Answered step by step

Verified Expert Solution

Question

1 Approved Answer

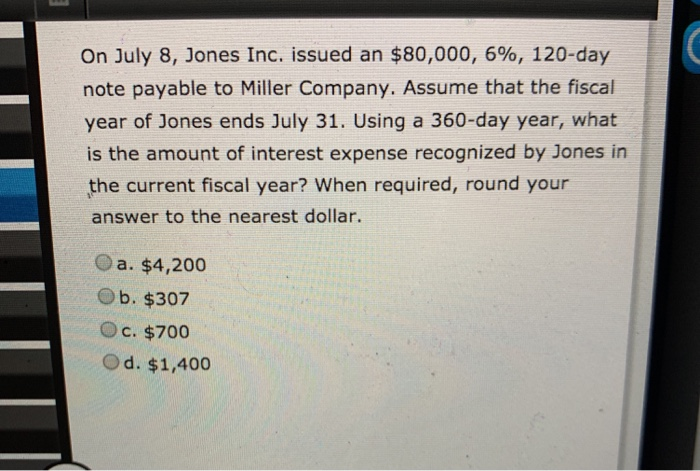

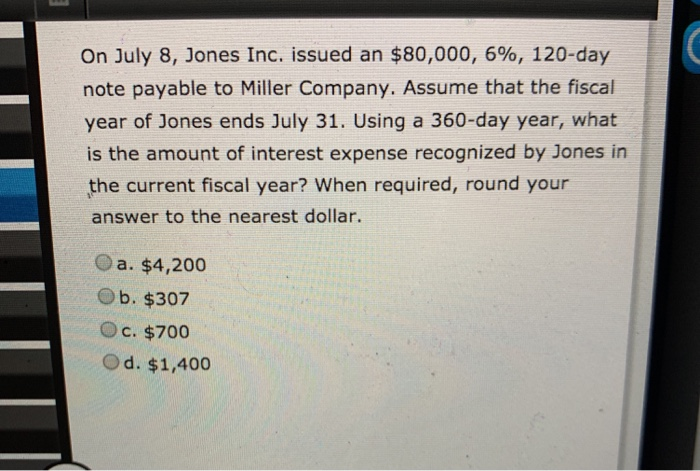

On July 8, Jones Inc. issued an $80,000, 6%, 120-day note payable to Miller Company. Assume that the fiscal year of Jones ends July 31.

