Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On June 1, Sure Foot Outfitters, Inc. bought 50 pairs of hiking boots for $100 per pair from a vendor on account with terms

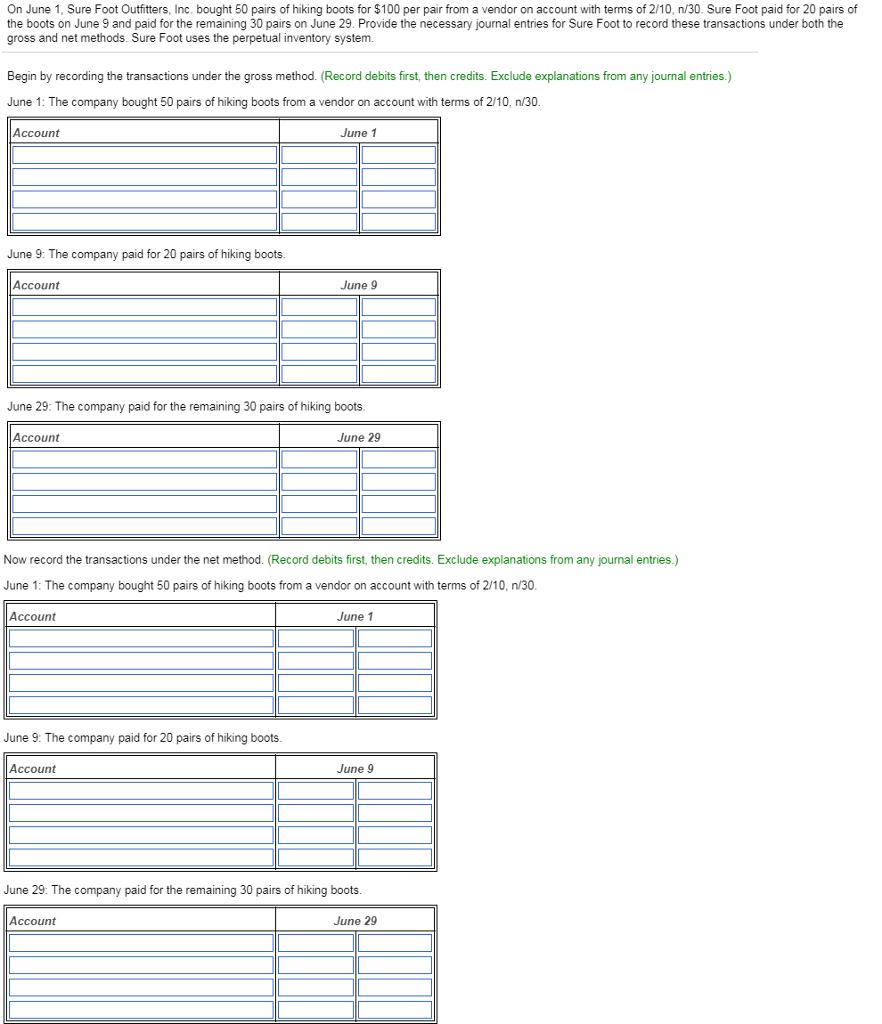

On June 1, Sure Foot Outfitters, Inc. bought 50 pairs of hiking boots for $100 per pair from a vendor on account with terms of 2/10, n/30. Sure Foot paid for 20 pairs of the boots on June 9 and paid for the remaining 30 pairs on June 29. Provide the necessary journal entries for Sure Foot to record these transactions under both the gross and net methods. Sure Foot uses the perpetual inventory system. Begin by recording the transactions under the gross method. (Record debits first, then credits. Exclude explanations from any journal entries.) June 1: The company bought 50 pairs of hiking boots from vendor on account with terms of 2/10, n/30. Account June 9: The company paid for 20 pairs of hiking boots. Account June 1 June 29: The company paid for the remaining 30 pairs of hiking boots. Account June 29 Account June 9 Now record the transactions under the net method. (Record debits first, then credits. Exclude explanations from any journal entries.) June 1: The company bought 50 pairs of hiking boots from a vendor on account with terms of 2/10, n/30. June 9: The company paid for 20 pairs of hiking boots. Account June 1 June 9 June 29: The company paid for the remaining 30 pairs of hiking boots. Account June 29

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Transaction entries under Gross method Date Account Title and Explanatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started