Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 1, 2017, Global Satellites Corporation issued $1,390,000 of 10-year, 8% bonds to yield a market interest rate of 7%. The bonds pay

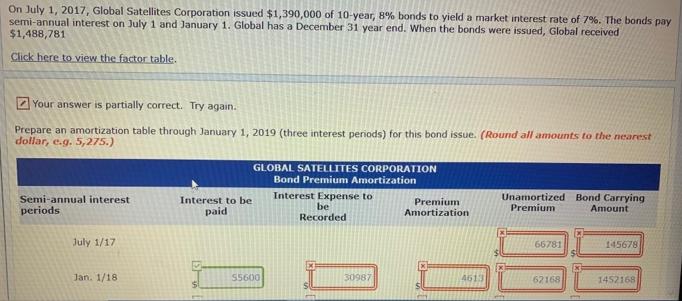

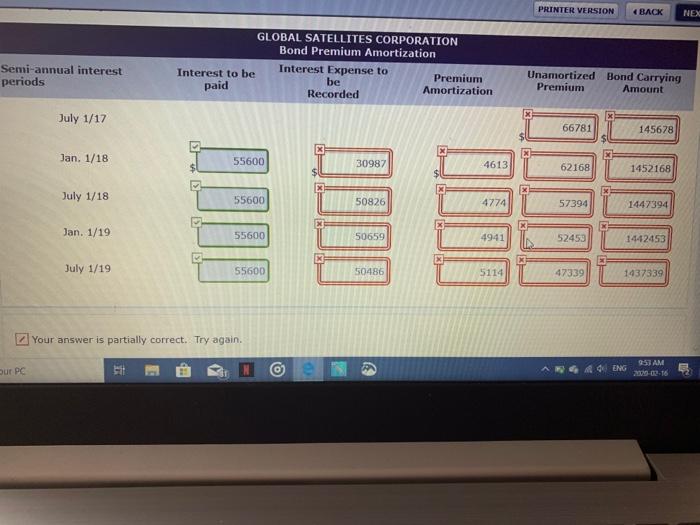

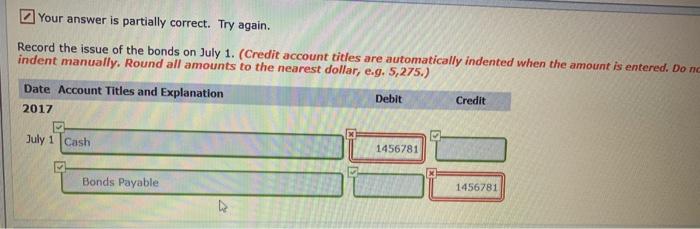

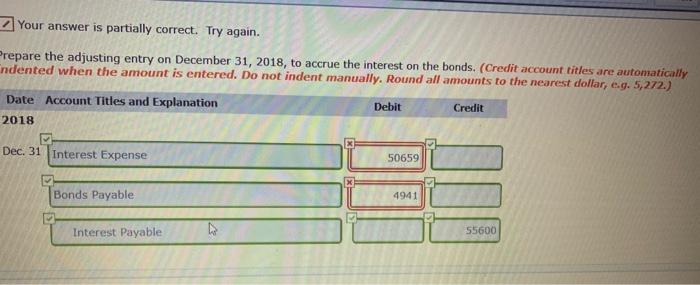

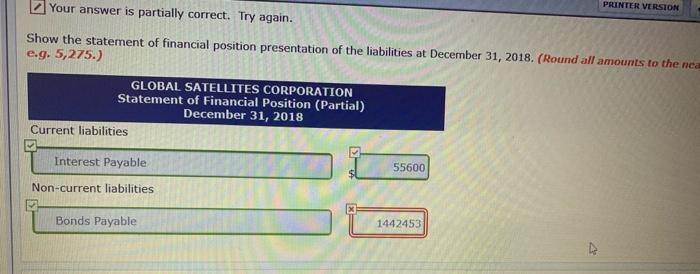

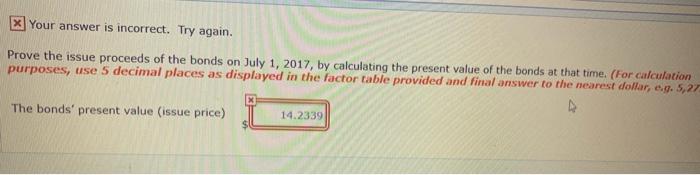

On July 1, 2017, Global Satellites Corporation issued $1,390,000 of 10-year, 8% bonds to yield a market interest rate of 7%. The bonds pay semi-annual interest on July 1 and January 1. Global has a December 31 year end. When the bonds were issued, Global received $1,488,781 Click here to view the factor table. 2 Your answer is partially correct. Try again. Prepare an amortization table through January 1, 2019 (three interest periods) for this bond issue. (Round all amounts to the nearest dollar, e.g. 5,275.) GLOBAL SATELLITES CORPORATION Bond Premium Amortization Semi-annual interest periods Interest paid Interest Expense to be Recorded Unamortized Bond Carrying Premium be Premium Amortization Amount July 1/17 66781 145678 Jan. 1/18 S5600 30987 4613 62168 1452168 PRINTER VERSION 4 BACK NEX GLOBAL SATELLITES CORPORATION Bond Premium Amortization Semi-annual interest Interest Expense to be Recorded Interest to be Premium Amortization Unamortized Bond Carrying Premium periods paid Amount July 1/17 66781 145678 Jan. 1/18 55600 30987 4613 62168 1452168 July 1/18 55600 50826 4774 57394 1447394 Jan. 1/19 55600 50659 52453 4941 1442453 July 1/19 55600 50486 1437339 5114 47339 Z Your answer is partially correct. Try again. 953 AM our PC A ENG 2020-02-16 Your answer is partially correct. Try again. Record the issue of the bonds on July 1. (Credit account titles are automatically indented when the amount is entered. Do nc indent manually. Round all amounts to the nearest dollar, e.g. 5,275.) Date Account Titles and Explanation Debit Credit 2017 July 1 Cash 1456781 Bonds Payable 1456781 Your answer is partially correct. Try again. Prepare the adjusting entry on December 31, 2018, to accrue the interest on the bonds. (Credit account titles are automatically ndented when the amount is entered. Do not indent manually. Round all amounts to the nearest dollar, e.g. 5,272.) Date Account Titles and Explanation Debit Credit 2018 Dec. 31 Interest Expense 50659 4941 Bonds Payable 55600 Interest Payable PRINTER VERSION Your answer is partially correct. Try again. Show the statement of financial position presentation of the liabilities at December 31, 2018. (Round all amounts to the nca e.g. 5,275.) GLOBAL SATELLITES CORPORATION Statement of Financial Position (Partial) December 31, 2018 Current liabilities Interest Payable 55600 Non-current liabilities 1442453 Bonds Payable X Your answer is incorrect. Try again. Prove the issue proceeds of the bonds on July 1, 2017, by calculating the present value of the bonds at that time. