Answered step by step

Verified Expert Solution

Question

1 Approved Answer

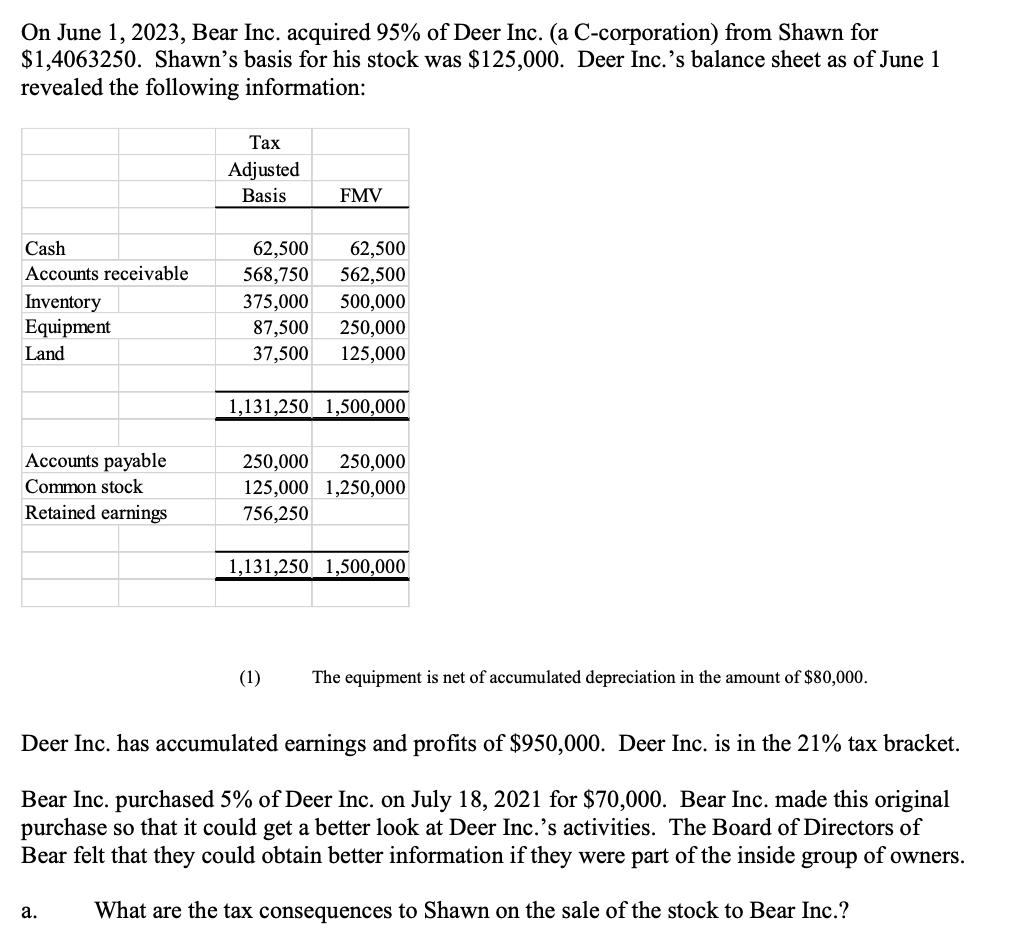

On June 1, 2023, Bear Inc. acquired 95% of Deer Inc. (a C-corporation) from Shawn for $1,4063250. Shawn's basis for his stock was $125,000.

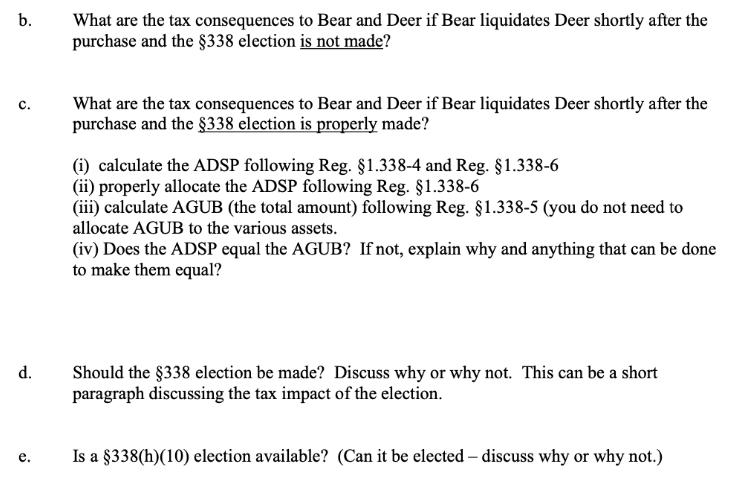

On June 1, 2023, Bear Inc. acquired 95% of Deer Inc. (a C-corporation) from Shawn for $1,4063250. Shawn's basis for his stock was $125,000. Deer Inc.'s balance sheet as of June 1 revealed the following information: Cash Accounts receivable Inventory Equipment Land Accounts payable Common stock Retained earnings Tax Adjusted Basis a. 62,500 568,750 FMV 62,500 562,500 375,000 500,000 87,500 250,000 37,500 125,000 1,131,250 1,500,000 250,000 000 125,000 1,250,000 756,250 (1) 1,131,250 1,500,000 The equipment is net of accumulated depreciation in the amount of $80,000. Deer Inc. has accumulated earnings and profits of $950,000. Deer Inc. is in the 21% tax bracket. Bear Inc. purchased 5% of Deer Inc. on July 18, 2021 for $70,000. Bear Inc. made this original purchase so that it could get a better look at Deer Inc.'s activities. The Board of Directors of Bear felt that they could obtain better information if they were part of the inside group of owners. What are the tax consequences to Shawn on the sale of the stock to Bear Inc.? b. C. d. e. What are the tax consequences to Bear and Deer if Bear liquidates Deer shortly after the purchase and the 338 election is not made? What are the tax consequences to Bear and Deer if Bear liquidates Deer shortly after the purchase and the $338 election is properly made? (i) calculate the ADSP following Reg. 1.338-4 and Reg. 1.338-6 (ii) properly allocate the ADSP following Reg. 1.338-6 (iii) calculate AGUB (the total amount) following Reg. 1.338-5 (you do not need to allocate AGUB to the various assets. (iv) Does the ADSP equal the AGUB? If not, explain why and anything that can be done to make them equal? Should the $338 election be made? Discuss why or why not. This can be a short paragraph discussing the tax impact of the election. Is a 338(h) (10) election available? (Can it be elected discuss why or why not.) -

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Shawn will recognize a longterm capital gain on the sale of his Der Inc stock to Bear Inc ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started