Question

On June 3, 2016, Shire plc acquired all of the outstanding common stock of Baxalta, Inc. for $18.00 per share in cash and shares of

a. Related to the Baxalta acquisition amounts that will appear in the [A] consolidation entry on that date?

b. Assume none of the intangible assets were reported on Baxalta's pre-acquisition balance sheet Prepare the [A] consolidation entry to recognize the intangible assets on the consolidated balance sheet at December 31, 2016 are the preliminary values as of December 31, 2016 the b.

c. With respect to the measurement period adjustments, what are the primary factors that caused Goodwill to increase more than $5 billion between June 3 and December 31, 2016? Describe the logic of the transfer between these account categories.

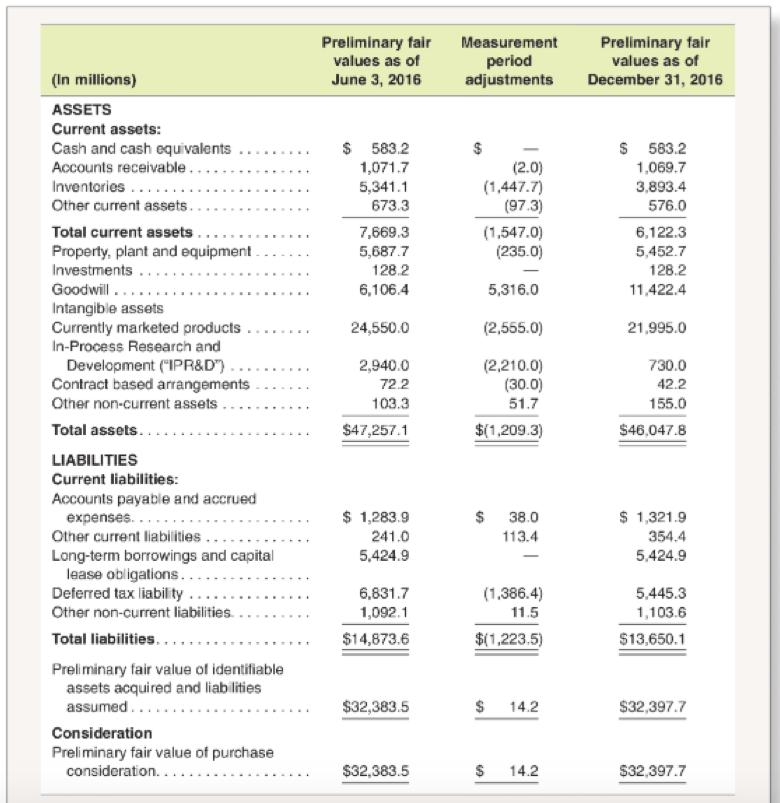

(In millions) ASSETS Current assets: Cash and cash equivalents Accounts receivable..... Inventories..... Other current assets... Total current assets. Property, plant and equipment. Investments. Goodwill.... Intangible assets Currently marketed products.. In-Process Research and Development ("IPR&D").. Contract based arrangements Other non-current assets... Total assets....... LIABILITIES Current liabilities: Accounts payable and accrued expenses... Other current liabilities... Long-term borrowings and capital lease obligations... Deferred tax liability... Other non-current liabilities. Total liabilities...... Preliminary fair value of identifiable assets acquired and liabilities assumed... Consideration Preliminary fair value of purchase consideration.... Preliminary fair values as of June 3, 2016 $ 583.2 1,071.7 5,341.1 673.3 7,669.3 5,687.7 128.2 6,106.4 24,550.0 2,940.0 72.2 103.3 $47,257.1 $ 1,283.9 241.0 5,424.9 6,831.7 1,092.1 $14,873.6 $32,383.5 $32,383.5 Measurement period adjustments $ (2.0) (1,447.7) (97.3) (1,547.0) (235.0) 5,316.0 (2,555.0) (2,210.0) (30.0) 51.7 $(1,209.3) $ 38.0 113.4 (1.386.4) 11.5 $(1,223.5) $ 14.2 $ 14.2 Preliminary fair values as of December 31, 2016 $ 583.2 1,069.7 3,893.4 576.0 6,122.3 5,452.7 128.2 11,422.4 21,995.0 730.0 42.2 155.0 $46,047.8 $ 1,321.9 354.4 5,424.9 5.445.3 1,103.6 $13,650.1 $32,397.7 $32,397.7

Step by Step Solution

3.60 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a A Dr Cash 5832 Dr Accounts Receivable 10697 Dr Inventories 38934 Dr Other Current Assets 5760 Dr Property Plant and Equipment 22100 Dr Investments 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started