Answered step by step

Verified Expert Solution

Question

1 Approved Answer

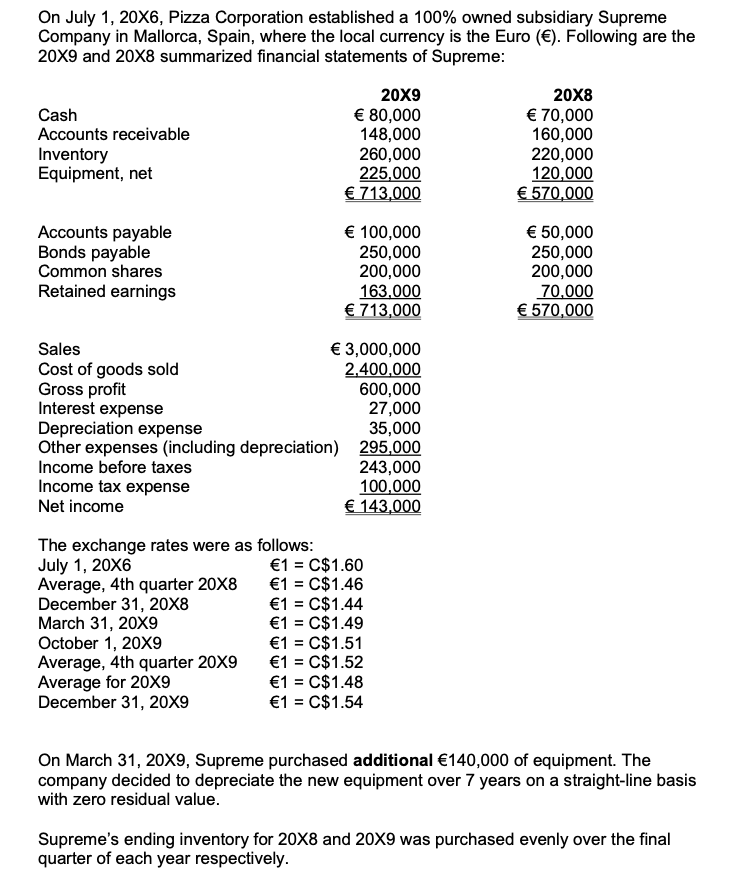

On July 1, 20X6, Pizza Corporation established a 100% owned subsidiary Supreme Company in Mallorca, Spain, where the local currency is the Euro ().

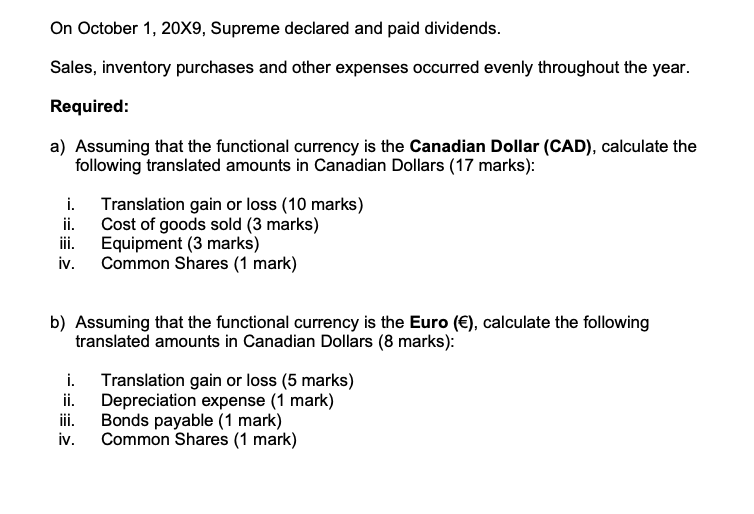

On July 1, 20X6, Pizza Corporation established a 100% owned subsidiary Supreme Company in Mallorca, Spain, where the local currency is the Euro (). Following are the 20X9 and 20X8 summarized financial statements of Supreme: Cash Accounts receivable Inventory Equipment, net Accounts payable Bonds payable Common shares Retained earnings 20X9 80,000 148,000 260,000 225,000 713,000 100,000 250,000 200,000 163,000 20X8 70,000 160,000 220,000 120,000 570,000 50,000 250,000 200,000 70,000 570,000 713,000 Sales 3,000,000 Cost of goods sold 2,400,000 Gross profit 600,000 Interest expense 27,000 Depreciation expense 35,000 Other expenses (including depreciation) 295,000 Income before taxes 243,000 Income tax expense 100,000 Net income 143,000 The exchange rates were as follows: July 1, 20X6 1 = C$1.60 Average, 4th quarter 20X8 1 = C$1.46 December 31, 20X8 1 = C$1.44 March 31, 20X9 1 = C$1.49 October 1, 20X9 1 = C$1.51 Average, 4th quarter 20X9 1 = C$1.52 Average for 20X9 1 = C$1.48 December 31, 20X9 1 = C$1.54 On March 31, 20X9, Supreme purchased additional 140,000 of equipment. The company decided to depreciate the new equipment over 7 years on a straight-line basis with zero residual value. Supreme's ending inventory for 20X8 and 20X9 was purchased evenly over the final quarter of each year respectively. On October 1, 20X9, Supreme declared and paid dividends. Sales, inventory purchases and other expenses occurred evenly throughout the year. Required: a) Assuming that the functional currency is the Canadian Dollar (CAD), calculate the following translated amounts in Canadian Dollars (17 marks): i. ii. iii. Translation gain or loss (10 marks) Cost of goods sold (3 marks) Equipment (3 marks) iv. Common Shares (1 mark) b) Assuming that the functional currency is the Euro (), calculate the following translated amounts in Canadian Dollars (8 marks): i. Translation gain or loss (5 marks) Depreciation expense (1 mark) ii. iii. Bonds payable (1 mark) iv. Common Shares (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Supreme Company Translation Analysis Functional Currency Canadian Dollar CAD a Translation Amounts i Translation Gain or Loss 10 marks We need to tran...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started