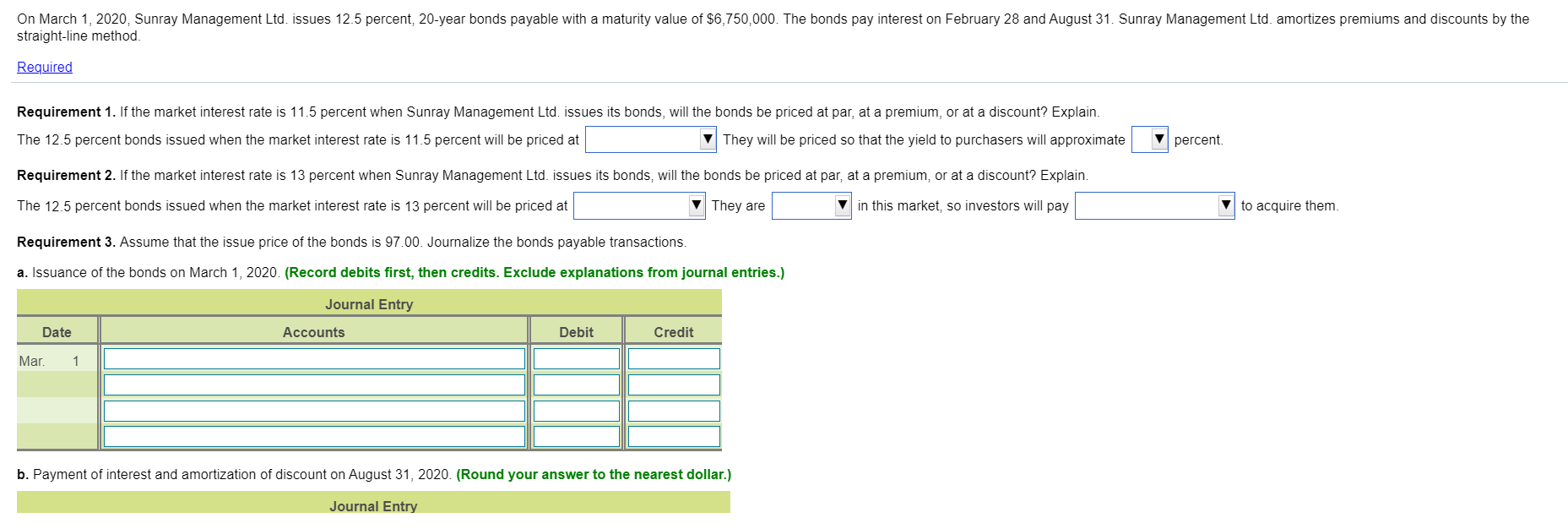

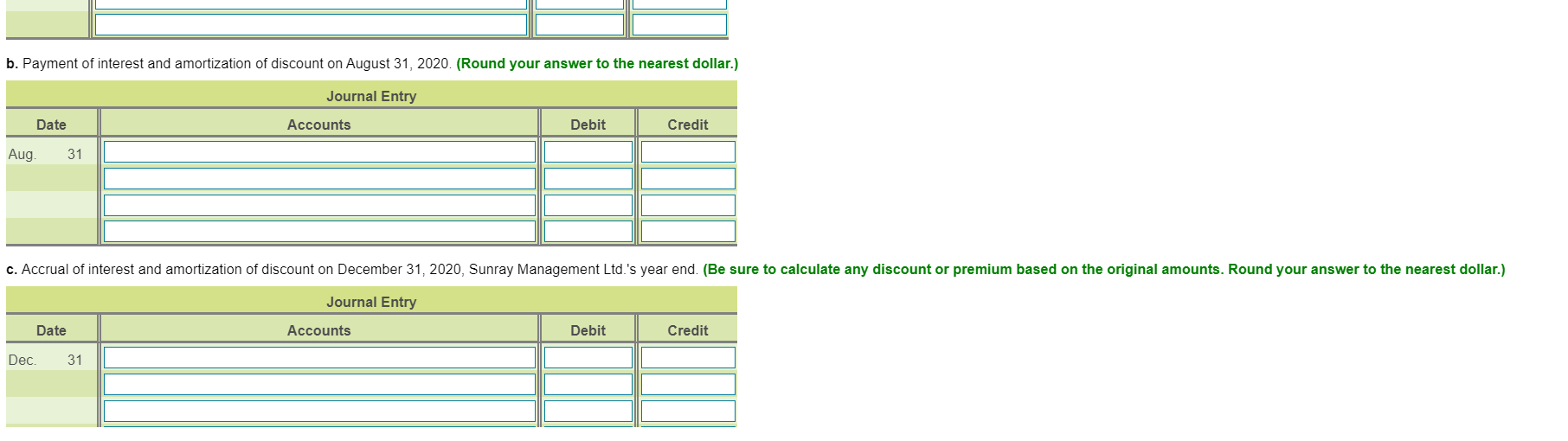

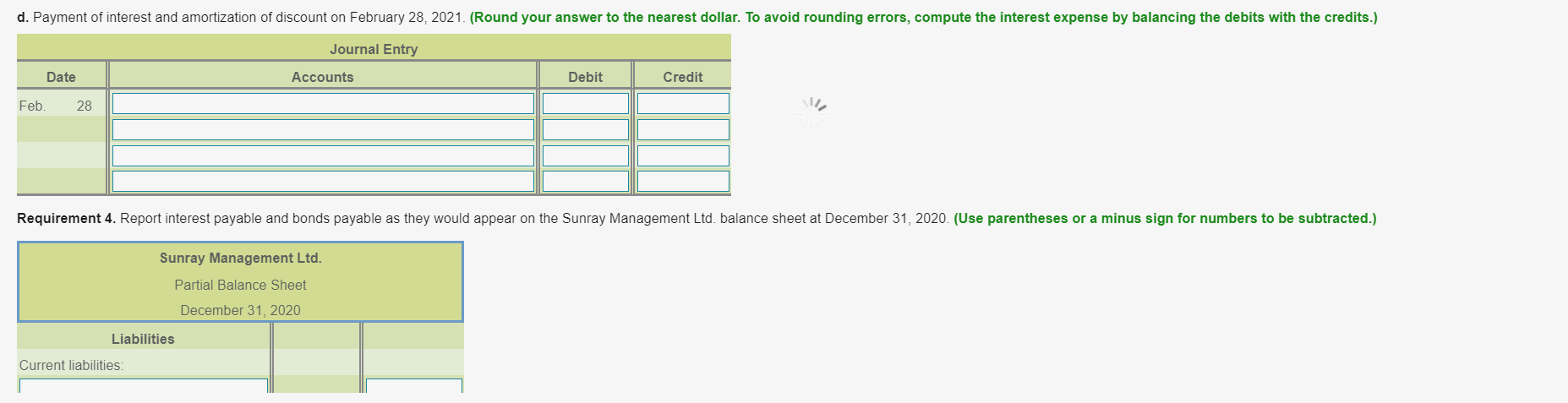

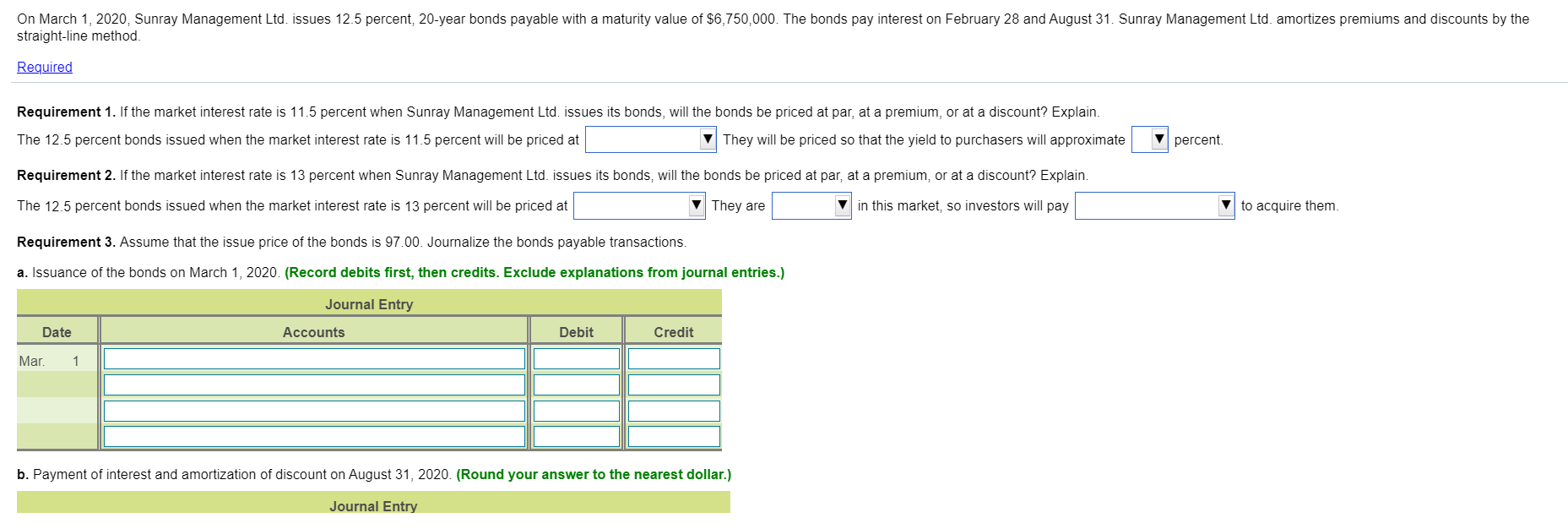

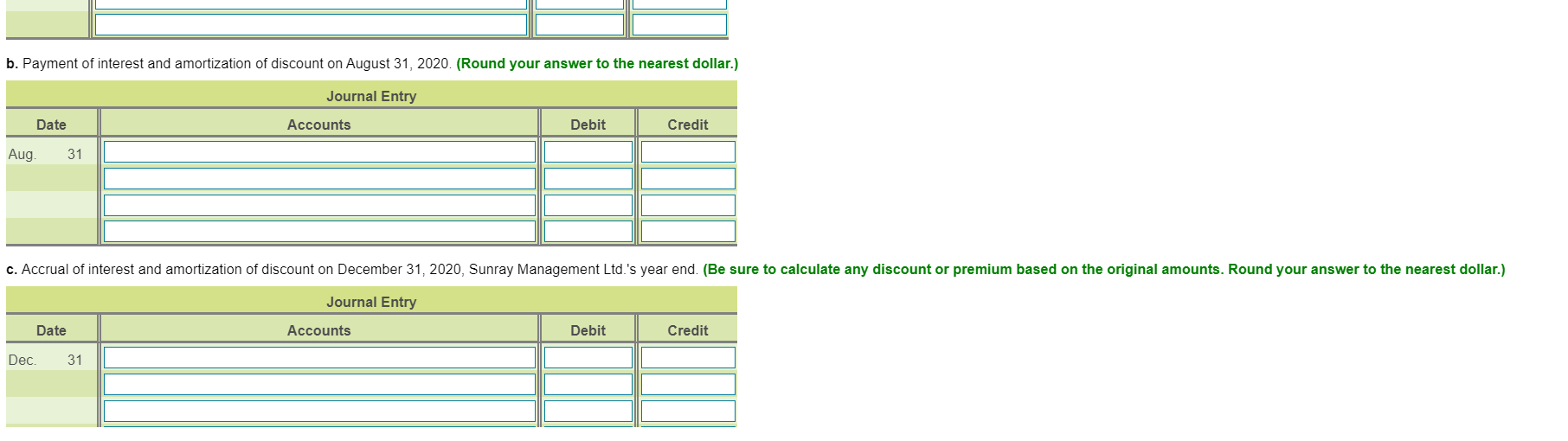

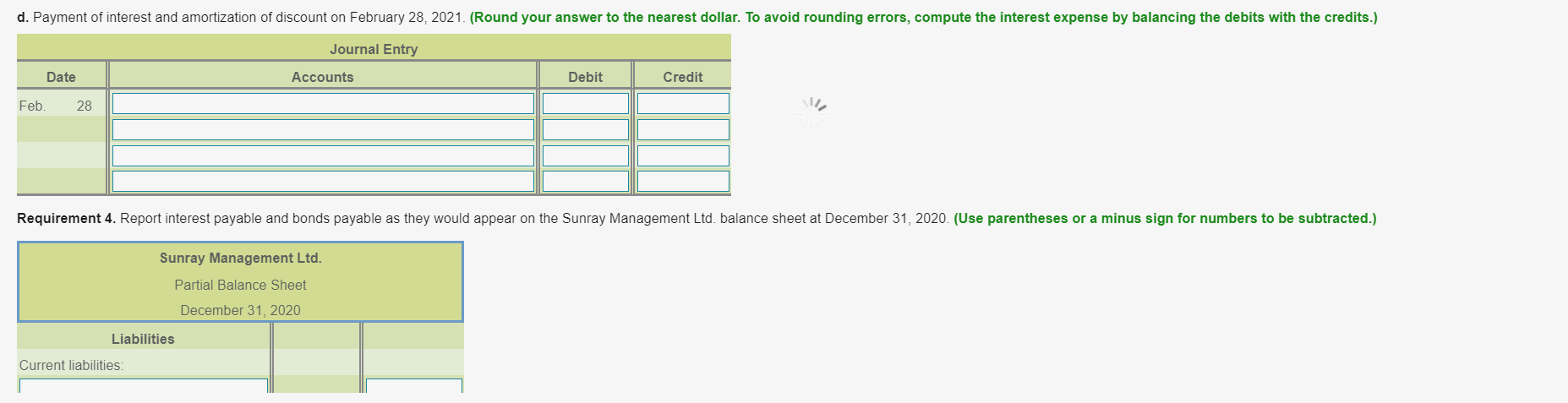

On March 1, 2020, Sunray Management Ltd. issues 12.5 percent, 20-year bonds payable with a maturity value of $6,750,000. The bonds pay interest on February 28 and August 31. Sunray Management Ltd. amortizes premiums and discounts by the straight-line method Required Requirement 1. If the market interest rate is 11.5 percent when Sunray Management Ltd. issues its bonds, will the bonds be