Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 1,2022 , Burrough Company acquired 124,000 of the outstanding shares of Carter Company for $13 per share. This acquisition gave Burrough a 25

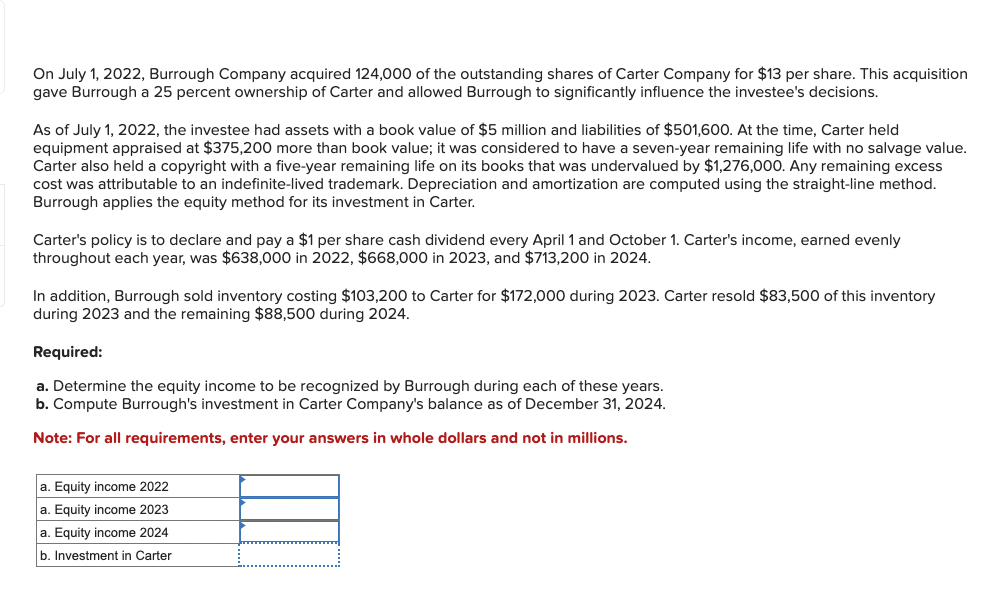

On July 1,2022 , Burrough Company acquired 124,000 of the outstanding shares of Carter Company for $13 per share. This acquisition gave Burrough a 25 percent ownership of Carter and allowed Burrough to significantly influence the investee's decisions. As of July 1, 2022, the investee had assets with a book value of $5 million and liabilities of $501,600. At the time, Carter held equipment appraised at $375,200 more than book value; it was considered to have a seven-year remaining life with no salvage value. Carter also held a copyright with a five-year remaining life on its books that was undervalued by $1,276,000. Any remaining excess cost was attributable to an indefinite-lived trademark. Depreciation and amortization are computed using the straight-line method. Burrough applies the equity method for its investment in Carter. Carter's policy is to declare and pay a $1 per share cash dividend every April 1 and October 1 . Carter's income, earned evenly throughout each year, was $638,000 in 2022, $668,000 in 2023, and $713,200 in 2024. In addition, Burrough sold inventory costing $103,200 to Carter for $172,000 during 2023 . Carter resold $83,500 of this inventory during 2023 and the remaining $88,500 during 2024 . Required: a. Determine the equity income to be recognized by Burrough during each of these years. b. Compute Burrough's investment in Carter Company's balance as of December 31, 2024. Note: For all requirements, enter your answers in whole dollars and not in millions

On July 1,2022 , Burrough Company acquired 124,000 of the outstanding shares of Carter Company for $13 per share. This acquisition gave Burrough a 25 percent ownership of Carter and allowed Burrough to significantly influence the investee's decisions. As of July 1, 2022, the investee had assets with a book value of $5 million and liabilities of $501,600. At the time, Carter held equipment appraised at $375,200 more than book value; it was considered to have a seven-year remaining life with no salvage value. Carter also held a copyright with a five-year remaining life on its books that was undervalued by $1,276,000. Any remaining excess cost was attributable to an indefinite-lived trademark. Depreciation and amortization are computed using the straight-line method. Burrough applies the equity method for its investment in Carter. Carter's policy is to declare and pay a $1 per share cash dividend every April 1 and October 1 . Carter's income, earned evenly throughout each year, was $638,000 in 2022, $668,000 in 2023, and $713,200 in 2024. In addition, Burrough sold inventory costing $103,200 to Carter for $172,000 during 2023 . Carter resold $83,500 of this inventory during 2023 and the remaining $88,500 during 2024 . Required: a. Determine the equity income to be recognized by Burrough during each of these years. b. Compute Burrough's investment in Carter Company's balance as of December 31, 2024. Note: For all requirements, enter your answers in whole dollars and not in millions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started