Question

A business purchased a motor vehicle for $44,000 (GST inclusive i.e. $40,000 plus $4,000 GST) on 1 January 2016. The motor vehicle has an

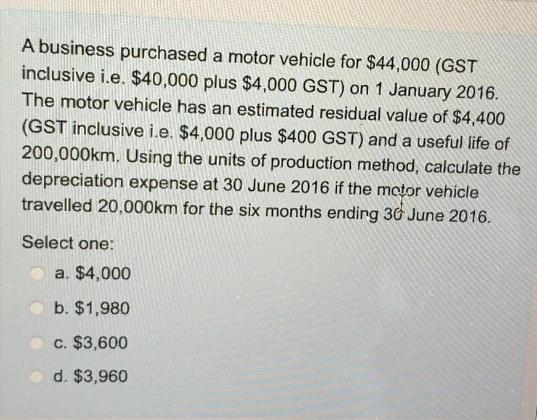

A business purchased a motor vehicle for $44,000 (GST inclusive i.e. $40,000 plus $4,000 GST) on 1 January 2016. The motor vehicle has an estimated residual value of $4,400 (GST inclusive i.e. $4,000 plus $400 GST) and a useful life of 200,000km. Using the units of production method, calculate the depreciation expense at 30 June 2016 if the motor vehicle travelled 20,000km for the six months ending 30 June 2016. Select one: a. $4,000 b. $1,980 c. $3,600 d. $3,960

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The depreciation expense can be calculated using the units of production method which is ba...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

13th Edition

978-0073379616, 73379611, 978-0697789938

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App