Answered step by step

Verified Expert Solution

Question

1 Approved Answer

on Livia's return from the leave, Meatpackers must ia to her same position or a comparable position. porary family leave from her job at Meatpackers

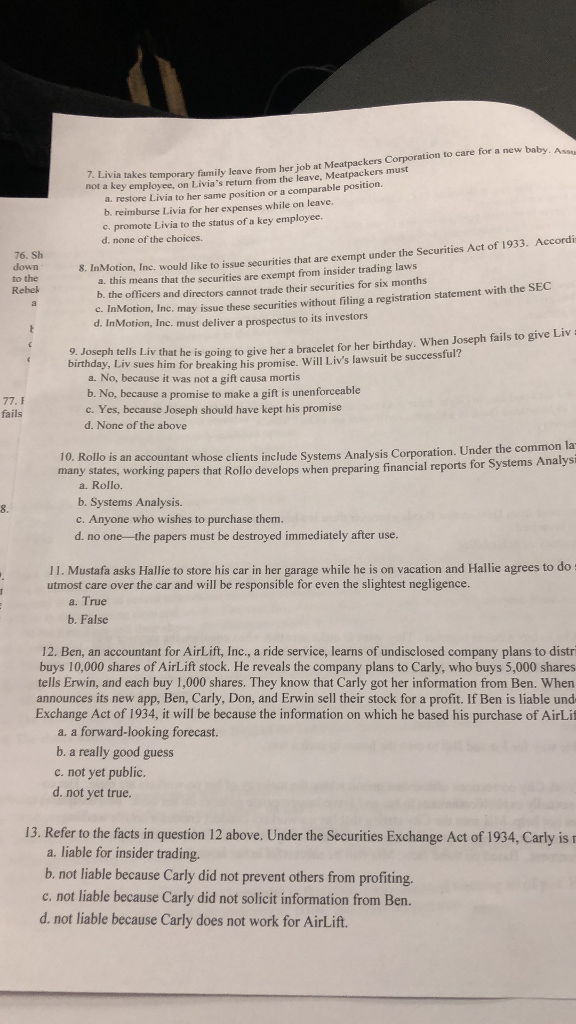

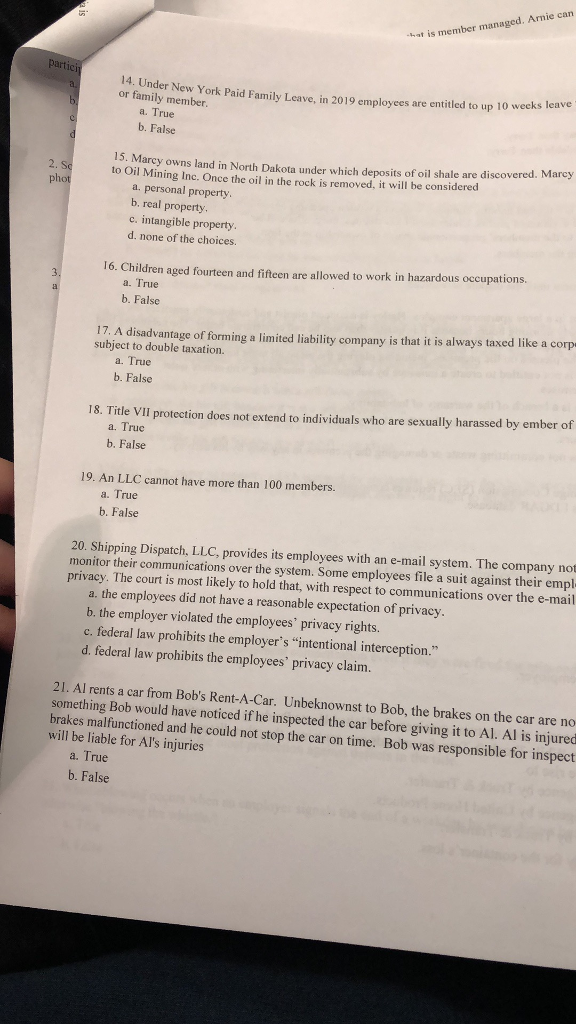

on Livia's return from the leave, Meatpackers must ia to her same position or a comparable position. porary family leave from her job at Meatpackers Corporation to care for a new baby a. restore Liv b. reimburse Livia for her expenses while on leave. c. promote Livia to the status of a key employee. d. none of the choices. 76. Sh down to the Rebek 8. InMotion, Inc. would like to issue securities that are exempt under the Securities Act of 1933. Accordi a. this means that the securities are exempt from insider trading laws b. the officers and directors cannot trade their securities for six months statement with the SEC e. InMotion, Inc. may issue these securities without filing a registration d. InMotion, Inc. must deliver a prospectu s to its investors Joseph tells Liv that he is going to give her a bracelet for her birthday. When Joseph fails to give Liv a sues him for breaking his promise. Will Liv's lawsuit be successful? a. No, because it was not a gift causa mortis b. No, because a promise to make a gift is unenforceable c. Yes, because Joseph should have kept his promise d. None of the above 77.F fails 10. Rollo is an accountant whose clients include Systems Analysis Corporation. Under many states, working papers that Rollo develops when preparing financial reports for Systems Ana the common la lysi a. Rollo. b. Systems Analysis c. Anyone who wishes to purchase them. d. no one-the papers must be destroyed immediately after use 8. 11. Mustafa asks Hallie to store his car in her garage while he is on vacation and Hallie agrees to do utmost care over the car and will be responsible for even the slightest negligence. a. True b. False 12. Ben, an accountant for AirLift, Inc., a ride service, learns of undisclosed company plans to distr buys 10,000 shares of AirLift stock. He reveals the company plans to Carly, who buys 5,000 shares tells Erwin, and each buy 1,000 shares. They know that Carly got her information from Ben. When announces its new app, Ben, Carly, Don, and