Answered step by step

Verified Expert Solution

Question

1 Approved Answer

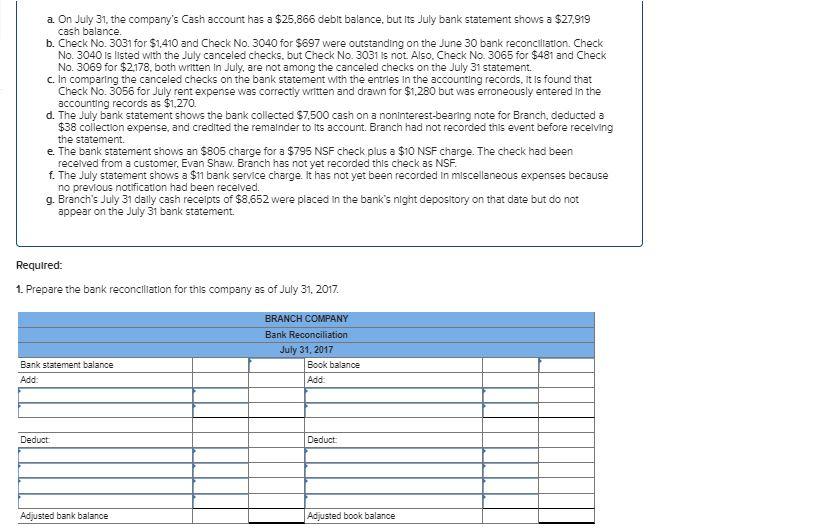

a. On July 31, the company's Cash account has a $25.866 debit balance, but Its July bank statement shows a $27,919 cash balance. b.

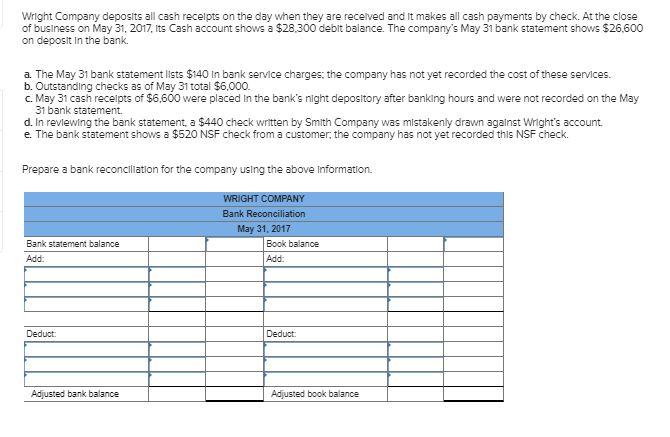

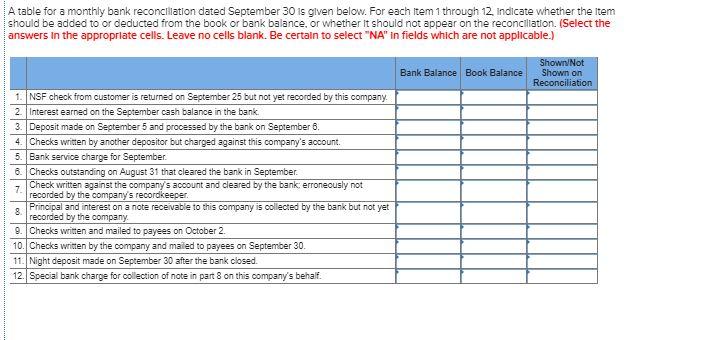

a. On July 31, the company's Cash account has a $25.866 debit balance, but Its July bank statement shows a $27,919 cash balance. b. Check No. 3031 for $1,410 and Check No. 3040 for $697 were outstanding on the June 30 bank reconciliation. Check No. 3040 is listed with the July canceled checks, but Check No. 3031 is not Also, Check No. 3065 for $481 and Check No. 3069 for $2178, both written in July, are not among the canceled checks on the July 31 statement. C. in comparing the canceled checks on the bank statement with the entries in the accounting records. It is found that Check No. 3056 for July rent expense was correctiy written and drawn for $1,280 but was erroneously entered in the accounting records as $1,270. d. The July bank statement shows the bank collected $7.500 cash on a noninterest-bearing note for Branch, deducted a $38 collection expense, and credited the remalnder to Its account. Branch had not recorded this event before recelving the statement. e. The bank statement shows an $805 charge for a $795 NSF check plus a $1O NSF charge. The check had been recelved from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $11 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification had been recelved. g. Branch's July 31 daly cash receipts of $8.652 were placed in the bank's night depository on that date but do not appear on the July 31 bank statement. Required: 1. Prepare the bank reconciliation for this company as of July 31, 2017. BRANCH COMPANY Bank Reconciliation July 31, 2017 Bank statement balance Book balance Add: Add Deduct Deduct Adjusted bank balance Adjusted book balance Wright Company deposits all cash recelpts on the day when they are recelved and It makes all cash payments by check. At the close of business on May 31, 2017, Its Cash account shows a $28,300 debit balance. The company's May 31 bank statement shows $26,600 on deposit in the bank, a. The May 31 bank statement lists $140 In bank service charges; the company has not yet recorded the cost of these services. b. Outstanding checks as of May 31 total $6.000. C. May 31 cash recelpts of $6,60 were placed In the bank's night depository after banking hours and were not recorded on the May 31 bank statement. d. In reviewing the bank statement, a $440 check written by Smith Company was mistakenly drawn against Wright's account e. The bank statement shows a $520 NSF check from a customer, the company has not yet recorded this NSF check. Prepare a bank reconciliation for the company using the above Information. WRIGHT COMPANY Bank Reconciliation May 31, 2017 Bank statement balance Book balance Add: Add: Deduct Deduct Adjusted bank balance Adjusted book balance A table for a monthly bank reconcilation dated September 30 is glven below. For each Item 1 through 12. indicate whether the Item should be added to or deducted from the book or bank balance, or whether It should not appear on the reconciliation. (Select the answers In the appropriate cells. Leave no cells blank. Be certain to select "NA" in fields which are not applicable.) Shown/Not Shown on Reconciliation Bank Balance Book Balance 1. NSF check from customer is returned on September 25 but not yet recorded by this company. 2. | Interest earned on the September cash balance in the bank. 3. Deposit made on September 5 and processed by the bank on September 6. 4. Checks written by another depositor but charged against this company's account. 5. Bank service charge for September. 6. Checks outstanding on August 31 that cleared the bank in September. Check written against the company's account and cleared by the bank: erroneously not 7. recorded by the company's recordkeeper. Principal and interest on a note receivable to this company is collected by the bank but not yet 8. recorded by the company. 9. Checks written and mailed to payees 10. Checks written by the company and maled to payees on September 30. 11. Night deposit made on September 30 after the bank closed. 12. Special bank charge for collection of note in part 8 on this company's behalf. October 2.

Step by Step Solution

★★★★★

3.32 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

1 Branch Company Bank Reconciliation July 31 2017 27919 Book balance Add 8652 Notes Receivable 7500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d87829e6ff_176472.pdf

180 KBs PDF File

635d87829e6ff_176472.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started