Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On June 1, 2006, Nazario Corporation received authorization to issue up to 60,000 shares of P10 par value preference shares that pays a 9%

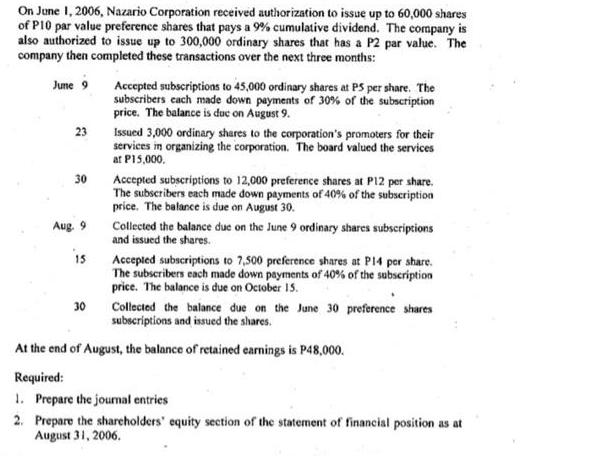

On June 1, 2006, Nazario Corporation received authorization to issue up to 60,000 shares of P10 par value preference shares that pays a 9% cumulative dividend. The company is also authorized to issue up to 300,000 ordinary shares that has a P2 par value. The company then completed these transactions over the next three months: June 9 23 30 Aug. 9 15 30 Accepted subscriptions to 45,000 ordinary shares at PS per share. The subscribers each made down payments of 30% of the subscription price. The balance is duc on August 9. Issued 3,000 ordinary shares to the corporation's promoters for their services in organizing the corporation. The board valued the services at P15,000. Accepted subscriptions to 12,000 preference shares at P12 per share. The subscribers each made down payments of 40% of the subscription price. The balance is due on August 30. Collected the balance due on the June 9 ordinary shares subscriptions and issued the shares. Accepted subscriptions to 7,500 preference shares at P14 per share. The subscribers each made down payments of 40% of the subscription price. The balance is due on October 15. Collected the balance due on the June 30 preference shares subscriptions and issued the shares. At the end of August, the balance of retained earnings is P48,000. Required: 1. Prepare the journal entries 2. Prepare the shareholders' equity section of the statement of financial position as at August 31, 2006.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started