Answered step by step

Verified Expert Solution

Question

1 Approved Answer

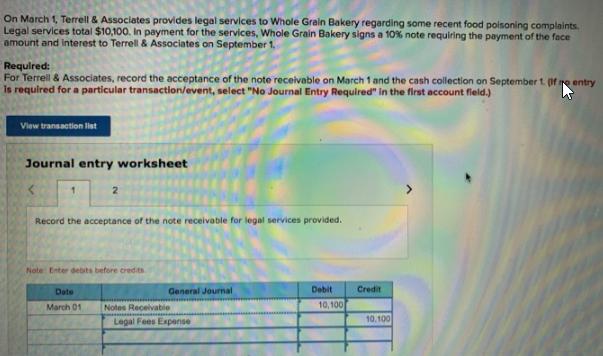

On March 1, Terrell & Associates provides legal services to Whole Gralin Bakery regarding some recent food poisoning complaints. Legal services total $10,100. In

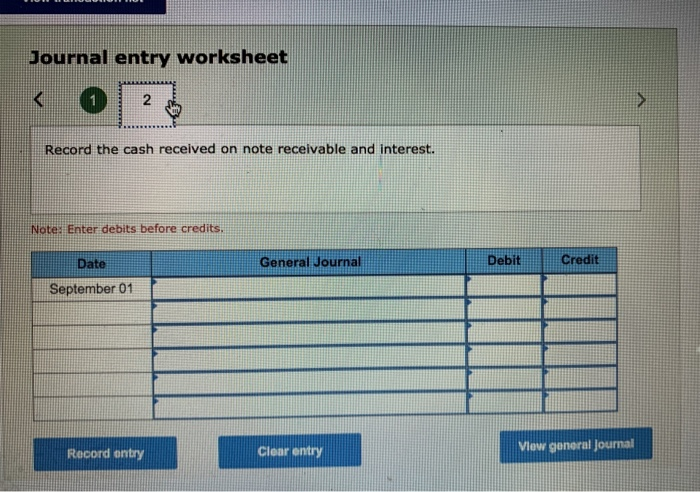

On March 1, Terrell & Associates provides legal services to Whole Gralin Bakery regarding some recent food poisoning complaints. Legal services total $10,100. In payment for the services, Whole Grain Bakery signs a 10% note requiring the payment of the face amount and Interest to Terrell & Associates on September 1. Required: For Terrell & Associates, record the acceptance of the note receivable on March 1 and the cash collection on Septembert (f re entry Is required for a particular transaction/event, select "No Journal Entry Required" in the first account fleld.) View transaction lst Journal entry worksheet 1. 2 Record the acceptance of the note receivable for legal services provided. Note Enter debits before credita Dote General Journal Debit Credit Notes Receivabie 10, 100 March 01 Legal Fees Expense 10.100 Journal entry worksheet 2 Record the cash received on note receivable and interest. Note: Enter debits before credits. Date General Journal Debit Credit September 01 Record ontry Clear entry Vlew general Journal

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Date General Journal Debit Credit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started