Erwin sell their stock for a profit. If Ben is liable und Exchange Act of 1934, it will be because the information on which he based his purchase of AirLif a. a forward-looking forecast. b. a really good guess c. not yet public. d. not yet true 13. Refer to the facts in question 12 above. Under the Securities Exchange Act of 1934, Carly is a. liable for insider trading. b. not liable bcause Carly did not prevent others from profiting. c, not liable because Carly did not solicit information from Ben. d. not liable because Carly does not work for AirLift. bat is member managed. Arnie can Partic 14. Under New York Paid Family Leave, in 2019 employees are or family member entitled to up 10 weeks leave a. True b. False 15. Marcy owns land in North Dakota under which deposits of oil shale are discovered. Marcy to Oil Mining Inc. Once the oil in the rock is removed, it will be considered a. personal property b. real property c. intangible property. d. none of the choices. 16. Children aged fourteen and fifteen are allowed to work in hazardous occupations. a. True b. False 17. A disadvantage of forming a limited liability company is that it is always taxed like a corp subject to double taxation. a. True b. False 18. Title VII protection does not extend to individuals who are sexually harassed by ember of a. True b. False 19. An LLC cannot have more than 100 members. a. True b. False 20. Shipping Dispatch, LLC, provides its employees with an e-mail system. The company not onitor their communications over the system. Some employees file a suit against their empl privacy. The court is most likely to hold that, with respect to communications over the e-mail a. the employees did not have a reasonable expectation of privacy b. the employer violated the employees' privacy rights. c. federal law prohibits the employer's "intentional interception." d. federal law prohibits the employees' privacy claim. 21. Al rents a car from Bob's Rent-A-Car. Unbeknownst to Bob, the brakes on the car are no something Bob would have noticed if he inspected the car before giving it to Al. Al is injured brakes malfunctioned and he could not stop the car on time. Bob was responsible for inspect will be liable for Al's injuries a. True b.False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started