Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On June 1 , Lily Company borrows $ 9 0 , 0 0 0 from First Bank on a 6 - month, $ 9 0

On June Lily Company borrows $ from First Bank on a month, $ note.

Prepare the entry on June Credit account titles are automatically indented when amount is entered. Do not indent

manually.

Date Account Titles and Explanation

Debit

Credit

June

eTextbook and Media

List of Accounts

Prepare the adjusting entry on June Credit account titles are automatically indented when amount is entered. Do not

indent manually.

Prepare the entry at maturity December assuming monthly adjusting entries have been made through November Credit

These payroll liability accounts are included in the ledger of Sunland Company on January

In January, the following transactions occurred.

Jan. Sent check for $ to union treasurer for union dues.

Remitted check for $ to the Federal Reserve bank for FICA taxes and federal income taxes withheld.

Purchased US Savings Bonds for employees by writing check for $

Paid state income taxes withheld from employees.

Paid federal and state unemployment taxes.

Completed monthly payroll register, which shows salaries and wages $ FICA taxes withheld $

federal income taxes payable $ state income taxes payable $ union dues payable $ United

Fund contributions payable $ and net pay $

Prepared payroll checks for the net pay and distributed checks to employees.

At January the company also makes the following accrued adjustments pertaining to employee compensation.

Employer payroll taxes: FICA taxes federal unemployment taxes and state unemployment taxes

Vacation pay: of gross earnings.

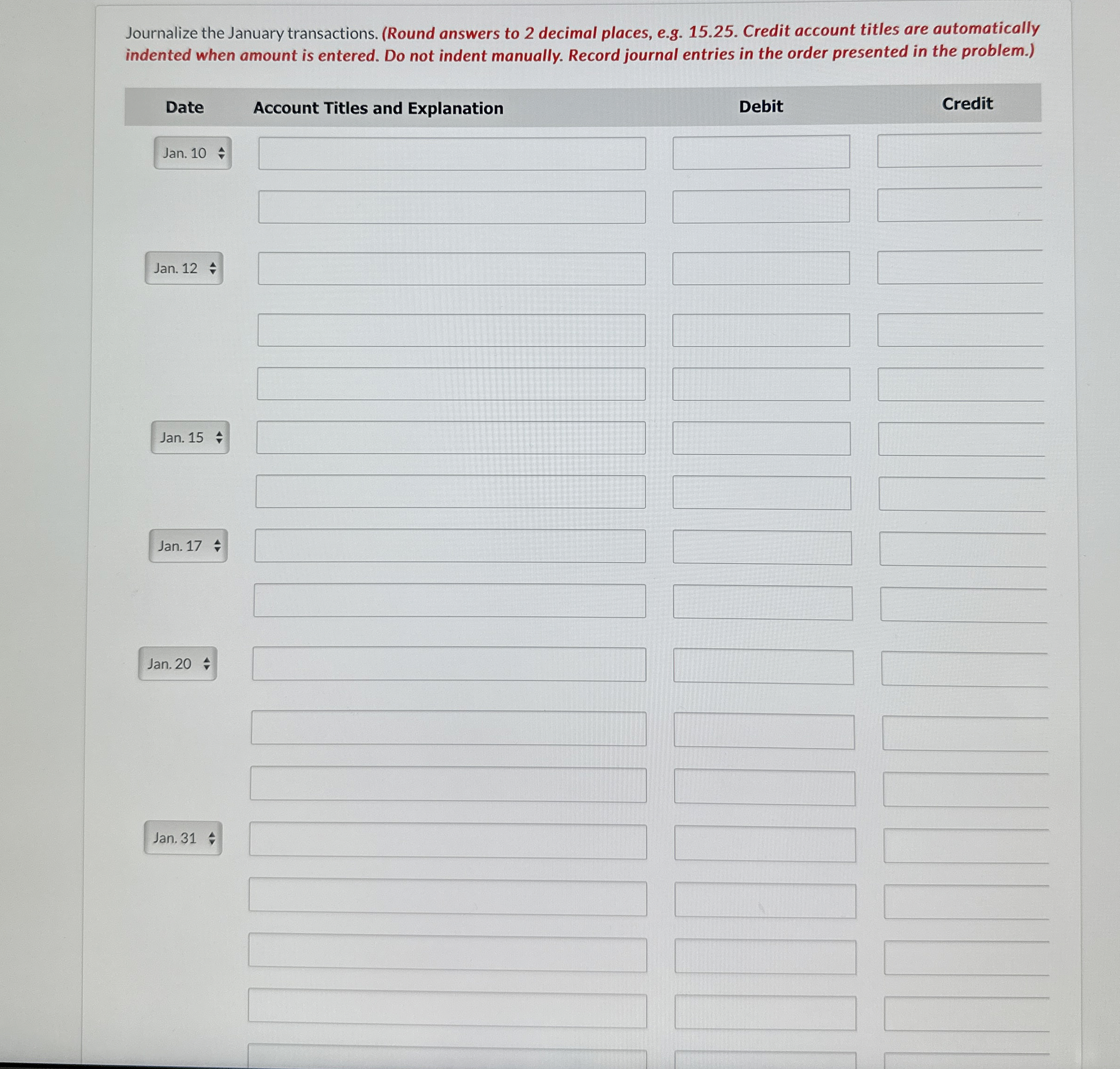

Journalize the January transactions. Round answers to decimal places, eg Credit account titles are automatically

indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.

Date

Account Titles and Explanation

Debit

Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started