Answered step by step

Verified Expert Solution

Question

1 Approved Answer

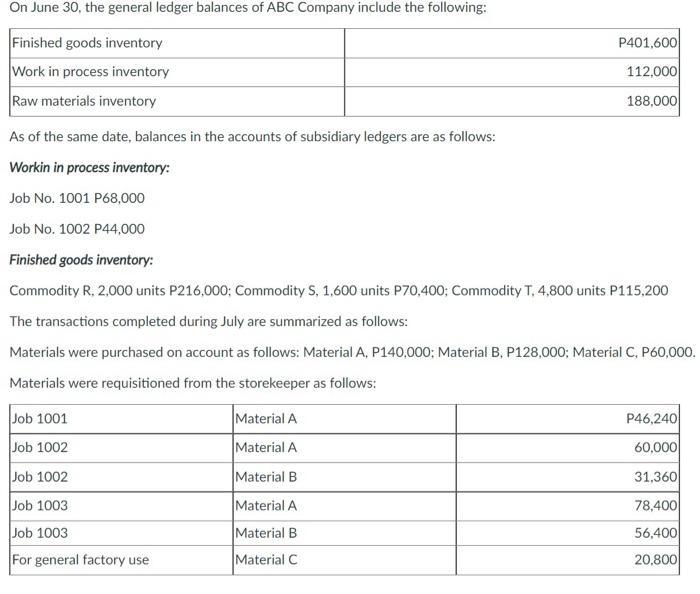

On June 30, the general ledger balances of ABC Company include the following: Finished goods inventory Work in process inventory Raw materials inventory As

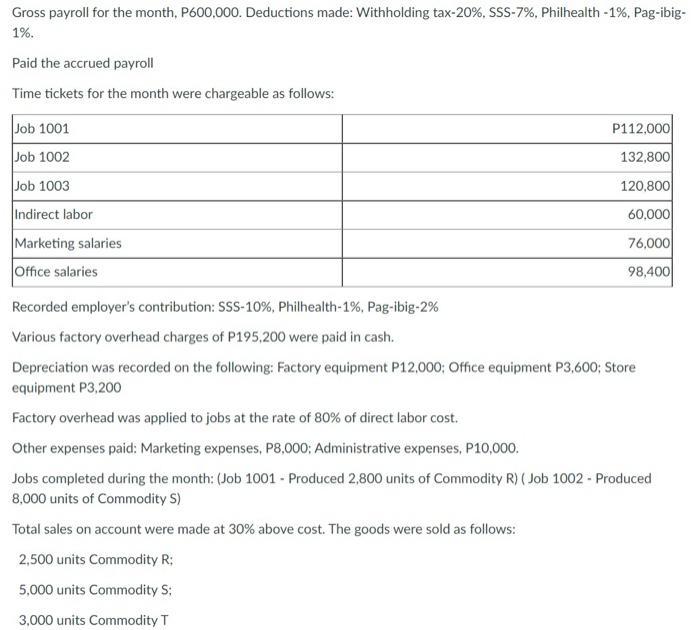

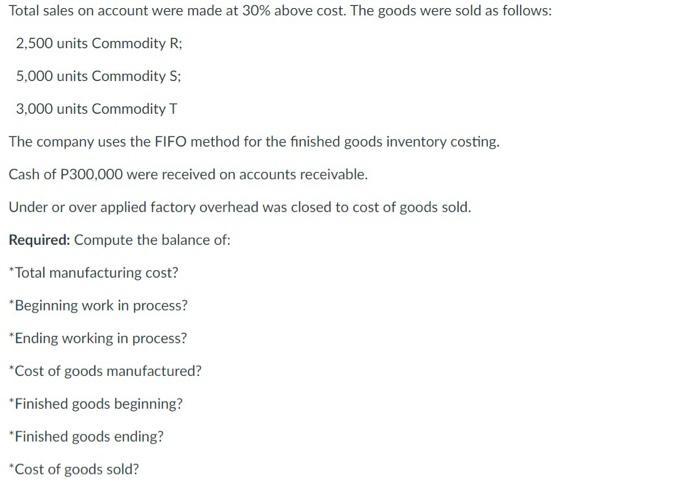

On June 30, the general ledger balances of ABC Company include the following: Finished goods inventory Work in process inventory Raw materials inventory As of the same date, balances in the accounts of subsidiary ledgers are as follows: Workin in process inventory: Job No. 1001 P68,000 Job No. 1002 P44,000 Finished goods inventory: Commodity R. 2,000 units P216,000; Commodity S, 1,600 units P70,400; Commodity T, 4,800 units P115,200 The transactions completed during July are summarized as follows: Materials were purchased on account as follows: Material A, P140,000; Material B, P128,000; Material C, P60,000. Materials were requisitioned from the storekeeper as follows: Job 1001 Job 1002 Job 1002 Job 1003 Job 1003 For general factory use P401,600 112,000 188,000 Material A Material A Material B Material A Material B Material C P46,240 60,000 31,360 78,400 56,400 20,800 Gross payroll for the month, P600,000. Deductions made: Withholding tax-20%, SSS-7%, Philhealth -1%, Pag-ibig- 1%. Paid the accrued payroll Time tickets for the month were chargeable as follows: Job 1001 Job 1002 Job 1003 Indirect labor Marketing salaries Office salaries P112,000 132,800 120,800 60,000 76,000 98,400 Recorded employer's contribution: SSS-10%, Philhealth-1% , Pag-ibig-2% Various factory overhead charges of P195,200 were paid in cash. Depreciation was recorded on the following: Factory equipment P12,000; Office equipment P3,600; Store equipment P3,200 Factory overhead was applied to jobs at the rate of 80% of direct labor cost. Other expenses paid: Marketing expenses, P8,000; Administrative expenses, P10,000. Jobs completed during the month: (Job 1001 - Produced 2,800 units of Commodity R) (Job 1002 - Produced 8,000 units of Commodity S) Total sales on account were made at 30% above cost. The goods were sold as follows: 2,500 units Commodity R; 5,000 units Commodity S; 3,000 units Commodity T Total sales on account were made at 30% above cost. The goods were sold as follows: 2,500 units Commodity R; 5,000 units Commodity S: 3,000 units Commodity T The company uses the FIFO method for the finished goods inventory costing. Cash of P300,000 were received on accounts receivable. Under or over applied factory overhead was closed to cost of goods sold. Required: Compute the balance of: *Total manufacturing cost? *Beginning work in process? *Ending working in process? *Cost of goods manufactured? *Finished goods beginning? *Finished goods ending? *Cost of goods sold?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Total manufacturing cost 6000046240760003136060000784005640078400208003200 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started