Answered step by step

Verified Expert Solution

Question

1 Approved Answer

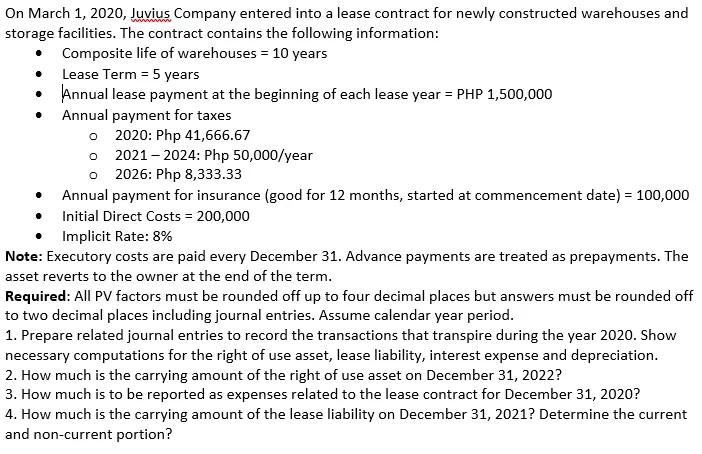

On March 1, 2020, Juvius Company entered into a lease contract for newly constructed warehouses and storage facilities. The contract contains the following information:

On March 1, 2020, Juvius Company entered into a lease contract for newly constructed warehouses and storage facilities. The contract contains the following information: Composite life of warehouses = 10 years Lease Term = 5 years Annual lease payment at the beginning of each lease year = PHP 1,500,000 Annual payment for taxes o 2020: Php 41,666.67 o 2021- 2024: Php 50,000/year o 2026: Php 8,333.33 Annual payment for insurance (good for 12 months, started at commencement date) = 100,000 Initial Direct Costs = 200,000 Implicit Rate: 8% Note: Executory costs are paid every December 31. Advance payments are treated as prepayments. The asset reverts to the owner at the end of the term. Required: All PV factors must be rounded off up to four decimal places but answers must be rounded off to two decimal places including journal entries. Assume calendar year period. 1. Prepare related journal entries to record the transactions that transpire during the year 2020. Show necessary computations for the right of use asset, lease liability, interest expense and depreciation. 2. How much is the carrying amount of the right of use asset on December 31, 2022? 3. How much is to be reported as expenses related to the lease contract for December 31, 2020? 4. How much is the carrying amount of the lease liability on December 31, 2021? Determine the current and non-current portion?

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution Given details are as follows Commencement date 0103202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started