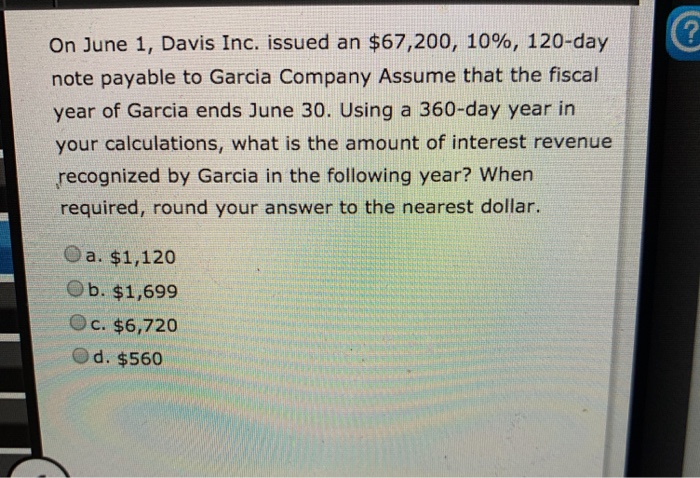

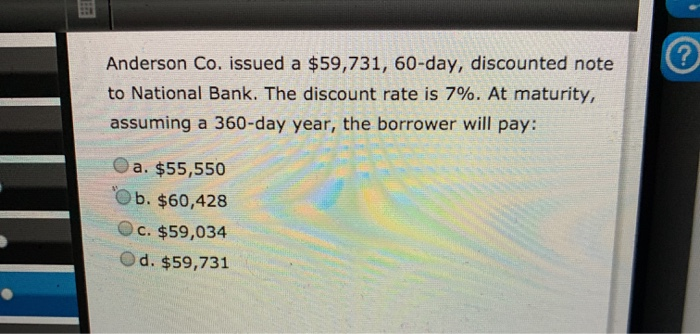

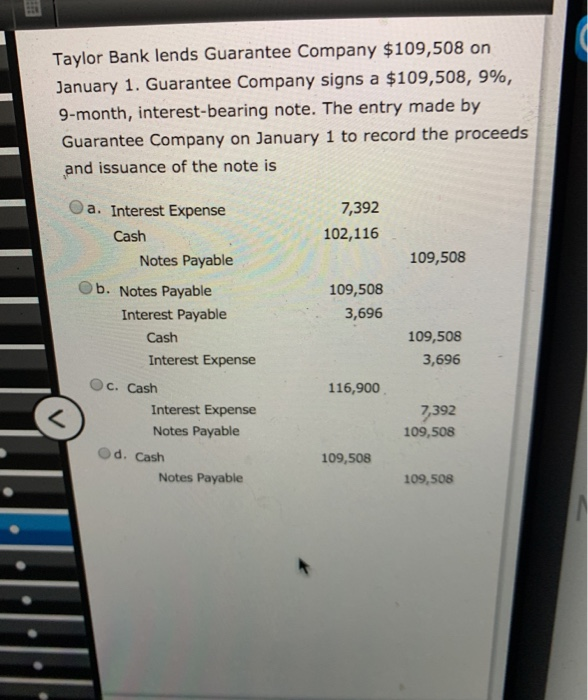

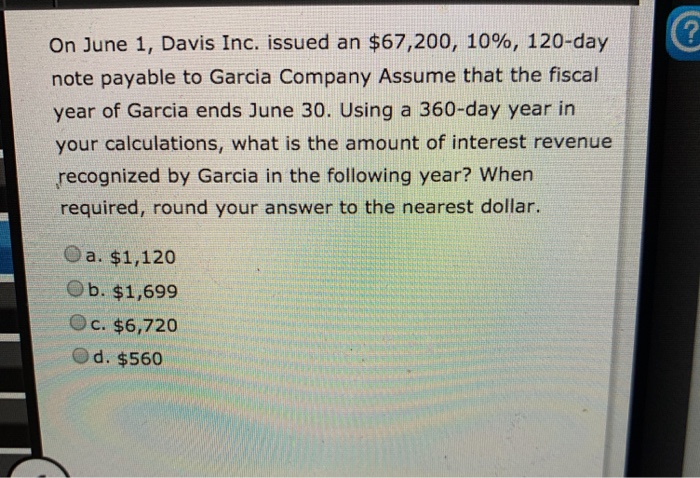

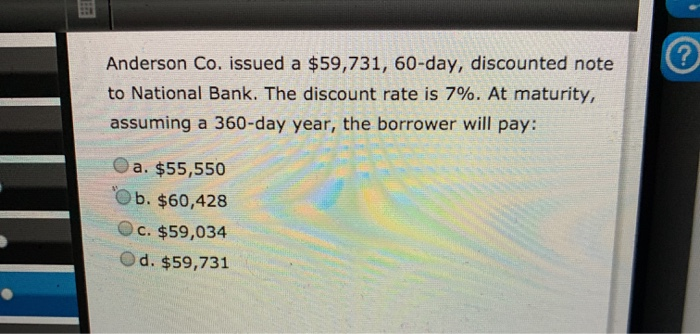

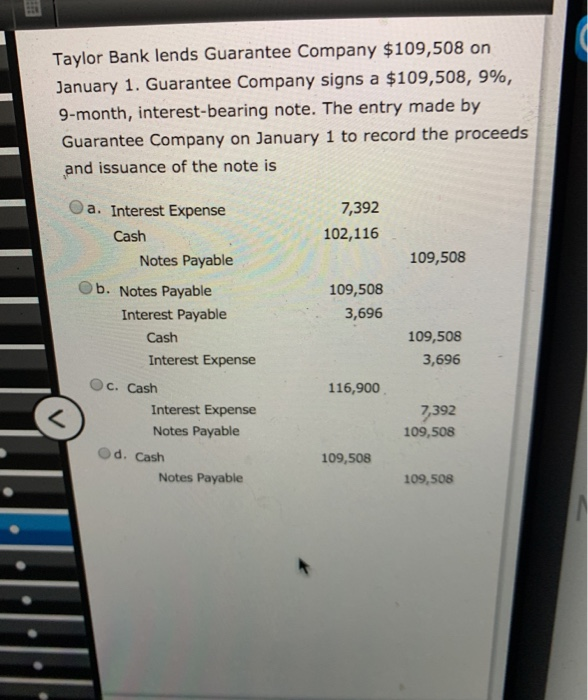

On July 8, Jones Inc. issued an $80,000, 6%, 120-day note payable to Miller Company. Assume that the fiscal year of Jones ends July 31. Using a 360-day year, what is the amount of interest expense recognized by Jones in the current fiscal year? When required, round your answer to the nearest dollar. O a. $4,200 Ob. $307 Oc. $700 Od. $1,400 On June 1, Davis Inc. issued an $67,200, 10%, 120-day note payable to Garcia Company Assume that the fiscal year of Garcia ends June 30. Using a 360-day year in your calculations, what is the amount of interest revenue recognized by Garcia in the following year? When required, round your answer to the nearest dollar. O a. $1,120 Ob. $1,699 Oc. $6,720 d. $560 Anderson Co. issued a $59,731, 60-day, discounted note to National Bank. The discount rate is 7%. At maturity, assuming a 360-day year, the borrower will pay: a. $55,550 Ob. $60,428 c. $59,034 Od. $59,731 Taylor Bank lends Guarantee Company $109,508 on January 1. Guarantee Company signs a $109,508, 9%, 9-month, interest-bearing note. The entry made by Guarantee Company on January 1 to record the proceeds and issuance of the note is 7,392 102,116 109,508 O a. Interest Expense Cash Notes Payable b. Notes Payable Interest Payable Cash Interest Expense c. Cash Interest Expense Notes Payable 109,508 3,696 109,508 3,696 116,900 7,392 109,508 d. Cash 109,508 Notes Payable 109,508

