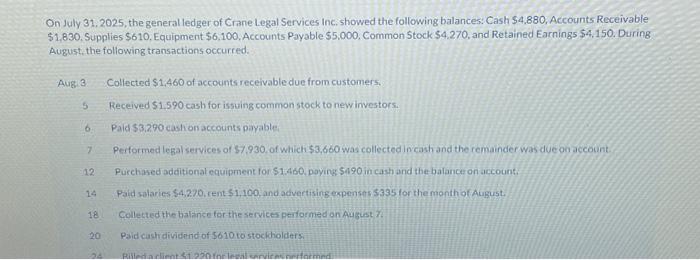

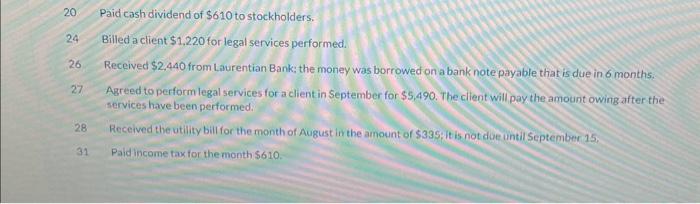

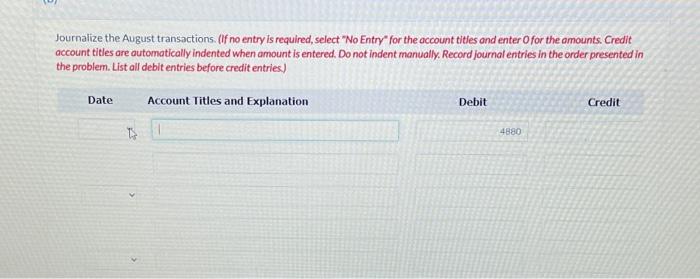

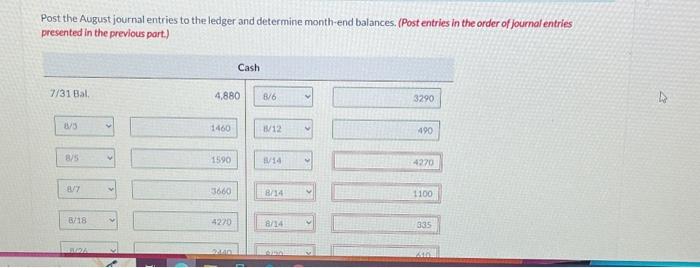

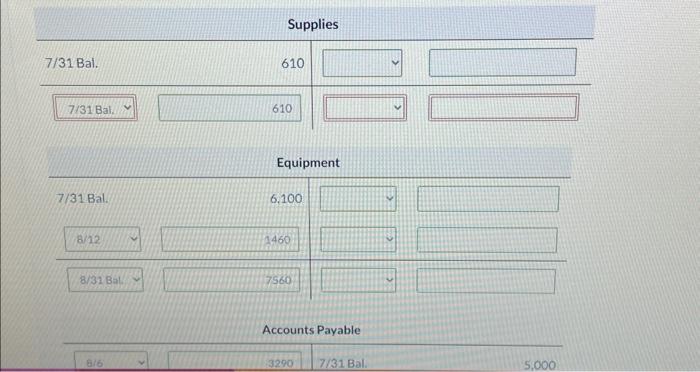

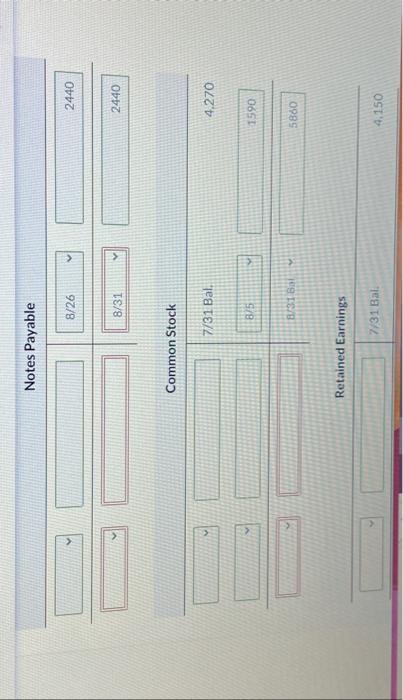

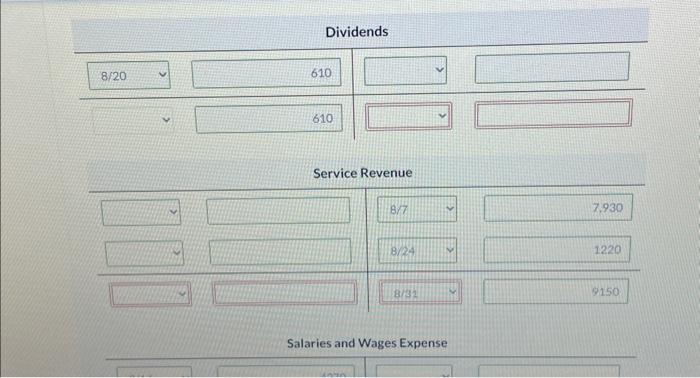

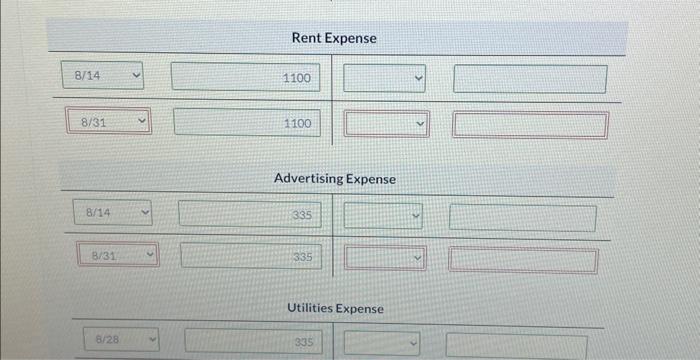

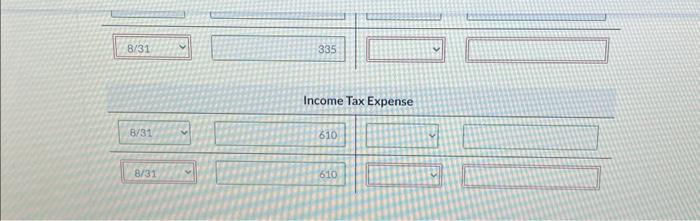

On July 31, 2025, the general ledger of Crane Legal Services Inc: showed the following balances: Cash $4.880, Accounts Receivable $1,830. Supplies $610, Equipment $6,100, Accounts Payable $5,000, Common Stock $4,270, and Retained Earning5 $4,150. During August, the following transactions occurred. Aug. 3 Collected $1,460 of accounts receivable due from customers. 5 Received $1.590 cash for issuing common stock to newinvestors. 6. Paid $3,290 eashon accounts payable 7. Performed legal services of $7,930, of which $3,660 was collected in cash and the remainder was due on accouint. 12. Purchped additional equipment for $1.480, poying $190 in cash and the balance on account. 14 Paid salaries $4,270, rent $1,100, and advertising expensts 5335 for the month of August 18. Colletted the balanse tor-the services performed an Augist 7 . 20 Peid castrdividend of $610 to stocholders 20 Paid cash dividend of $610 to stockholders. 24 Billed a client $1,220 for legal services performed. 26 Received \$2,440 from Laurentian Bank; the money was borrowed on a bank note payable that is due in 6 months. 27. Agreed to perform legal services for a client in September for $5,490. The client will pay the amount owing after the services have been performed. 28 Received the utility bill for the month of August in the amount of $335 : it is not doe until September 15. 31 Paidincome tax for the month $610. Journalize the August transactions. (If no entry is required, select "No Entry" for the account tities ond enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries) Post the August journal entries to the ledger and determine month-end balances, (Post entries in the order of journal entries presented in the previous part.) Supplies 7/31Bal. 610 