Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 15, 2013, Martin Stevens formed a business to rent and service vacuum cleaning machines for domestic helping providers. He operates the business

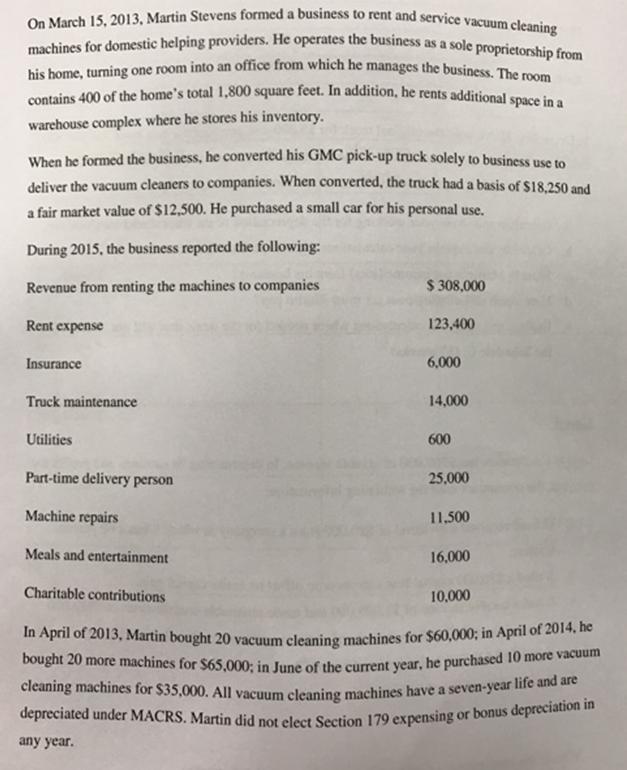

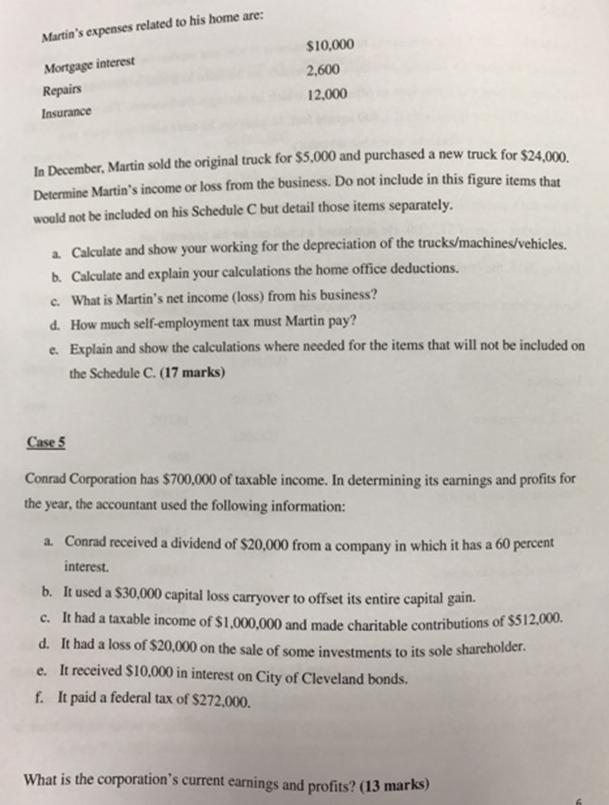

On March 15, 2013, Martin Stevens formed a business to rent and service vacuum cleaning machines for domestic helping providers. He operates the business as a sole proprietorship from his home, turning one room into an office from which he manages the business Thee contains 400 of the home's total 1,800 square feet. In addition, he rents additional space in a warchouse complex where he stores his inventory. When he formed the business, he converted his GMC pick-up truck solely to business use to deliver the vacuum cleaners to companies. When converted, the truck had a basis of $18.250 and a fair market value of $12,500. He purchased a small car for his personal use. During 2015, the business reported the following: Revenue from renting the machines to companies $ 308,000 Rent expense 123,400 Insurance 6,000 Truck maintenance 14,000 Utilities 600 Part-time delivery person 25,000 Machine repairs 11,500 Meals and entertainment 16,000 Charitable contributions 10,000 In April of 2013, Martin bought 20 vacuum cleaning mchines for $60,000; in April oft 2014, he bought 20 more machines for $65,000; in June of the current year, he purchased 10 more vacuum cleaning machines for $35,000. All vacuum cleaning machines have a seven-year life and are depreciated under MACRS. Martin did not elect Section 179 expensing or bonus depreciation in any year. Martin's expenses related to his home are: $10,000 Mortgage interest 2,600 Repairs 12,000 Insurance In December, Martin sold the original truck for $5,000 and purchased a new truck for $24,000 Determine Martin's income or loss from the business. Do not include in this figure items that would not be included on his Schedule C but detail those items separately. a Calculate and show your working for the depreciation of the trucks/machines/vehicles. b. Calculate and explain your calculations the home office deductions. c. What is Martin's net income (loss) from his business? d. How much self-employment tax must Martin pay? e. Explain and show the calculations where needed for the items that will not be included on the Schedule C. (17 marks) Case 5 Conrad Corporation has $700,000 of taxable income. In determining its eamings and profits for the year, the accountant used the following information: a. Conrad received a dividend of $20,000 from a company in which it has a 60 percent interest. b. It used a $30,000 capital loss carryover to offset its entire capital gain. c. It had a taxable income of $1,000,000 and made charitable contributions of $512,000. had a loss of $20,000 on the sale of some investments to its sole shareholder. e. It received $10,000 in interest on City of Cleveland bonds. d. f. It paid a federal tax of $272,000. What is the corporation's current earnings and profits? (13 marks)

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Depreciation on vacuum cleaners Month placed in service Cost basis MACRS 7year recovery rate Amount Explanation Apr13 60000 1676 10056 Placed in ser...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started