Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 15, Unilever Company (a U.S. firm) purchases a futures contract specifying 3,000,000 Thai Baht with the September settlement date to hedge its exchange

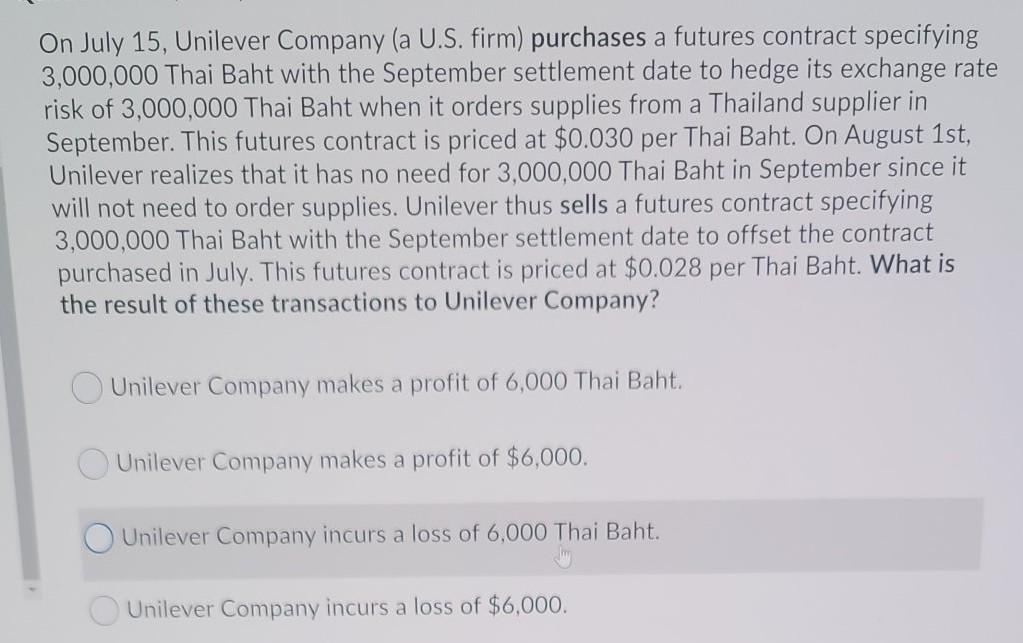

On July 15, Unilever Company (a U.S. firm) purchases a futures contract specifying 3,000,000 Thai Baht with the September settlement date to hedge its exchange rate risk of 3,000,000 Thai Baht when it orders supplies from a Thailand supplier in September. This futures contract is priced at $0.030 per Thai Baht. On August 1st, Unilever realizes that it has no need for 3,000,000 Thai Baht in September since it will not need to order supplies. Unilever thus sells a futures contract specifying 3,000,000 Thai Baht with the September settlement date to offset the contract purchased in July. This futures contract is priced at $0.028 per Thai Baht. What is the result of these transactions to Unilever Company? Unilever Company makes a profit of 6,000 Thai Baht. Unilever Company makes a profit of $6,000. Unilever Company incurs a loss of 6,000 Thai Baht. Unilever Company incurs a loss of $6,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started