Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On June 30, 2024, the Esquire Company sold merchandise to a customer and accepted a noninterest-bearing note in exchange. The note requires payment of

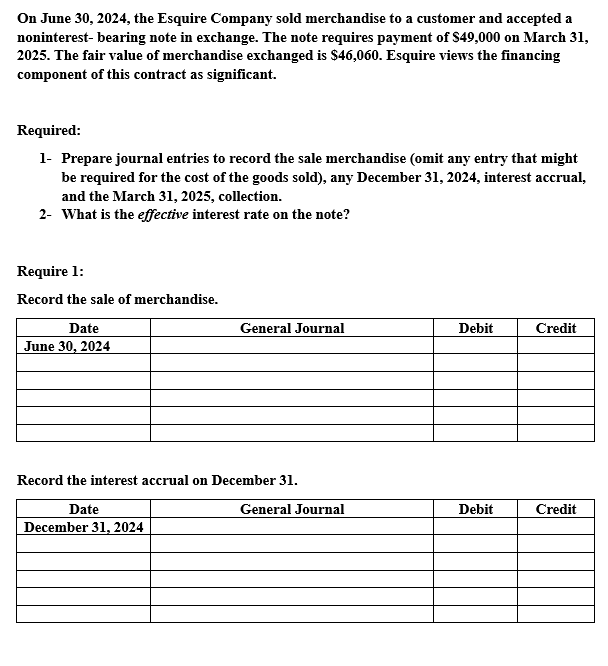

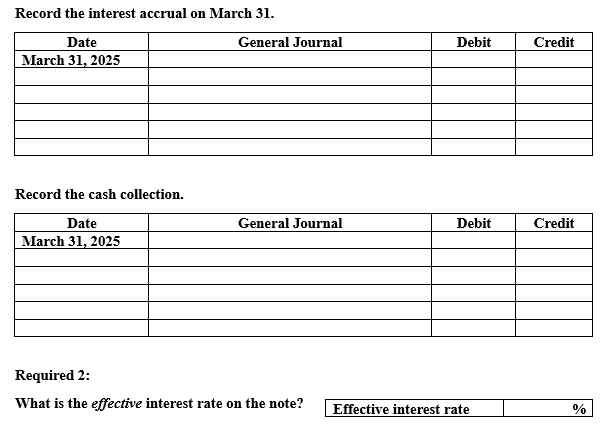

On June 30, 2024, the Esquire Company sold merchandise to a customer and accepted a noninterest-bearing note in exchange. The note requires payment of $49,000 on March 31, 2025. The fair value of merchandise exchanged is $46,060. Esquire views the financing component of this contract as significant. Required: 1- Prepare journal entries to record the sale merchandise (omit any entry that might be required for the cost of the goods sold), any December 31, 2024, interest accrual, and the March 31, 2025, collection. 2- What is the effective interest rate on the note? Require 1: Record the sale of merchandise. Date June 30, 2024 General Journal Debit Credit Record the interest accrual on December 31. Date December 31, 2024 General Journal Debit Credit Record the interest accrual on March 31. Date March 31, 2025 Record the cash collection. Date March 31, 2025 Required 2: General Journal Debit Credit General Journal Debit Credit What is the effective interest rate on the note? Effective interest rate %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 Journal Entries a Record the sale of merchandise on June 30 2024 Date June 30 2024 Genera...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started