Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On June 1, 2023, Chris Jones started a new business for providing disc-jockey services at wedding receptions, reunions, and other parties. The business is

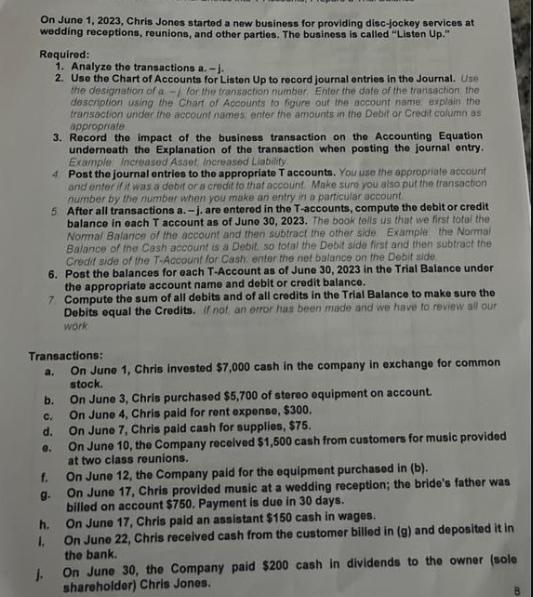

On June 1, 2023, Chris Jones started a new business for providing disc-jockey services at wedding receptions, reunions, and other parties. The business is called "Listen Up." Required: 1. Analyze the transactions a.-j. 2. Use the Chart of Accounts for Listen Up to record journal entries in the Journal. Use the designation of a - for the transaction number. Enter the date of the transaction the description using the Chart of Accounts to figure out the account name explain the transaction under the account names enter the amounts in the Debit or Credit column as appropriate 3. Record the impact of the business transaction on the Accounting Equation underneath the Explanation of the transaction when posting the journal entry. Example Increased Asset Increased Liability 4 Post the journal entries to the appropriate T accounts. You use the appropriate account and enter if it was a debit or a credit to that account. Make sure you also put the transaction number by the number when you make an entry in a particular account 5 After all transactions a.-j. are entered in the T-accounts, compute the debit or credit balance in each T account as of June 30, 2023. The book tells us that we first total the Normal Balance of the account and then subtract the other side Example the Normal Balance of the Cash account is a Debit, so total the Debit side first and then subtract the Credit side of the T-Account for Cash enter the net balance on the Debit side 6. Post the balances for each T-Account as of June 30, 2023 in the Trial Balance under the appropriate account name and debit or credit balance. 7. Compute the sum of all debits and of all credits in the Trial Balance to make sure the Debits equal the Credits. If not, an error has been made and we have to review all our work Transactions: On June 1, Chris invested $7,000 cash in the company in exchange for common stock. a. b. C. d. 0. f. 9- h. 1. On June 3, Chris purchased $5,700 of stereo equipment on account. On June 4, Chris paid for rent expense, $300. On June 7, Chris paid cash for supplies, $75. On June 10, the Company received $1,500 cash from customers for music provided at two class reunions. On June 12, the Company paid for the equipment purchased in (b). On June 17, Chris provided music at a wedding reception; the bride's father was billed on account $750. Payment is due in 30 days. On June 17, Chris paid an assistant $150 cash in wages. On June 22, Chris received cash from the customer billed in (g) and deposited it in the bank. J. On June 30, the Company paid $200 cash in dividends to the owner (sole shareholder) Chris Jones.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Analyze the transactions aj a Chris invested 7000 cash in the company in exchange for common stock This is a capital contribution by the owner b Chris purchased 5700 of stereo equipment on account T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started