Answered step by step

Verified Expert Solution

Question

1 Approved Answer

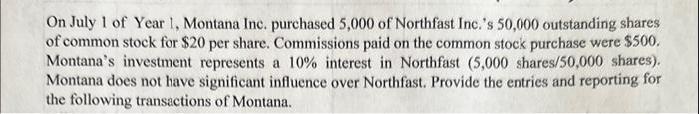

On July 1 of Year 1, Montana Inc. purchased 5,000 of Northfast Inc.'s 50,000 outstanding shares of common stock for $20 per share. Commissions

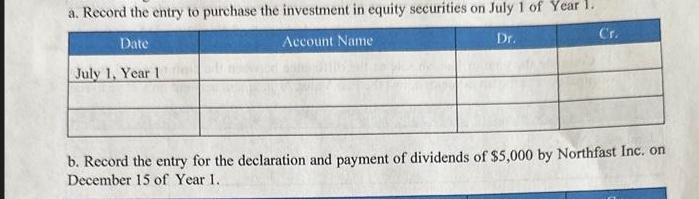

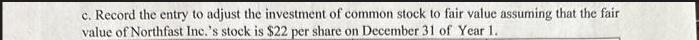

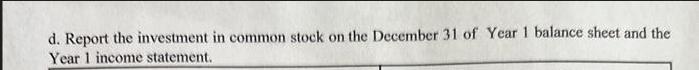

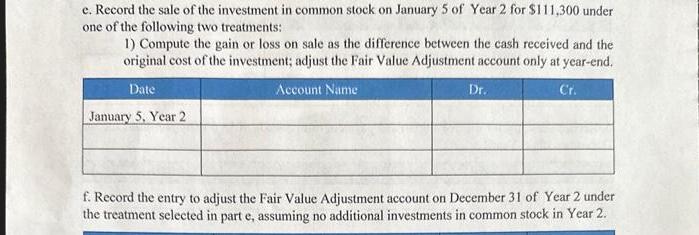

On July 1 of Year 1, Montana Inc. purchased 5,000 of Northfast Inc.'s 50,000 outstanding shares of common stock for $20 per share. Commissions paid on the common stock purchase were $500. Montana's investment represents a 10% interest in Northfast (5,000 shares/50,000 shares). Montana does not have significant influence over Northfast. Provide the entries and reporting for the following transactions of Montana. a. Record the entry to purchase the investment in equity securities on July 1 of Year 1. Date Account Name Dr. Cr. July 1, Year 1 b. Record the entry for the declaration and payment of dividends of $5,000 by Northfast Inc. on December 15 of Year 1. c. Record the entry to adjust the investment of common stock to fair value assuming that the fair value of Northfast Inc.'s stock is $22 per share on December 31 of Year 1. d. Report the investment in common stock on the December 31 of Year 1 balance sheet and the Year 1 income statement. e. Record the sale of the investment in common stock on January 5 of Year 2 for $111,300 under one of the following two treatments: 1) Compute the gain or loss on sale as the difference between the cash received and the original cost of the investment; adjust the Fair Value Adjustment account only at year-end. Date Account Name Cr. January 5, Year 2 Dr. f. Record the entry to adjust the Fair Value Adjustment account on December 31 of Year 2 under the treatment selected in part e, assuming no additional investments in common stock in Year 2.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a Record the entry to purchase the investment in equity securities on July 1 of Year 1 Date A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started