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answer to the nearest dollar, eg. 5,27 The bonds' present value (issue price) 14.2339 On July 1, 2017, Global Satellites Corporation issued $1,390,000 of 10-year, 8% bonds to yield a market interest rate of 7%. The bonds pay semi-annual interest on July 1 and January 1. Global has a December 31 year end. When the bonds were issued, Global received $1,488,781 Click here to view the factor table. 2 Your answer is partially correct. Try again. Prepare an amortization table through January 1, 2019 (three interest periods) for this bond issue. (Round all amounts to the nearest dollar, e.g. 5,275.) GLOBAL SATELLITES CORPORATION Bond Premium Amortization Semi-annual interest periods Interest paid Interest Expense to be Recorded Unamortized Bond Carrying Premium be Premium Amortization Amount July 1/17 66781 145678 Jan. 1/18 S5600 30987 4613 62168 1452168 PRINTER VERSION 4 BACK NEX GLOBAL SATELLITES CORPORATION Bond Premium Amortization Semi-annual interest Interest Expense to be Recorded Interest to be Premium Amortization Unamortized Bond Carrying Premium periods paid Amount July 1/17 66781 145678 Jan. 1/18 55600 30987 4613 62168 1452168 July 1/18 55600 50826 4774 57394 1447394 Jan. 1/19 55600 50659 52453 4941 1442453 July 1/19 55600 50486 1437339 5114 47339 Z Your answer is partially correct. Try again. 953 AM our PC A ENG 2020-02-16 Your answer is partially correct. Try again. Record the issue of the bonds on July 1. (Credit account titles are automatically indented when the amount is entered. Do nc indent manually. Round all amounts to the nearest dollar, e.g. 5,275.) Date Account Titles and Explanation Debit Credit 2017 July 1 Cash 1456781 Bonds Payable 1456781 Your answer is partially correct. Try again. Prepare the adjusting entry on December 31, 2018, to accrue the interest on the bonds. (Credit account titles are automatically ndented when the amount is entered. Do not indent manually. Round all amounts to the nearest dollar, e.g. 5,272.) Date Account Titles and Explanation Debit Credit 2018 Dec. 31 Interest Expense 50659 4941 Bonds Payable 55600 Interest Payable PRINTER VERSION Your answer is partially correct. Try again. Show the statement of financial position presentation of the liabilities at December 31, 2018. (Round all amounts to the nca e.g. 5,275.) GLOBAL SATELLITES CORPORATION Statement of Financial Position (Partial) December 31, 2018 Current liabilities Interest Payable 55600 Non-current liabilities 1442453 Bonds Payable X Your answer is incorrect. Try again. Prove the issue proceeds of the bonds on July 1, 2017, by calculating the present value of the bonds at that time. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answer to the nearest dollar, eg. 5,27 The bonds' present value (issue price) 14.2339 On July 1, 2017, Global Satellites Corporation issued $1,390,000 of 10-year, 8% bonds to yield a market interest rate of 7%. The bonds pay semi-annual interest on July 1 and January 1. Global has a December 31 year end. When the bonds were issued, Global received $1,488,781 Click here to view the factor table. 