Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On June 30, 2023, BigCo Inc. completed the acquisition of 100% of Lilco Enterprises. Fair values of acquired asset equaled predecessor book value except for

| On June 30, 2023, BigCo Inc. completed the acquisition of 100% of Lilco Enterprises. Fair values of acquired asset equaled predecessor book value |

| except for intangible assets which were worth $20,000,000 and had a 5 year life. The acquisition price was $60,000,000 paid in a note payable |

| to the seller bearing interest at 8% which was deemed to be a fair rate of interest |

| Assume income tax rate of 0% |

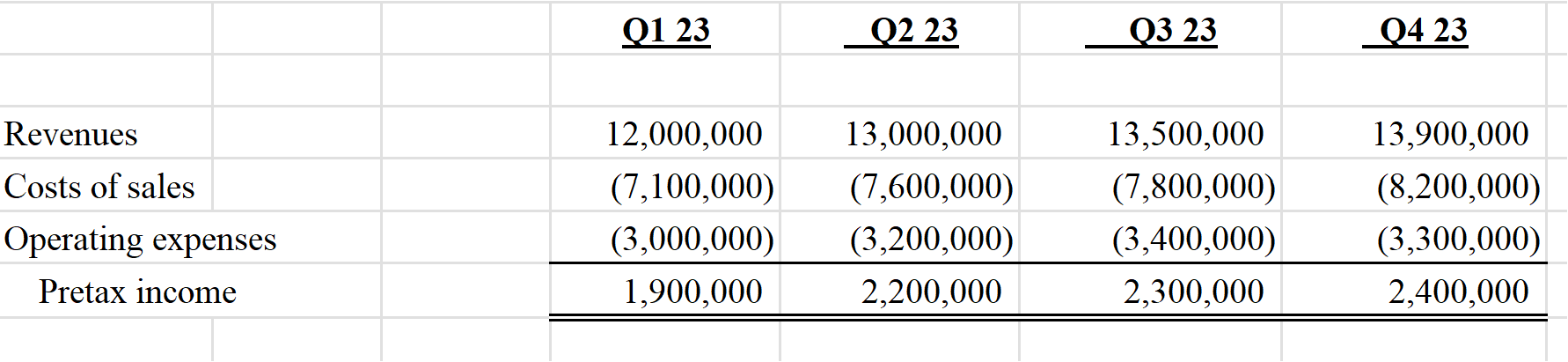

| Lilco Enterprises prepared the following stand-alone quarterly income statements for the four quarters in the year ended 12/31/23. These EXCLUDE all impacts of acquisition accounting. |

|

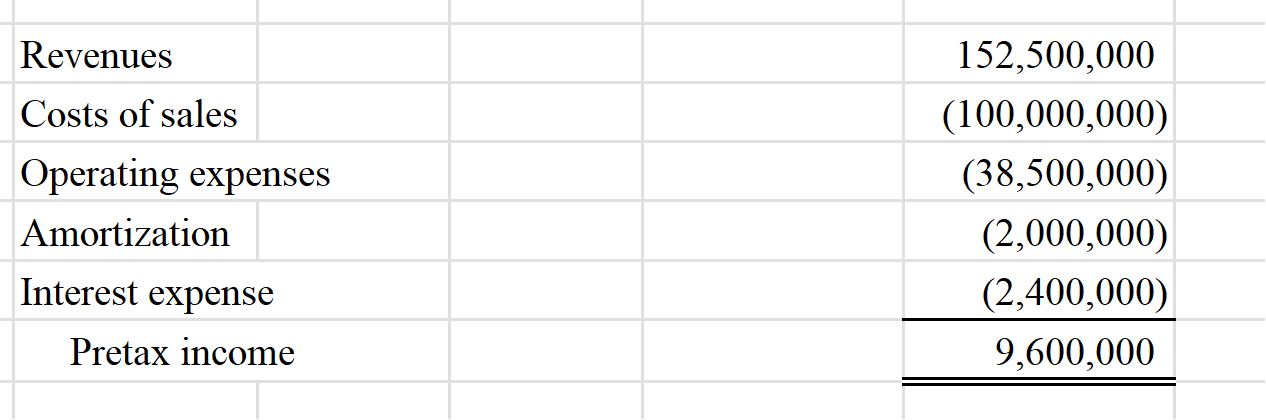

| Consolidated net income of BigCo for the year ended 12/31/23 was as follows: |

|

| What amount is pro-forma consolidated revenue for BigCo for 2023 assuming the acquisition had happened at the beginning of the year |

| What amount would the pro-forma consolidated pretax income of Parent be for 2023 assuming the acquisition had happened as the beginning of the year? |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started