Answered step by step

Verified Expert Solution

Question

1 Approved Answer

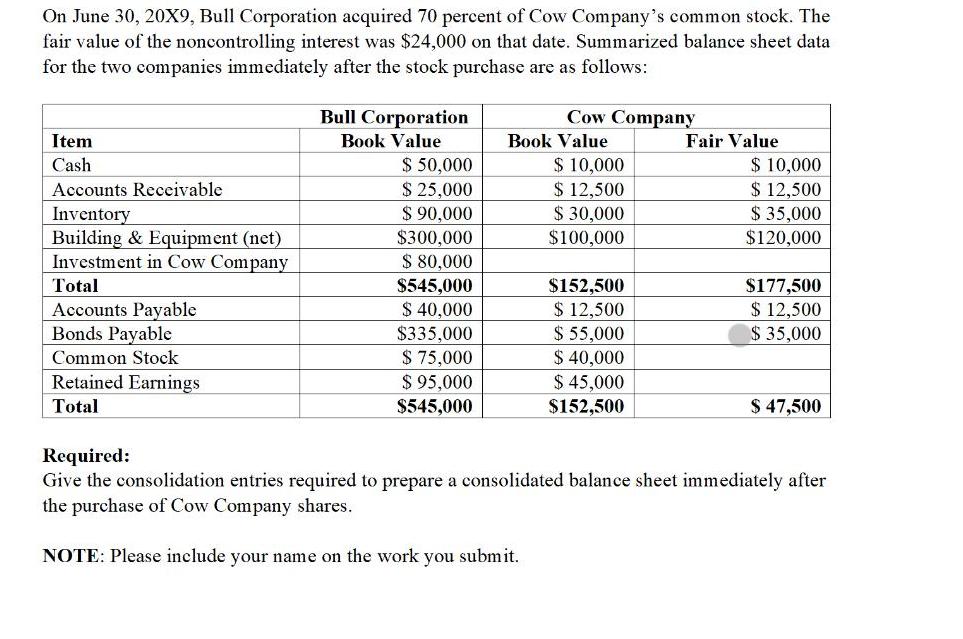

On June 30, 20X9, Bull Corporation acquired 70 percent of Cow Company's common stock. The fair value of the noncontrolling interest was $24,000 on

On June 30, 20X9, Bull Corporation acquired 70 percent of Cow Company's common stock. The fair value of the noncontrolling interest was $24,000 on that date. Summarized balance sheet data for the two companies immediately after the stock purchase are as follows: Item Cash Accounts Receivable Inventory Building & Equipment (net) Investment in Cow Company Total Accounts Payable Bonds Payable Common Stock Retained Earnings Total Bull Corporation Book Value $ 50,000 $ 25,000 $ 90,000 $300,000 $ 80,000 $545,000 $ 40,000 $335,000 $ 75,000 $ 95,000 $545,000 Cow Company Book Value $ 10,000 $ 12,500 $ 30,000 $100,000 $152,500 $ 12,500 $ 55,000 $ 40,000 $ 45,000 $152,500 Fair Value $ 10,000 $ 12,500 $ 35,000 $120,000 $177,500 $ 12,500 $ 35,000 $ 47,500 Required: Give the consolidation entries required to prepare a consolidated balance sheet immediately after the purchase of Cow Company shares. NOTE: Please include your name on the work you submit.

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer Net Asset Cash Accounts receivable inventory Bu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started