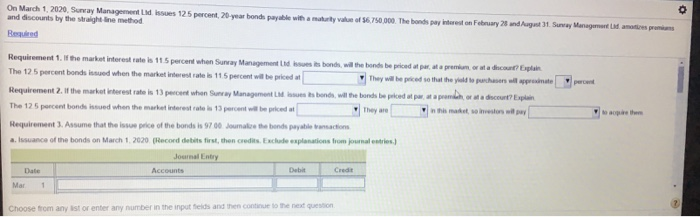

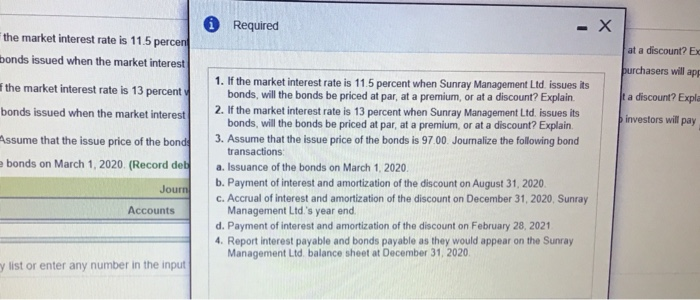

On March 1, 2020. Surray Management Lid issues 125 percent, 20-year bonds payable with a maturity value of 6.750,000. The bonds pay interest on February 23 und August 31 Sunway Management Ladates premios and discounts by the straight line method Required Requirement 1. if the market interest rate is 115 percent when Sunway Management Lidis bonds, will the bond be priced at per ata prenumerata dupa The 125 percent bonds itsed when the market interest rate is 115 percent will be priced at They will be priced so that the yield to purchases will remate Requiremont 2. It the market interest rate is 15 percent when Suneay Management Lot sun is bonds, wit the bonde le priced at para a prendah, rata decout? Espain The 125 percent bonde issued when the market interest rate is 13 percent will be priced at They are Requirements. Assume that the issue price of the bonds is 9700 Joumatore the bends payable ansactions a. Issuance of the bonds on March 1, 2020 [Record debits first, then credits. Exclude explanations from journalis) Journal Entry Date Accounts Debit Credit Mar 1 Choose from any ist or enter any number in the input felds and then continue to the next questo 0 Required - X at a discount? EX purchasers will app the market interest rate is 11.5 percent bonds issued when the market interest the market interest rate is 13 percent bonds issued when the market interest Assume that the issue price of the bond bonds on March 1, 2020 (Record de t a discount? Expla investors will pay 1. If the market interest rate is 11.5 percent when Sunray Management Ltd. issues its bonds, will the bonds be priced at par, at a premium, or at a discount? Explain. 2. If the market interest rate is 13 percent when Sunray Management Ltd. issues its bonds, will the bonds be priced at par, at a premium, or at a discount? Explain. 3. Assume that the issue price of the bonds is 97.00. Journalize the following bond transactions a. Issuance of the bonds on March 1, 2020. b. Payment of interest and amortization of the discount on August 31, 2020. c. Accrual of interest and amortization of the discount on December 31, 2020, Sunray Management Ltd.'s year end. d. Payment of interest and amortization of the discount on February 28, 2021 4. Report interest payable and bonds payable as they would appear on the Sunray Management Ltd. balance sheet at December 31, 2020 Journ Accounts y list or enter any number in the input