2 Your answer is partially correct. Try again. Prepare an amortization table through January 1, 2019 (three interest periods) for this bond issue. (Round all amounts to the nearest dollar, e.g. 5,275.) GLOBAL SATELLITES CORPORATION Bond Premium Amortization Semi-annual interest periods Interest paid Interest Expense to be Recorded Unamortized Bond Carrying Premium be Premium Amortization Amount July 1/17 66781 145678 Jan. 1/18 S5600 30987 4613 62168 1452168 PRINTER VERSION 4 BACK NEX GLOBAL SATELLITES CORPORATION Bond Premium Amortization Semi-annual interest Interest Expense to be Recorded Interest to be Premium Amortization Unamortized Bond Carrying Premium periods paid Amount July 1/17 66781 145678 Jan. 1/18 55600 30987 4613 62168 1452168 July 1/18 55600 50826 4774 57394 1447394 Jan. 1/19 55600 50659 52453 4941 1442453 July 1/19 55600 50486 1437339 5114 47339 Z Your answer is partially correct. Try again. 953 AM our PC A ENG 2020-02-16 Your answer is partially correct. Try again. Record the issue of the bonds on July 1. (Credit account titles are automatically indented when the amount is entered. Do nc indent manually. Round all amounts to the nearest dollar, e.g. 5,275.) Date Account Titles and Explanation Debit Credit 2017 July 1 Cash 1456781 Bonds Payable 1456781 Your answer is partially correct. Try again. Prepare the adjusting entry on December 31, 2018, to accrue the interest on the bonds. (Credit account titles are automatically ndented when the amount is entered. Do not indent manually. Round all amounts to the nearest dollar, e.g. 5,272.) Date Account Titles and Explanation Debit Credit 2018 Dec. 31 Interest Expense 50659 4941 Bonds Payable 55600 Interest Payable PRINTER VERSION Your answer is partially correct. Try again. Show the statement of financial position presentation of the liabilities at December 31, 2018. (Round all amounts to the nca e.g. 5,275.) GLOBAL SATELLITES CORPORATION Statement of Financial Position (Partial) December 31, 2018 Current liabilities Interest Payable 55600 Non-current liabilities 1442453 Bonds Payable X Your answer is incorrect. Try again. Prove the issue proceeds of the bonds on July 1, 2017, by calculating the present value of the bonds at that time. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answer to the nearest dollar, eg. 5,27 The bonds' present value (issue price) 14.2339

Step by Step Solution

★★★★★

3.60 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Amortization table Col I Col II Col III Col IV Col V Date Interest Payment13900004 Interest expensesCol V35 Premium amorrtizationCol I Col II Unamortized Premium Bond carrying amount 01Jul17 98781 1488781 01Jan18 55600 52107 3493 95288 1485288 01Jul18 55600 51985 3615 91673 1481673 01Jan19 55600 51859 3741 87932 1477932 01Jul19 55600 51728 3872 84060 1474060 Date Accounts and explanation Debitin Creditin 01Jul17 Cash 1488781 Bonds Payable 1390000 Premium on Bond Payable 98781 31Dec18 Interest expenses ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started