Answered step by step

Verified Expert Solution

Question

1 Approved Answer

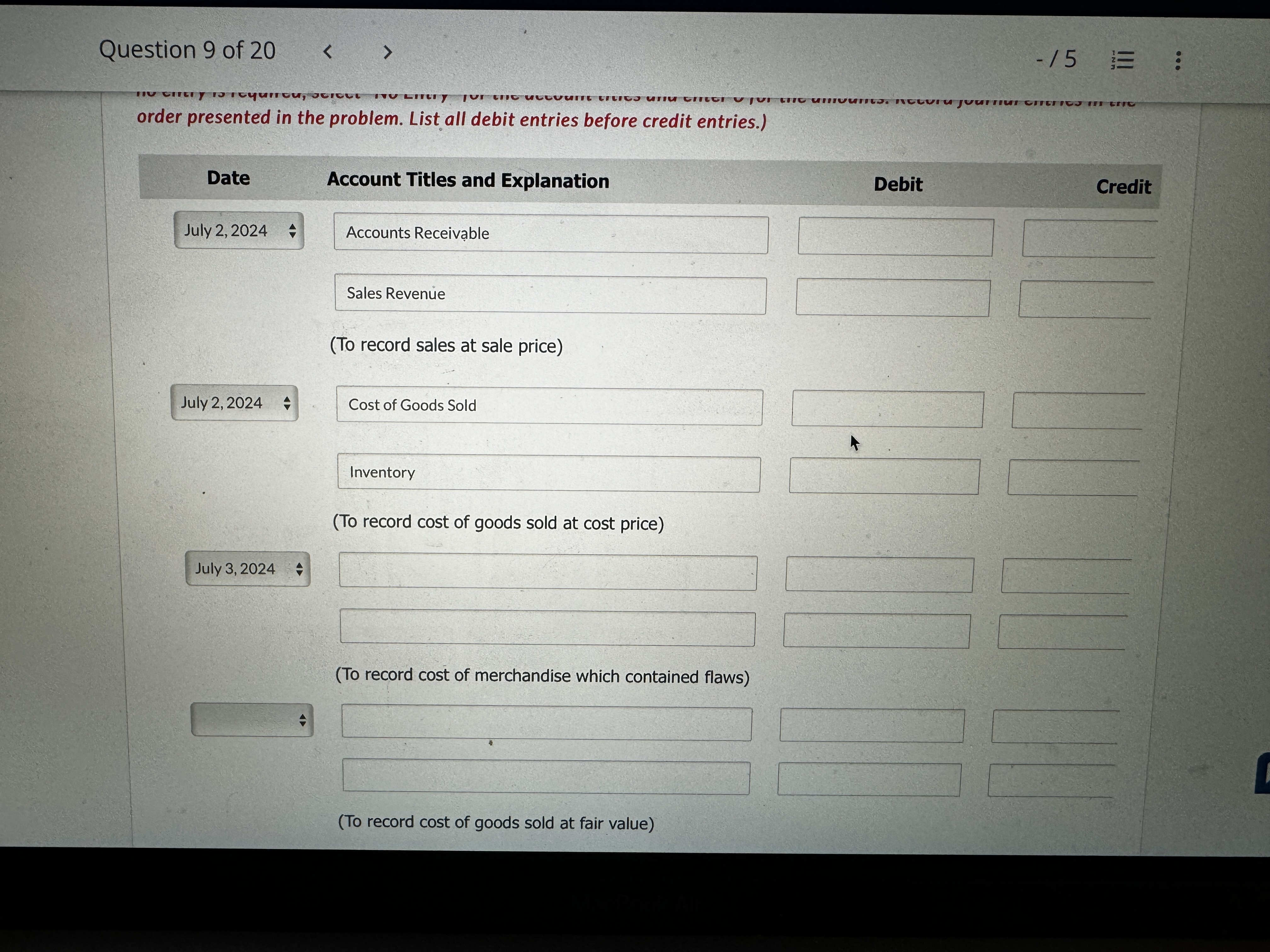

On July 2 , 2 0 2 4 , Skysong Company sold to Sue Black merchandise having a sales price of $ 1 2 ,

On July Skysong Company sold to Sue Black merchandise having a sales price of $cost $ with terms of n fob shipping point. Skysong estimates that merchandise with a sales value of $ will be returned. An invoice totaling $ terms n was received by Black on July from Pacific Delivery Service for the freight cost. Upon receipt of the goods, on July Black notified Skysong that $ of merchandise contained flaws. The same day, Skysong issued a credit memo covering the defective merchandise and returned it at Skysong's expense. Skysong estimates the returned items to have a fair value of $ The freight cost of $ on the returned merchandise was paid by Skysong on July On July the company received a check for the balance due from Black.Prepare journal entries for Skysong Company to record all the events noted above assuming sales and receivables are recorded at gross selling price.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started