Answered step by step

Verified Expert Solution

Question

1 Approved Answer

on March 1, 2020 kingbird inc. acquired real estate on which it planned to construct a small office building. The company paid $90,000 in cash.

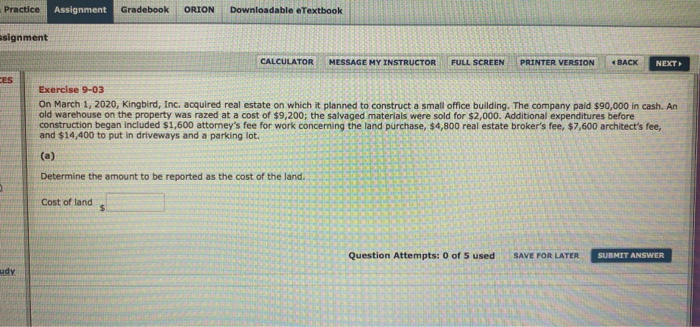

on March 1, 2020 kingbird inc. acquired real estate on which it planned to construct a small office building. The company paid $90,000 in cash. In old warehouse on the property was raised at the cost of $9200; the salvage materials were sold for $2000. Additional expenditures before construction began included $1600 attorneys fee for work concerning the land purchase, $4800 real estate brokers fee, $7600 architects fee, and $14,400 to put in driveways and a parking lot. Determine the amount to be reported as the cost of the land.

Practice Assignment Gradebook ORION Downloadable eTextbook signment CALCULATOR MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION BACK NEXT CES Exercise 9-03 On March 1, 2020, Kingbird, Inc. acquired real estate on which it planned to construct a small office building. The company paid $90,000 in cash. An old warehouse on the property was razed at a cost of $9,200; the salvaged materials were sold for $2,000. Additional expenditures before construction began included $1,600 attorney's fee for work concerning the land purchase, $4,800 real estate broker's fee, $7,600 architect's fee, and $14,400 to put in driveways and a parking lot. (a) Determine the amount to be reported as the cost of the land. Cost of land $ Question Attempts: 0 of 5 used SAVE FOR LATER SUBMIT ANSWER udy Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started