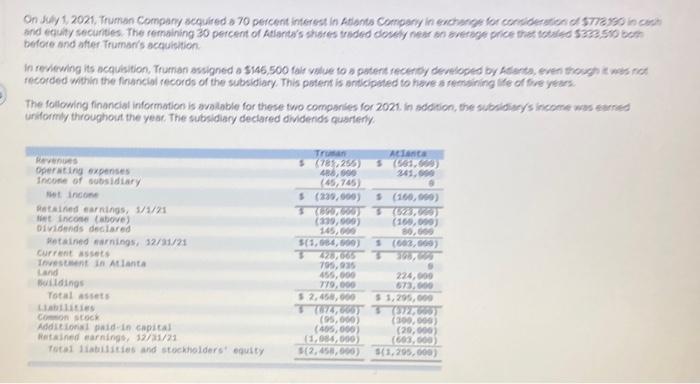

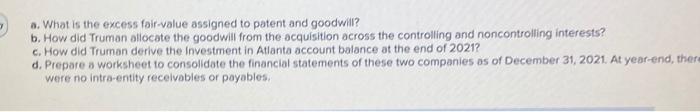

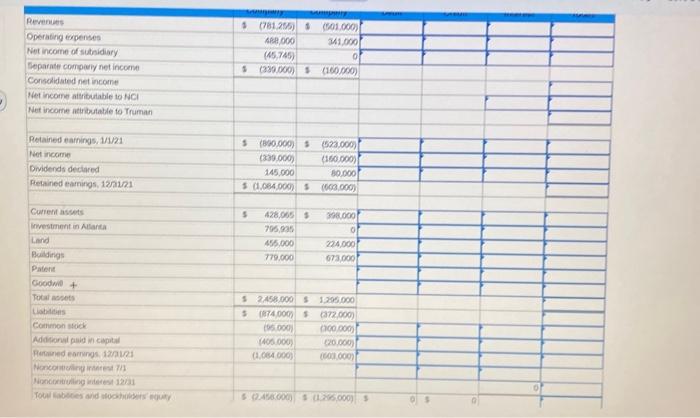

On July 1. 2021, Truman Company scquirsd o 70 percent intersst in Ationts Company in snchange for considerstion of 5773130 in ces? befcce and atter Truman's acquieltion. In reviewing its acquisition, Truman assigned a 5146,500 falr value to a potent receriby developed by Astanta, even thosgh it wes not fecorded whthin the financial records of the subsidiary. This potent is antlipbted to have a reensining life of fore yoses. The following financial information is avalable for these two componies for 2021. in sddition, the subiliscys income was zarned uniformly throughoia the yese. The subsidiscy declared dividends quarteryy a. What is the excess fair-value assigned to patent and goodwill? b. How did Truman allocate the goodwill from the acquisition across the controlling and noncontrolling interests? c. How did Truman derive the Investment in Atlanta account balance at the end of 2021 ? d. Prepare a worksheet to consolidate the financial statements of these two companies as of December 31, 2021, At year-end, ther were no intra-entity recelvables or payables. On July 1. 2021, Truman Company scquirsd o 70 percent intersst in Ationts Company in snchange for considerstion of 5773130 in ces? befcce and atter Truman's acquieltion. In reviewing its acquisition, Truman assigned a 5146,500 falr value to a potent receriby developed by Astanta, even thosgh it wes not fecorded whthin the financial records of the subsidiary. This potent is antlipbted to have a reensining life of fore yoses. The following financial information is avalable for these two componies for 2021. in sddition, the subiliscys income was zarned uniformly throughoia the yese. The subsidiscy declared dividends quarteryy a. What is the excess fair-value assigned to patent and goodwill? b. How did Truman allocate the goodwill from the acquisition across the controlling and noncontrolling interests? c. How did Truman derive the Investment in Atlanta account balance at the end of 2021 ? d. Prepare a worksheet to consolidate the financial statements of these two companies as of December 31, 2021, At year-end, ther were no intra-entity recelvables or payables