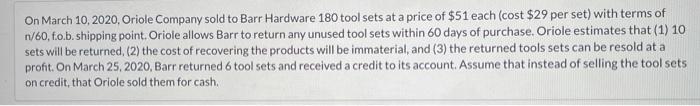

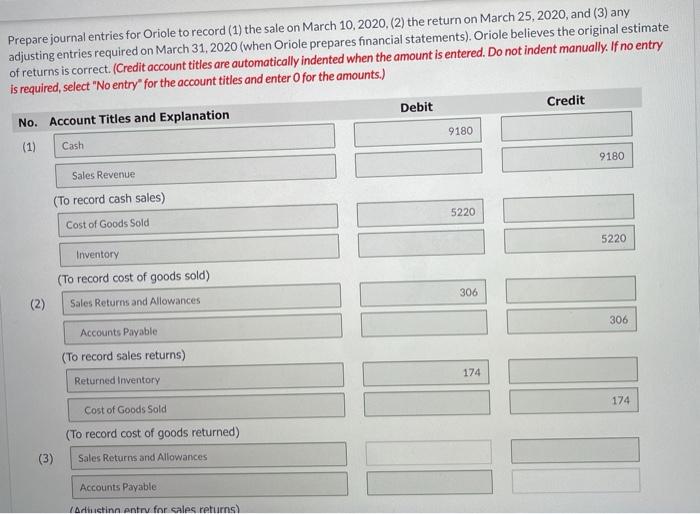

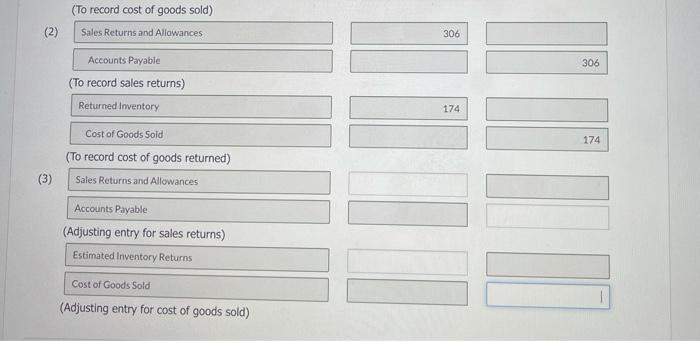

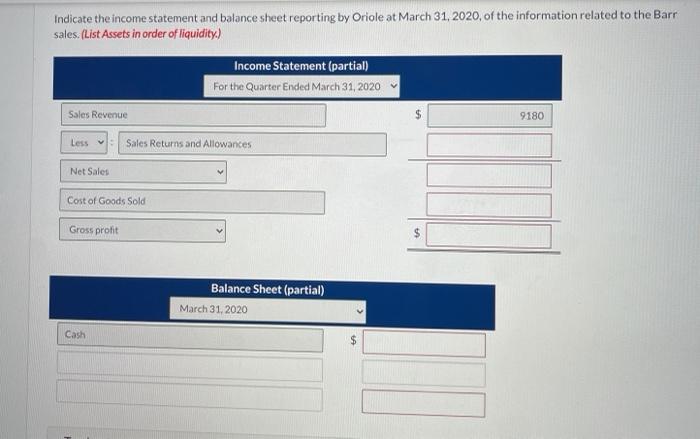

On March 10, 2020, Oriole Company sold to Barr Hardware 180 tool sets at a price of $51 each (cost $29 per set) with terms of n/60,fo.b, shipping point, Oriole allows Barr to return any unused tool sets within 60 days of purchase. Oriole estimates that (1) 10 sets will be returned, (2) the cost of recovering the products will be immaterial, and (3) the returned tools sets can be resold at a profit On March 25, 2020, Barr returned 6 tool sets and received a credit to its account. Assume that instead of selling the tool sets on credit, that Oriole sold them for cash. Prepare journal entries for Oriole to record (1) the sale on March 10, 2020, (2) the return on March 25, 2020, and (3) any adjusting entries required on March 31, 2020 (when Oriole prepares financial statements). Oriole believes the original estimate of returns is correct. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry for the account titles and enter for the amounts.) Debit Credit No. Account Titles and Explanation (1) Cash 9180 9180 Sales Revenue (To record cash sales) 5220 Cost of Goods Sold 5220 Inventory (To record cost of goods sold) Sales Returns and Allowances 306 (2) 306 Accounts Payable (To record sales returns) Returned Inventory 174 I 174 Cost of Goods Sold (To record cost of goods returned) Sales Returns and Allowances (3) Accounts Payable Adinctinn entry for sales returns (To record cost of goods sold) Sales Returns and Allowances (2) 306 306 Accounts Payable (To record sales returns) Returned Inventory 174 174 Cost of Goods Sold (To record cost of goods returned) Sales Returns and Allowances (3) Accounts Payable (Adjusting entry for sales returns) Estimated Inventory Returns Cost of Goods Sold 1 (Adjusting entry for cost of goods sold) Indicate the income statement and balance sheet reporting by Oriole at March 31, 2020, of the information related to the Barr sales. (List Assets in order of liquidity.) Income Statement (partial) For the Quarter Ended March 31, 2020 Sales Revenue 9180 Less Sales Returns and Allowances Net Sales Cost of Goods Sold Gross profit Balance Sheet (partial) March 31, 2020 Cash