7/31Bal 610 Equipment 7/31 Bal. 6.100 B/12 Accounts Payable 7/31Bal Dividends Service Revenue Salaries and Wages Expense Rent Expense Advertising Expense Utilities Expense Income Tax Expense On July 31, 2025, the general ledger of Crane Legal Services Inc: showed the following balances: Cash $4.880, Accounts Receivable $1,830. Supplies $610, Equipment $6,100, Accounts Payable $5,000, Common Stock $4,270, and Retained Earning5 $4,150. During August, the following transactions occurred. Aug. 3 Collected $1,460 of accounts receivable due from customers. 5 Received $1.590 cash for issuing common stock to newinvestors. 6. Paid $3,290 eashon accounts payable 7. Performed legal services of $7,930, of which $3,660 was collected in cash and the remainder was due on accouint. 12. Purchped additional equipment for $1.480, poying $190 in cash and the balance on account. 14 Paid salaries $4,270, rent $1,100, and advertising expensts 5335 for the month of August 18. Colletted the balanse tor-the services performed an Augist 7 . 20 Peid castrdividend of $610 to stocholders 20 Paid cash dividend of $610 to stockholders. 24 Billed a client $1,220 for legal services performed. 26 Received \$2,440 from Laurentian Bank; the money was borrowed on a bank note payable that is due in 6 months. 27. Agreed to perform legal services for a client in September for $5,490. The client will pay the amount owing after the services have been performed. 28 Received the utility bill for the month of August in the amount of $335 : it is not doe until September 15. 31 Paidincome tax for the month $610. Journalize the August transactions. (If no entry is required, select "No Entry" for the account tities ond enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries) Post the August journal entries to the ledger and determine month-end balances, (Post entries in the order of journal entries presented in the previous part.) Supplies 7/31Bal. 610 7/31Bal 610 Equipment 7/31 Bal. 6.100 B/12 Accounts Payable 7/31Bal Dividends Service Revenue Salaries and Wages Expense Rent Expense Advertising Expense Utilities Expense Income Tax Expense