On July 8, Jones Inc. issued an $80,000, 6%, 120-day note payable to Miller Company. Assume that the fiscal year of Jones ends July 31. Using a 360-day year, what is the amount of interest expense recognized by Jones in the current fiscal year? When required, round your answer to the nearest dollar. O a. $4,200 Ob. $307 Oc. $700 Od. $1,400 On June 1, Davis Inc. issued an $67,200, 10%, 120-day note payable to Garcia Company Assume that the fiscal year of Garcia ends June 30. Using a 360-day year in your calculations, what is the amount of interest revenue recognized by Garcia in the following year? When required, round your answer to the nearest dollar. O a. $1,120 Ob. $1,699 Oc. $6,720 d. $560 Anderson Co. issued a $59,731, 60-day, discounted note to National Bank. The discount rate is 7%. At maturity, assuming a 360-day year, the borrower will pay: a. $55,550 Ob. $60,428 c. $59,034 Od. $59,731 Taylor Bank lends Guarantee Company $109,508 on January 1. Guarantee Company signs a $109,508, 9%, 9-month, interest-bearing note. The entry made by Guarantee Company on January 1 to record the proceeds and issuance of the note is 7,392 102,116 109,508 O a. Interest Expense Cash Notes Payable b. Notes Payable Interest Payable Cash Interest Expense c. Cash Interest Expense Notes Payable 109,508 3,696 109,508 3,696 116,900 7,392 109,508 d. Cash 109,508 Notes Payable 109,508

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started