Question

On June 30, 2013, Stampol Company ceased operations and all of their assets and liabilities were purchased by Postoli Incorporated. Postoli paid $40,000 in cash

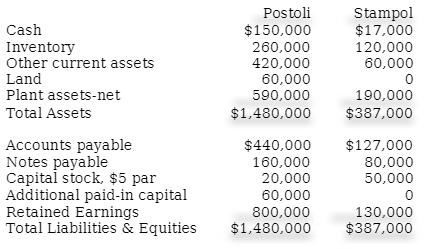

On June 30, 2013, Stampol Company ceased operations and all of their assets and liabilities were purchased by Postoli Incorporated. Postoli paid $40,000 in cash to the owner of Stampol, and signed a five-year note payable to the owners of Stampol in the amount of $200,000. Their closing balance sheets as of June 30, 2013 are shown below. In the purchase agreement, both parties noted that Inventory was undervalued on the books by $10,000, and Pistoli would also take possession of a customer list with a fair value of $18,000. Pistoli paid all legal costs of the acquisition, which amounted to $7,000.

Required:

1. Prepare the journal entry Postoli would record at the date of acquisition.

2. Prepare the journal entry Stampol would record at the date of acquisition.

Postoli $150,000 260,000 420,000 60,000 590,000 Stampol $17,000 Cash Inventory Other current assets 120,000 60,000 Land Plant assets-net 190,000 Total Assets $1,480,000 $387,000 Accounts payable Notes payable Capital stock, $5 par Additional paid-in capital Retained Earnings Total Liabilities & Equities $440,000 $127,000 160,000 20,000 80,000 50,000 60,000 800,000 130,000 $1,480,000 $387,000

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Purchase consideration purchase consideration cash paid 40000 liability note 200000 total purchase ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started