Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 1, Year 1, Chewtle Company issued a $23,000 installment note. The note had a 4-year term and a 6 percent interest rate.

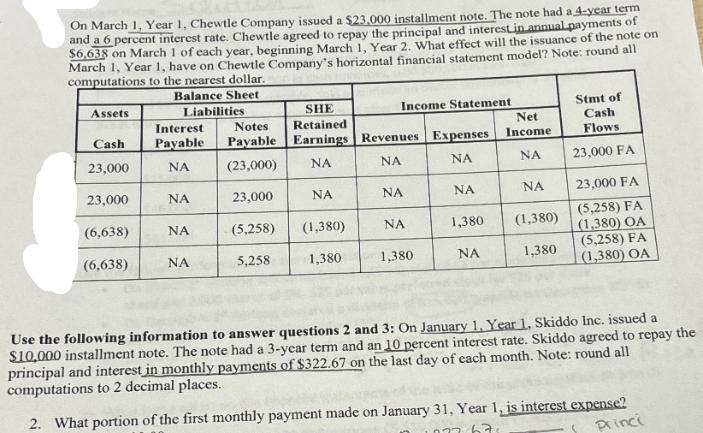

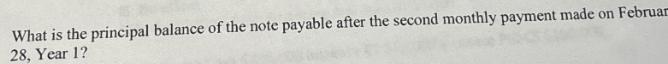

On March 1, Year 1, Chewtle Company issued a $23,000 installment note. The note had a 4-year term and a 6 percent interest rate. Chewtle agreed to repay the principal and interest in annual payments of $6,638 on March 1 of each year, beginning March 1, Year 2. What effect will the issuance of the note on March 1, Year 1, have on Chewtle Company's horizontal financial statement model? Note: round all computations to the nearest dollar. Balance Sheet Assets Liabilities SHE Income Statement Interest Notes Retained Cash Payable Payable Earnings Revenues Expenses Net Income Stmt of Cash Flows 23,000 NA (23,000) NA NA NA NA 23,000 FA 23,000 NA 23,000 NA NA NA NA 23,000 FA (6,638) NA (5,258) (1,380) NA 1,380 (1,380) (5,258) FA (1,380) OA (5,258) FA (6,638) NA 5,258 1,380 1,380 NA 1,380 (1,380) OA Use the following information to answer questions 2 and 3: On January 1, Year 1, Skiddo Inc. issued a $10,000 installment note. The note had a 3-year term and an 10 percent interest rate. Skiddo agreed to repay the principal and interest in monthly payments of $322.67 on the last day of each month. Note: round all computations to 2 decimal places. 2. What portion of the first monthly payment made on January 31, Year 1, is interest expense? Princi What is the principal balance of the note payable after the second monthly payment made on Februar 28, Year 1?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started