priced at par, at a premium, or at a discount? Explain. The 12.5 percent bonds issued when the market interest rate is 11.5 percent will be priced at They will be priced so that the yield to purchasers will approximate percent. Requirement 2. If the market interest rate is 13 percent when Sunray Management Ltd. issues its bonds, will the bonds be priced at par, at a premium, or at a discount? Explain. The 12.5 percent bonds issued when the market interest rate is 13 percent will be priced at They are v in this market, so investors will pay V to acquire them. Requirement 3. Assume that the issue price of the bonds is 97.00. Journalize the bonds payable transactions. a. Issuance of the bonds on March 1, 2020. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Date Accounts Debit Credit Mar. 1 b. Payment of interest and amortization of discount on August 31, 2020. (Round your answer to the nearest dollar.) Journal Entry b. Payment of interest and amortization of discount on August 31, 2020. (Round your answer to the nearest dollar.) Journal Entry Date Accounts Debit Credit Aug 31 c. Accrual of interest and amortization of discount on December 31, 2020, Sunray Management Ltd.'s year end. (Be sure to calculate any discount or premium based on the original amounts. Round your answer to the nearest dollar.) Journal Entry Date Accounts Debit Credit Dec. 31 d. Payment of interest and amortization of discount on February 28, 2021. (Round your answer to the nearest dollar. To avoid rounding errors, compute the interest expense by balancing the debits with the credits.) Journal Entry Date Accounts Debit Credit Feb. 28 Requirement 4. Report interest payable and bonds payable as they would appear on the Sunray Management Ltd. balance sheet at December 31, 2020. (Use parentheses or a minus sign for numbers to be subtracted.) Sunray Management Ltd. Partial Balance Sheet December 31, 2020 Liabilities Current liabilities