Answered step by step

Verified Expert Solution

Question

1 Approved Answer

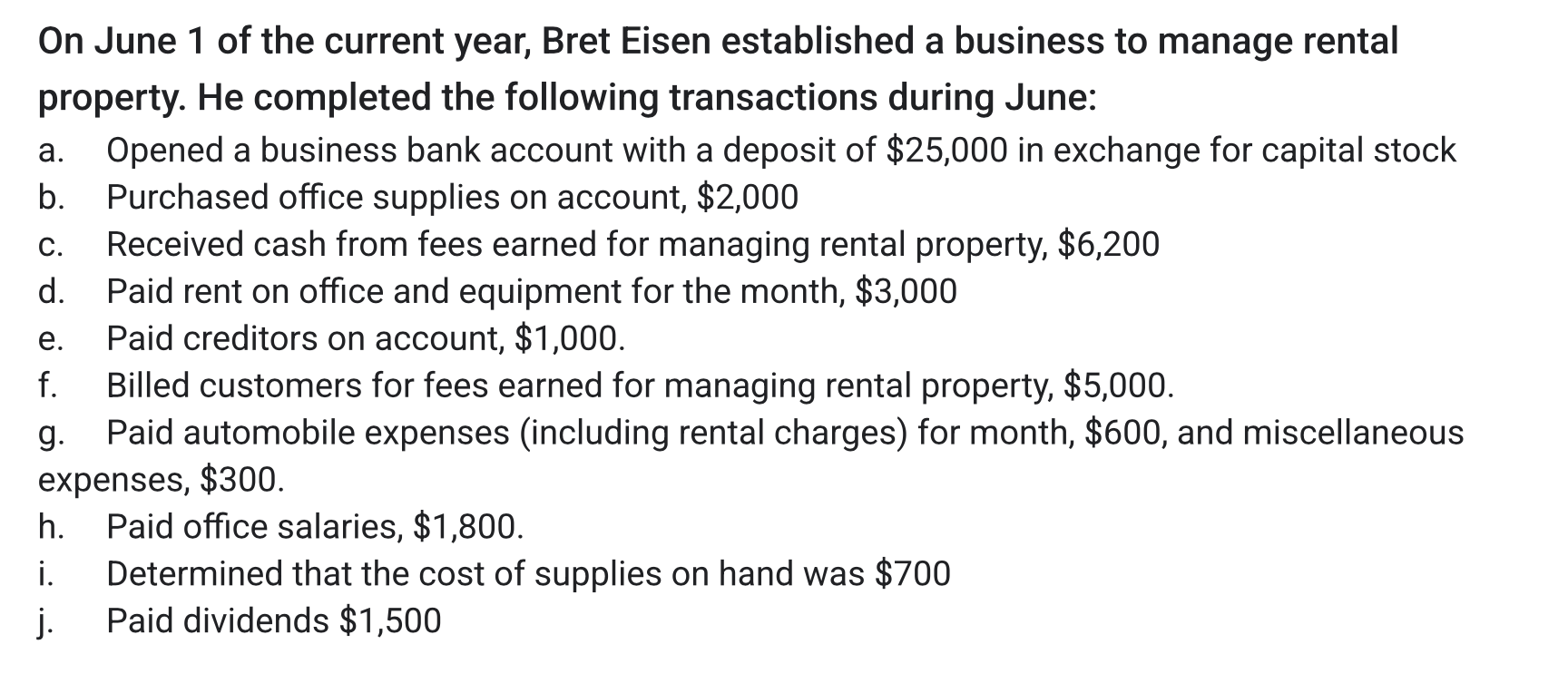

On June 1 of the current year, Bret Eisen established a business to manage rental property. He completed the following transactions during June: a. Opened

