Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 1, 2025, Ferguson Corp. purchased a put option on shares of SST stock. The contract was for 100 shares at a strike

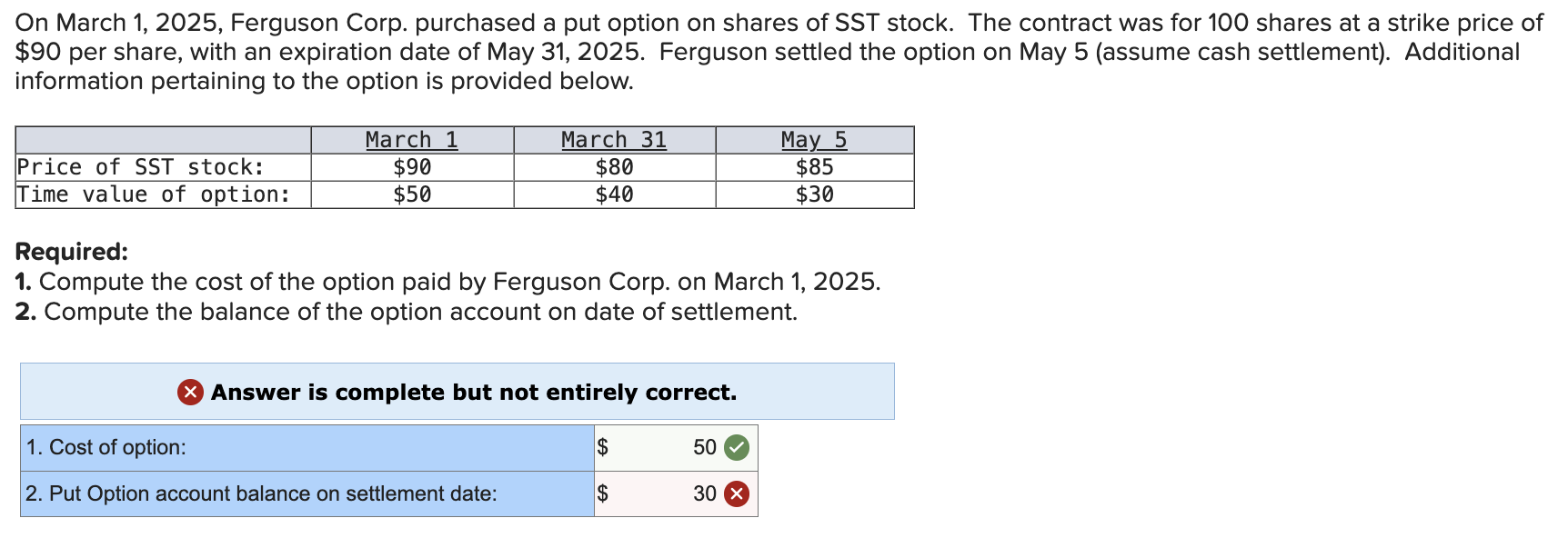

On March 1, 2025, Ferguson Corp. purchased a put option on shares of SST stock. The contract was for 100 shares at a strike price of $90 per share, with an expiration date of May 31, 2025. Ferguson settled the option on May 5 (assume cash settlement). Additional information pertaining to the option is provided below. Price of SST stock: March 1 $90 Time value of option: $50 Required: March 31 $80 May 5 $85 $40 $30 1. Compute the cost of the option paid by Ferguson Corp. on March 1, 2025. 2. Compute the balance of the option account on date of settlement. Answer is complete but not entirely correct. 1. Cost of option: $ 50 2. Put Option account balance on settlement date: $ 30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started