Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 28, 2023, Jerome Powell, the chairman of US Federal Reserve Bank (FED), hinted that the series of interest rate hikes could possibly

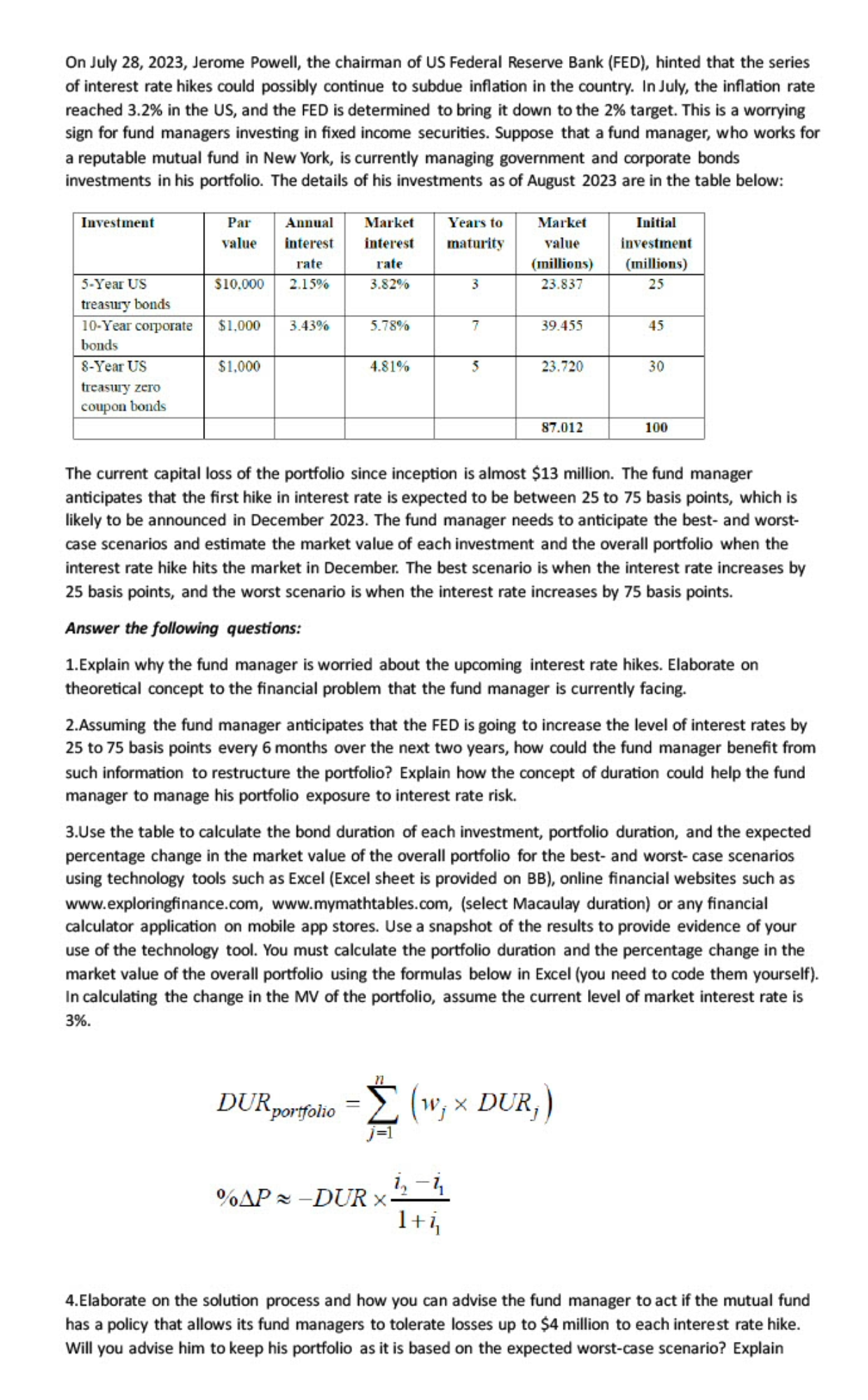

On July 28, 2023, Jerome Powell, the chairman of US Federal Reserve Bank (FED), hinted that the series of interest rate hikes could possibly continue to subdue inflation in the country. In July, the inflation rate reached 3.2% in the US, and the FED is determined to bring it down to the 2% target. This is a worrying sign for fund managers investing in fixed income securities. Suppose that a fund manager, who works for a reputable mutual fund in New York, is currently managing government and corporate bonds investments in his portfolio. The details of his investments as of August 2023 are in the table below: Investment 5-Year US treasury bonds 10-Year corporate bonds 8-Year US treasury zero coupon bonds Par Annual Market value interest interest rate rate 3.82% $10.000 2.15% $1,000 $1,000 3.43% 5.78% 4.81% DUR portfolio -( Years to maturity %AP-DUR x 3 7 5 1+i Market value (millions) 23.837 39.455 23.720 87.012 The current capital loss of the portfolio since inception is almost $13 million. The fund manager anticipates that the first hike in interest rate is expected to be between 25 to 75 basis points, which is likely to be announced in December 2023. The fund manager needs to anticipate the best- and worst- case scenarios and estimate the market value of each investment and the overall portfolio when the interest rate hike hits the market in December. The best scenario is when the interest rate increases by 25 basis points, and the worst scenario is when the interest rate increases by 75 basis points. Answer the following questions: 1.Explain why the fund manager is worried about the upcoming interest rate hikes. Elaborate on theoretical concept to the financial problem that the fund manager is currently facing. 2.Assuming the fund manager anticipates that the FED is going to increase the level of interest rates by 25 to 75 basis points every 6 months over the next two years, how could the fund manager benefit from such information to restructure the portfolio? Explain how the concept of duration could help the fund manager to manage his portfolio exposure to interest rate risk. Initial investment (millions) 25 3.Use the table to calculate the bond duration of each investment, portfolio duration, and the expected percentage change in the market value of the overall portfolio for the best- and worst- case scenarios using technology tools such as Excel (Excel sheet is provided on BB), online financial websites such as www.exploringfinance.com, www.mymathtables.com, (select Macaulay duration) or any financial calculator application on mobile app stores. Use a snapshot of the results to provide evidence of your use of the technology tool. You must calculate the portfolio duration and the percentage change in the market value of the overall portfolio using the formulas below in Excel (you need to code them yourself). In calculating the change in the MV of the portfolio, assume the current level of market interest rate is 3%. (w DUR) 45 30 100 4. Elaborate on the solution process and how you can advise the fund manager to act if the mutual fund has a policy that allows its fund managers to tolerate losses up to $4 million to each interest rate hike. Will you advise him to keep his portfolio as it is based on the expected worst-case scenario? Explain

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 The fund manager is worried about the upcoming interest rate hikes because the increase in interest rates will lead to an increase in the yield of existing bonds in the portfolio which will r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started