a $138,000 fair value to a patent recently developed by Atlanta, even though it was not recorded within the financial records of the subsidiary. This patent is anticipated to have a remaining life of five years. The following financial information is available for these two companies for 2021. In addition, the subsidiary's income was earned uniformly throughout the year. The subsidiary declared dividends quarterly. a. What is the excess fair-value assigned to patent and goodwill? b. How did Truman allocate the goodwill from the acquisition across the controlling and noncontroling interests? c. How did Truman derive the investment in Atlanta account balance at the end of 2021 ? d. Prepare a worksheet to consolidate the financlal statements of these two companies as of December 31, 2021. At yeat-end, there were no intra-enity receivabies or payables. Prepare a worksheet to consolidate the financial statements or these two companies as of December 31,2021 . At year-end, there were no intra-entity receivab or payables. (For accounts- where multiple consolidation entries are required, combine alf debit entries into one amount and enter this amount in the debit color of the warksheet. Similarly, combine all credit entries into one arnount and enter this amount in the credit column of the worksheet. Input all amounts as posith values.? On July 1, 2021, Truman Company acquired a 70 percent interest in Atlanta Company in exchange for consideration of $759.850 in cash and equity securities. The remaining 30 percent of Atlanta's shares traded closely near an average price that totaled $325,650 both before and after Truman's acquisition. In reviewing its acquisition, Truman assigned a $138,000 fair value to a patent recently developed by Atlanta, even though it was not recorded within the financial records of the subsidiary. This patent is anticipated to have a remaining life of five years. The following financial information is available for these two companies for 2021. In addition, the subsidiary's income was earned uniformly throughout the year. The subsidiary declared dividends quarterly. a. What is the excess fair-value assigned to patent and goodwill? b. How did Truman allocate the goodwill from the acquisition across the controlling and noncontroling interests? c. How did Truman derive the investment in Atlanta account balance at the end of 2021 ? d. Prepare a worksheet to consolidate the financlal statements of these two companies as of December 31, 2021. At yeat-end, there were no intra-enity receivabies or payables. Prepare a worksheet to consolidate the financial statements or these two companies as of December 31,2021 . At year-end, there were no intra-entity receivab or payables. (For accounts- where multiple consolidation entries are required, combine alf debit entries into one amount and enter this amount in the debit color of the warksheet. Similarly, combine all credit entries into one arnount and enter this amount in the credit column of the worksheet. Input all amounts as posith values