A) On March 01, 2009 Azfar Engineering Works had two jobs in process as follows. .... Job No. 18 . Job No. 19 Direct

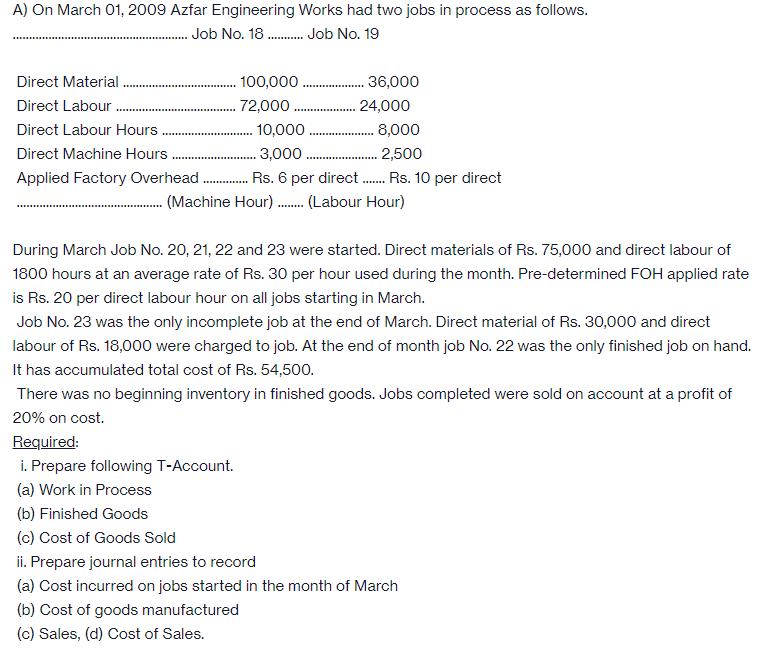

A) On March 01, 2009 Azfar Engineering Works had two jobs in process as follows. .... Job No. 18 . Job No. 19 Direct Material 100,000 . 36,000 ....... Direct Labour 72,000 24,000 Direct Labour Hours. 10,000 8,000 3,000 . Applied Factory Overhead . Rs. 6 per direct. Rs. 10 per direct (Machine Hour). (Labour Hour) Direct Machine Hours 2,500 ..... ........... During March Job No. 20, 21, 22 and 23 were started. Direct materials of Rs. 75,000 and direct labour of 1800 hours at an average rate of Rs. 30 per hour used during the month. Pre-determined FOH applied rate is Rs. 20 per direct labour hour on all jobs starting in March. Job No. 23 was the only incomplete job at the end of March. Direct material of Rs. 30,000 and direct labour of Rs. 18,000 were charged to job. At the end of month job No. 22 was the only finished job on hand. It has accumulated total cost of Rs. 54,500. There was no beginning inventory in finished goods. Jobs completed were sold on account at a profit of 20% on cost. Required: i. Prepare following T-Account. (a) Work in Process (b) Finished Goods (c) Cost of Goods Sold ii. Prepare journal entries to record (a) Cost incurred on jobs started in the month of March (b) Cost of goods manufactured (c) Sales, (d) Cost of Sales.

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer i T accounts would include the following a WIP Debit side Beginning balance 330000 Direc...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started