Answered step by step

Verified Expert Solution

Question

1 Approved Answer

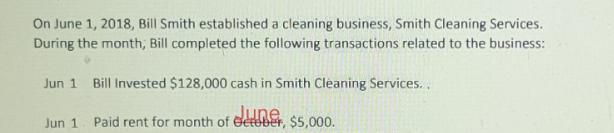

On June 1, 2018, Bill Smith established a cleaning business, Smith Cleaning Services. During the month, Bill completed the following transactions related to the

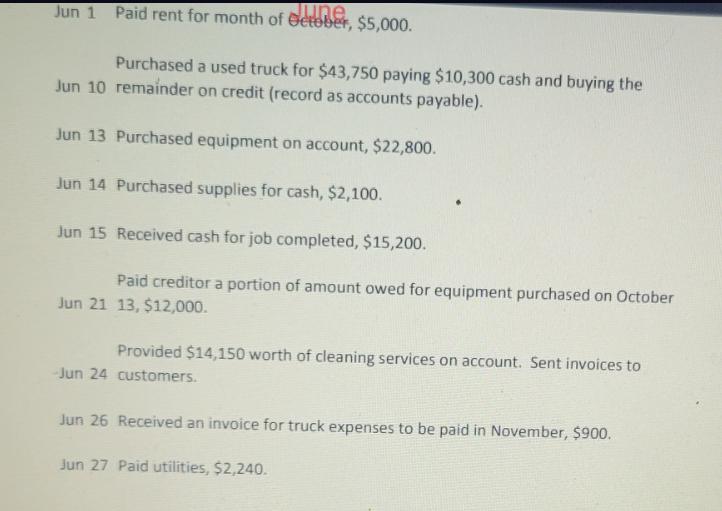

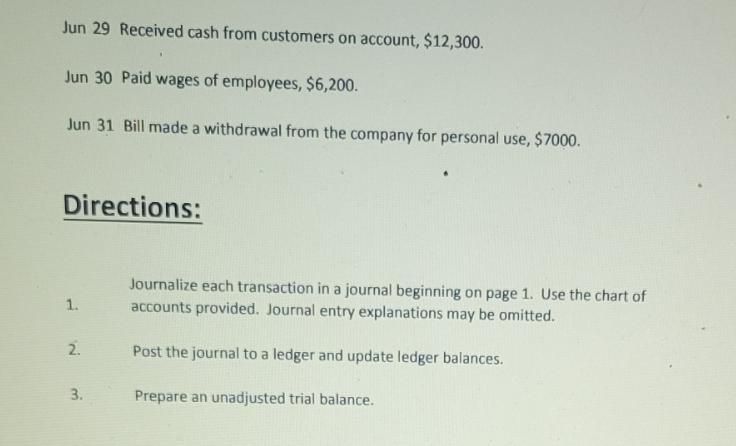

On June 1, 2018, Bill Smith established a cleaning business, Smith Cleaning Services. During the month, Bill completed the following transactions related to the business: Jun 1 Bill Invested $128,000 cash in Smith Cleaning Services.. Jun 1. Paid rent for month of eer, $5,000. Jun 1 Paid rent for month of October, $5,000. Purchased a used truck for $43,750 paying $10,300 cash and buying the Jun 10 remainder on credit (record as accounts payable). Jun 13 Purchased equipment on account, $22,800. Jun 14 Purchased supplies for cash, $2,100. Jun 15 Received cash for job completed, $15,200. Paid creditor a portion of amount owed for equipment purchased on October Jun 21 13, $12,000. Provided $14,150 worth of cleaning services on account. Sent invoices to -Jun 24 customers. Jun 26 Received an invoice for truck expenses to be paid in November, $900. Jun 27 Paid utilities, $2,240. Jun 29 Received cash from customers on account, $12,300. Jun 30 Paid wages of employees, $6,200. Jun 31 Bill made a withdrawal from the company for personal use, $7000. Directions: 1. 2. 3. Journalize each transaction in a journal beginning on page 1. Use the chart of accounts provided. Journal entry explanations may be omitted. Post the journal to a ledger and update ledger balances. Prepare an unadjusted trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 JOURNAL ENTRIES June 1 Debit Cash 128000 Credit Bill Capital 128000 To record investment in the business June 1 Debit Rent Expense 5000 Credit Cash 5000 Paid rent for the month of June June 1 Debit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started