Question

On March 10,2020, Prism Corporation acquired all of Skyhawk Inc.for to- tal consideration of $45 million, consisting of $43 million in cash and $2 million

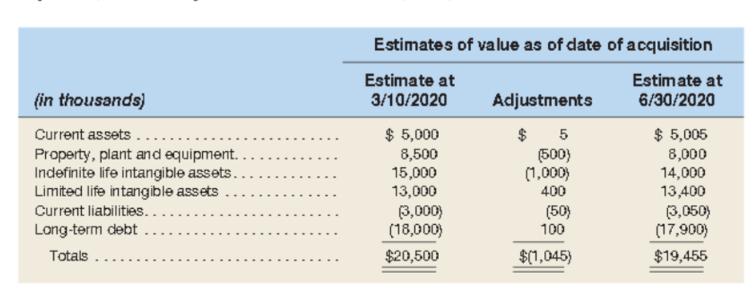

On March 10,2020, Prism Corporation acquired all of Skyhawk Inc.for to- tal consideration of $45 million, consisting of $43 million in cash and $2 million in vested stock options. Prism's acoounting year ends June 30. Fair values of Skyhawk's identi fiable net assets as of the date of acquisition, as well as adjustments made as of June 30, 2020, are listed below.

A more precise estimate at June 30, 2020 of the value of the vested stock options as of the acquisition date is $2.2 million a. Does Prism Corporation need an additional adjustment entry on June 30, 2020? Expalin why it has to adjust for the change. If your answer is "yes" continue to b Otherwise stop here. b. Please make any adjusting journal entry?

A more precise estimate at June 30, 2020 of the value of the vested stock options as of the acquisition date is $2.2 million a. Does Prism Corporation need an additional adjustment entry on June 30, 2020? Expalin why it has to adjust for the change. If your answer is "yes" continue to b Otherwise stop here. b. Please make any adjusting journal entry?

(in thousands) Current assets. Property, plant and equipment.. Indefinite life intangible assets.. Limited life intangible assets Current liabilities.... Long-term debt Totals Estimates of value as of date of acquisition Estimate at 6/30/2020 Estimate at 3/10/2020 $ 5,000 8,500 15,000 13,000 (3,000) (18,000) $20,500 Adjustments $ 5 (500) (1,000) 400 (50) 100 $(1,045) $ 5,005 8,000 14,000 13,400 (3,050) (17,900) $19,455

Step by Step Solution

There are 3 Steps involved in it

Step: 1

yes Reason If the modification Increase Granted the Intremental Fair Value over t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started