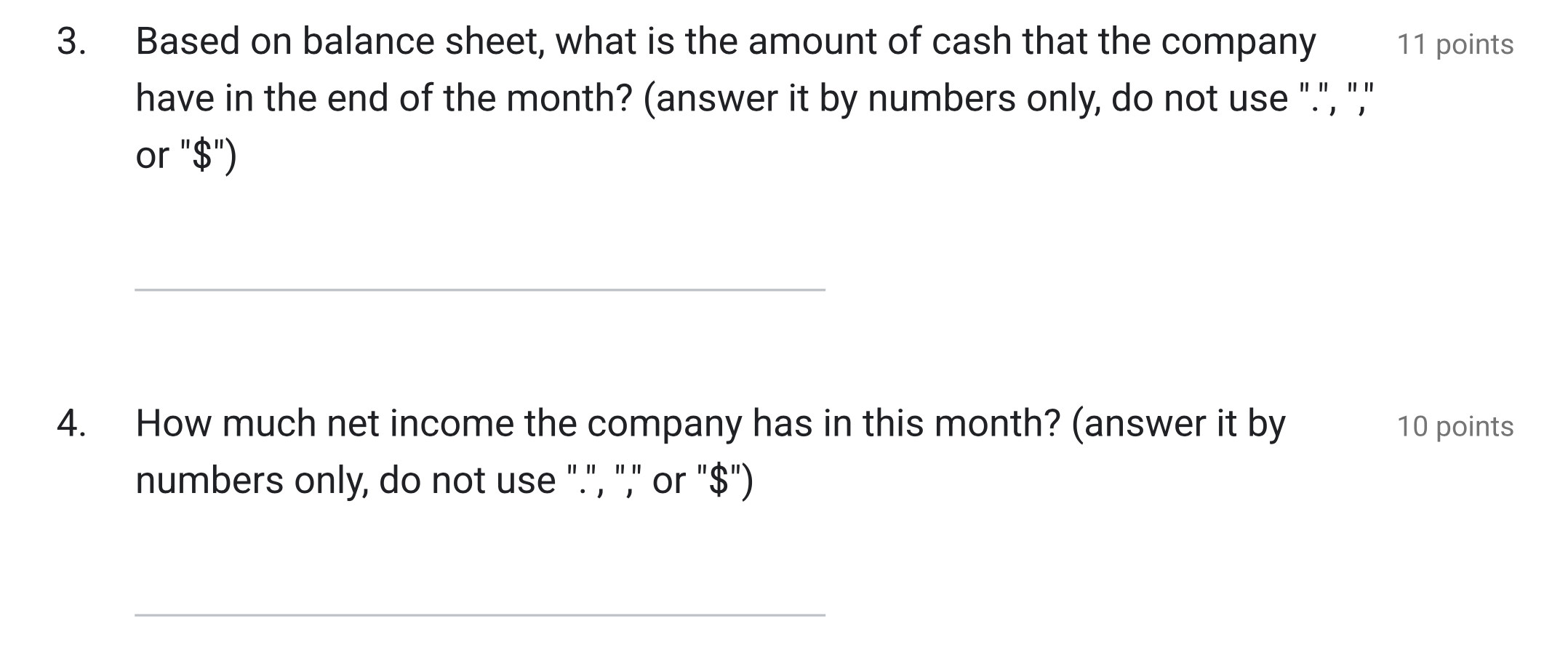

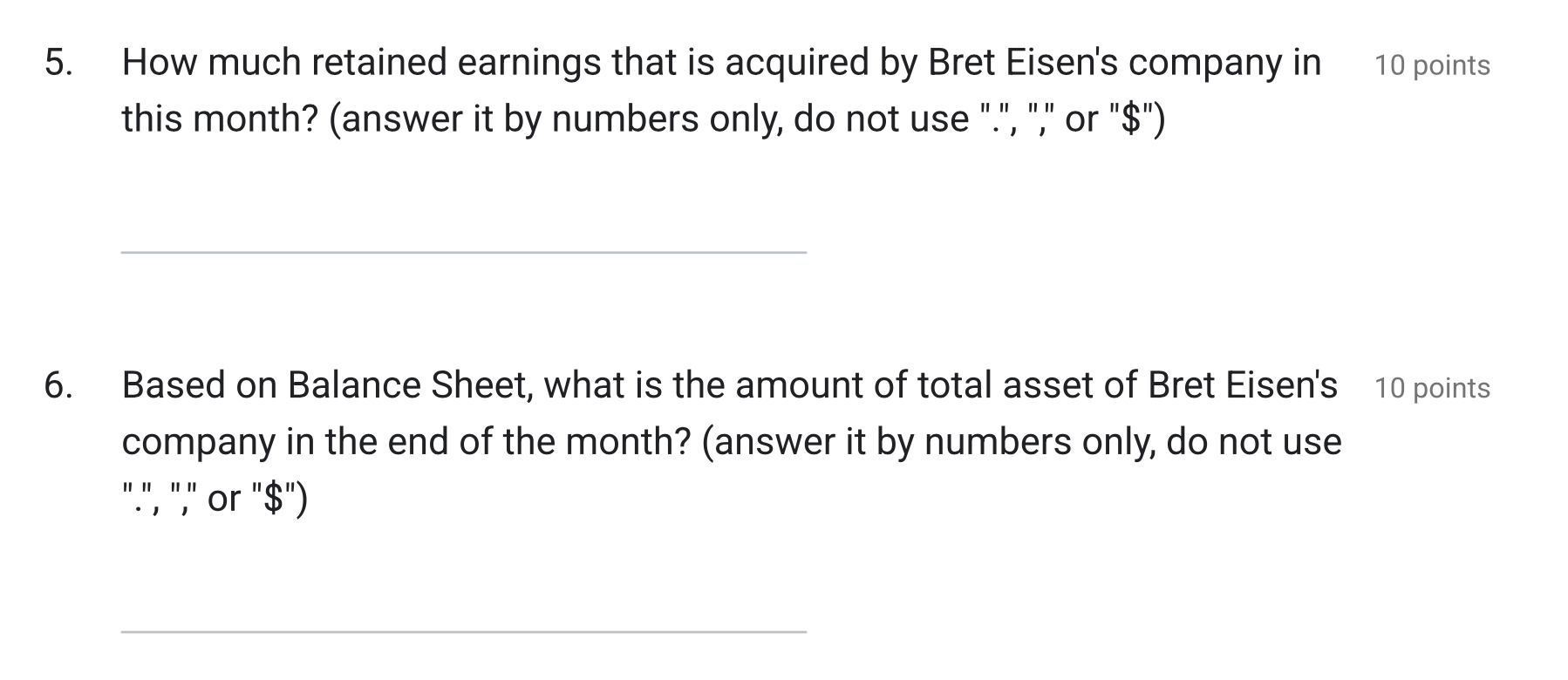

On June 1 of the current year, Bret Eisen established a business to manage rental property. He completed the following transactions during June: a. Opened a business bank account with a deposit of $25,000 in exchange for capital stock b. Purchased office supplies on account, $2,000 c. Received cash from fees earned for managing rental property, $6,200 d. Paid rent on office and equipment for the month, $3,000 e. Paid creditors on account, $1,000. f. Billed customers for fees earned for managing rental property, $5,000. g. Paid automobile expenses (including rental charges) for month, $600, and miscellaneous expenses, $300. h. Paid office salaries, $1,800. i. Determined that the cost of supplies on hand was $700 j. Paid dividends $1,500 Based on balance sheet, what is the amount of cash that the company have in the end of the month? (answer it by numbers only, do not use ".", "," or "\$") How much net income the company has in this month? (answer it by numbers only, do not use ".", "," or "\$") 5. How much retained earnings that is acquired by Bret Eisen's company in 10 points this month? (answer it by numbers only, do not use "..", "," or "\$") 5. Based on Balance Sheet, what is the amount of total asset of Bret Eisen's 10 points company in the end of the month? (answer it by numbers only, do not use ".", ",", or "\$")

On June 1 of the current year, Bret Eisen established a business to manage rental property. He completed the following transactions during June: a. Opened a business bank account with a deposit of $25,000 in exchange for capital stock b. Purchased office supplies on account, $2,000 c. Received cash from fees earned for managing rental property, $6,200 d. Paid rent on office and equipment for the month, $3,000 e. Paid creditors on account, $1,000. f. Billed customers for fees earned for managing rental property, $5,000. g. Paid automobile expenses (including rental charges) for month, $600, and miscellaneous expenses, $300. h. Paid office salaries, $1,800. i. Determined that the cost of supplies on hand was $700 j. Paid dividends $1,500 Based on balance sheet, what is the amount of cash that the company have in the end of the month? (answer it by numbers only, do not use ".", "," or "\$") How much net income the company has in this month? (answer it by numbers only, do not use ".", "," or "\$") 5. How much retained earnings that is acquired by Bret Eisen's company in 10 points this month? (answer it by numbers only, do not use "..", "," or "\$") 5. Based on Balance Sheet, what is the amount of total asset of Bret Eisen's 10 points company in the end of the month? (answer it by numbers only, do not use ".", ",", or "\$") Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started