Answered step by step

Verified Expert Solution

Question

1 Approved Answer

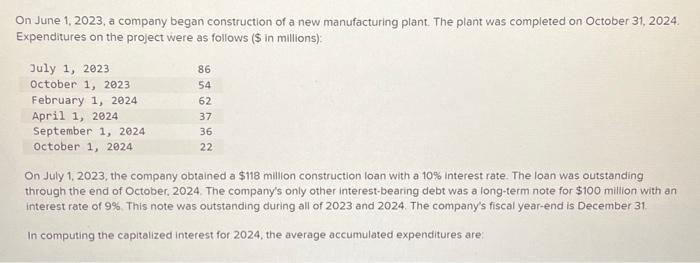

On June 1, 2023, a company began construction of a new manufacturing plant. The plant was completed on October 31, 2024. Expenditures on the

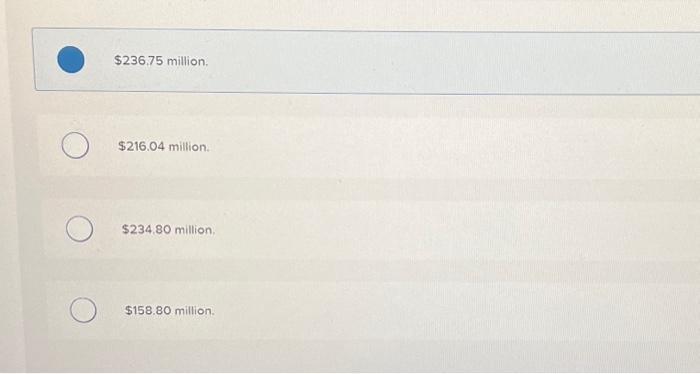

On June 1, 2023, a company began construction of a new manufacturing plant. The plant was completed on October 31, 2024. Expenditures on the project were as follows ($ in millions): July 1, 2023 October 1, 2023 February 1, 2024 April 1, 2024 September 1, 2024 October 1, 2024 86 54 62 37 36 22 On July 1, 2023, the company obtained a $118 million construction loan with a 10% interest rate. The loan was outstanding through the end of October, 2024. The company's only other interest-bearing debt was a long-term note for $100 million with an interest rate of 9% This note was outstanding during all of 2023 and 2024. The company's fiscal year-end is December 31. In computing the capitalized interest for 2024, the average accumulated expenditures are: $236.75 million. $216.04 million. $234.80 million. $158.80 million.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 15880 million To compute the capitalize...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started