Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 14, 2018 K meat shop Inc. saw $3200 of inventory (cost is 1200) on account to one of his customers. The terms were

On July 14, 2018 K meat shop Inc. saw $3200 of inventory (cost is 1200) on account to one of his customers. The terms were 1/10, and n/30, FOB destination. On July 16 K meat shop Inc. paid the freight charges of $45 related to the delivery of the goods sold on July 14. On July 20, $900 of goods (cost is $420) were returned by the customer. On July 23, K meat Inc. received payment in full from the customer.

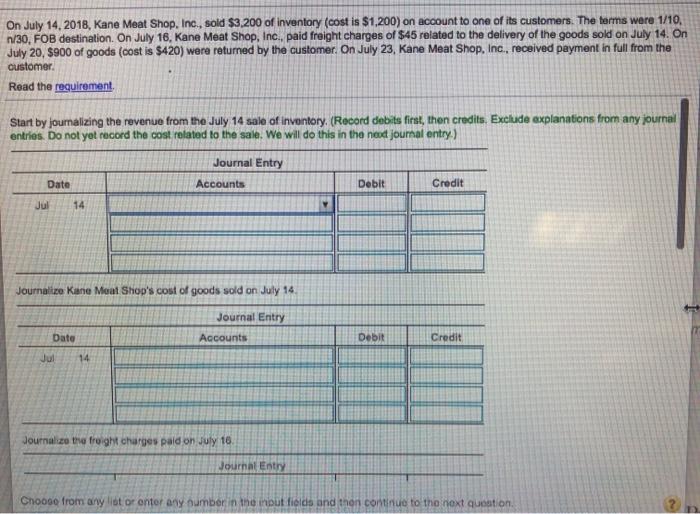

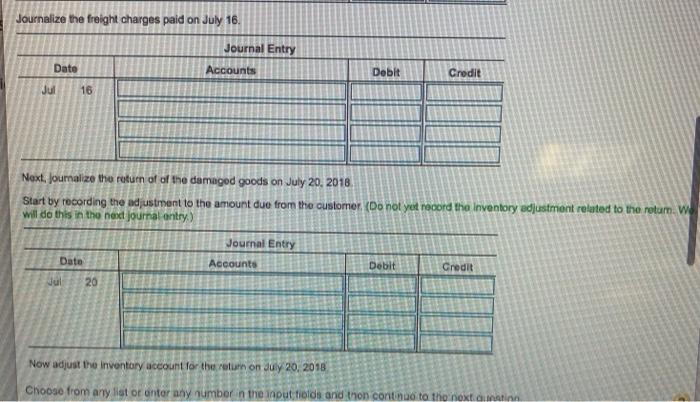

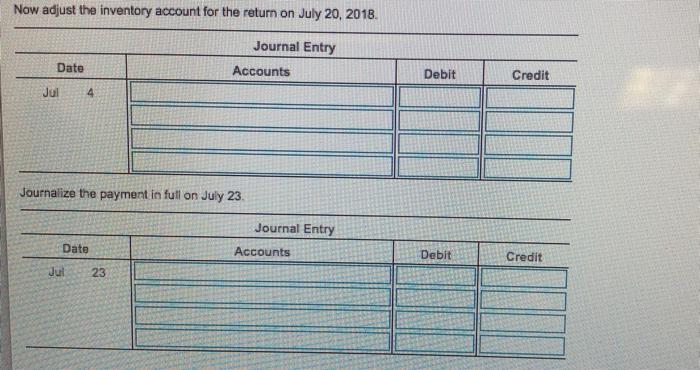

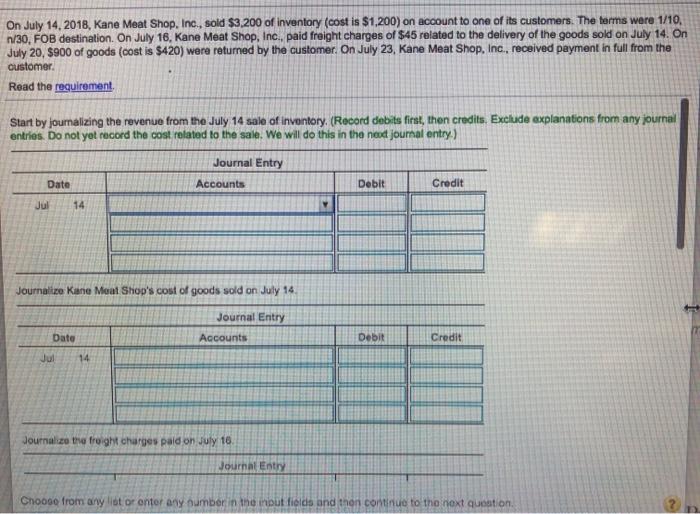

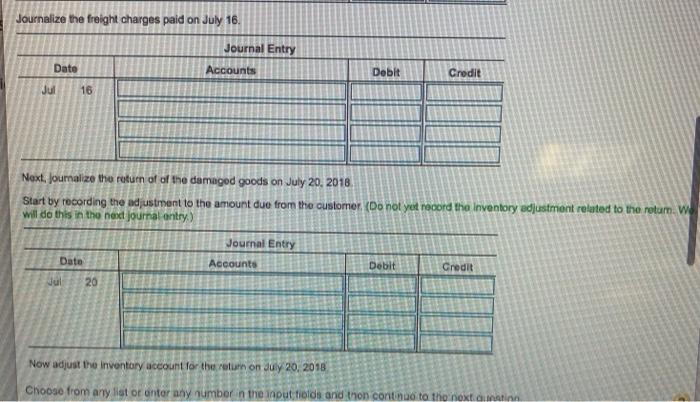

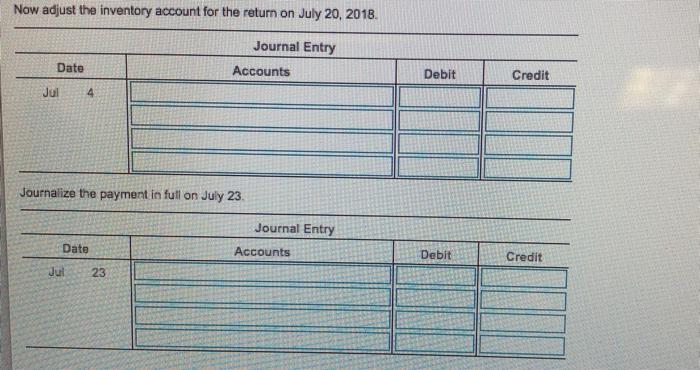

On July 14, 2018, Kane Meat Shop, Inc., sold $3.200 of inventory (cost is $1,200) on account to one of its customers. The terms were 1/10, n/30, FOB destination. On July 16, Kane Meat Shop, Inc., paid freight charges of $45 related to the delivery of the goods sold on July 14. On July 20, $900 of goods (cost is $420) were returned by the customer. On July 23, Kane Meat Shop, Inc., received payment in full from the customer. Read the requirement Start by joumalizing the revenue from the July 14 sale of inventory. (Record debits first, then credits. Exclude explanations from any journal entries. Do not yet record the cost related to the sale. We will do this in the need journal entry) Journal Entry Accounts Date Debit Credit Jul 14 Journalize Kine Moat Shop's cost of goods sold on July 14 Journal Entry Accounts Dato Debit Credit Jul 14 Journalize the freight charges paid on July 10 Journal Entry Choose from any lot or onter any oumber in the input fields and then continue to the next question Journalize the freight charges paid on July 16. Journal Entry Date Accounts Debit Credit Jul 16 Next, oumalize the return of of the damaged goods on July 20, 2018 Start by recording the adjustment to the amount due from the customer. (Do not yet record the inventory adjustment related to the return. We will do this in the need journal entry) Journal Entry Accounts Data Debit Credit 20 Now adjust the inventory account for the return on July 20, 2018 Choose from any liat or unter any number in the input fields and then continue to the next dan Now adjust the inventory account for the return on July 20, 2018 Journal Entry Accounts Date Debit Credit Jul 4 Journalize the payment in full on July 23 Journal Entry Date Accounts Debit Credit Jul 23 Start by journalizing the run of you from July 14 sale of inventory.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started