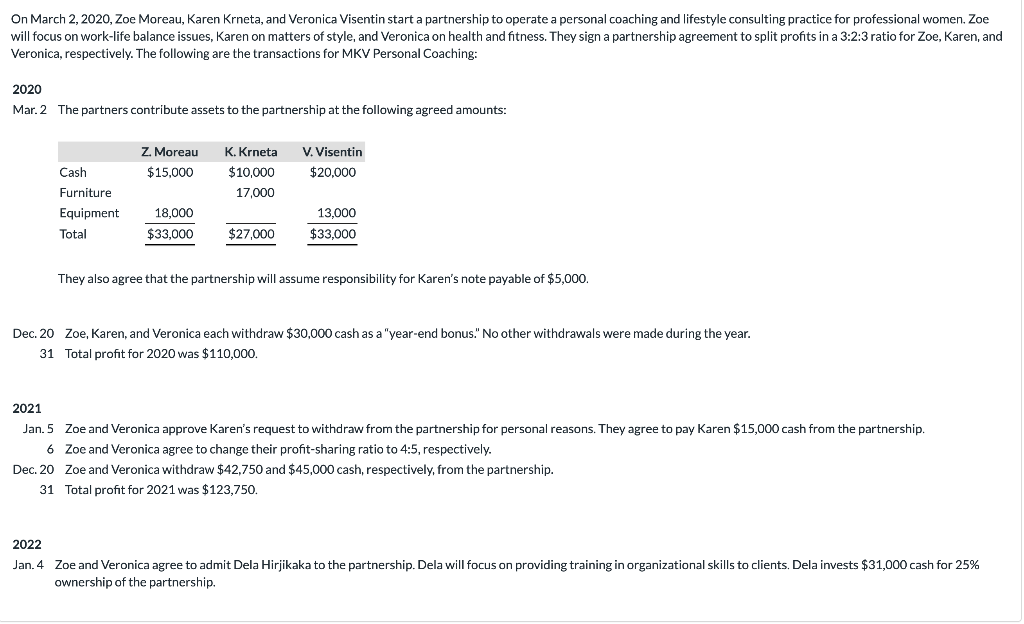

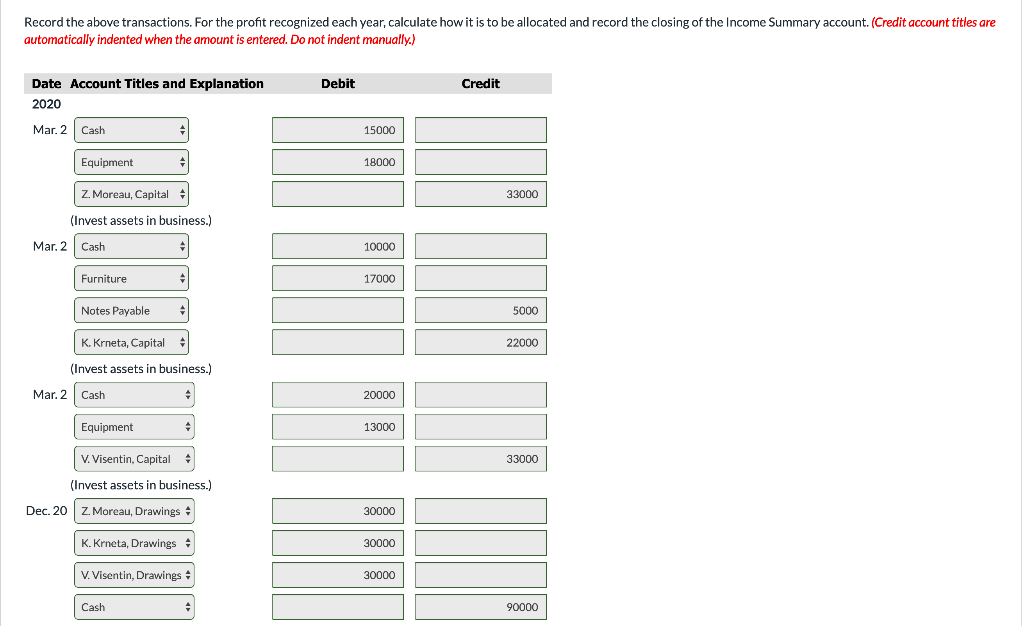

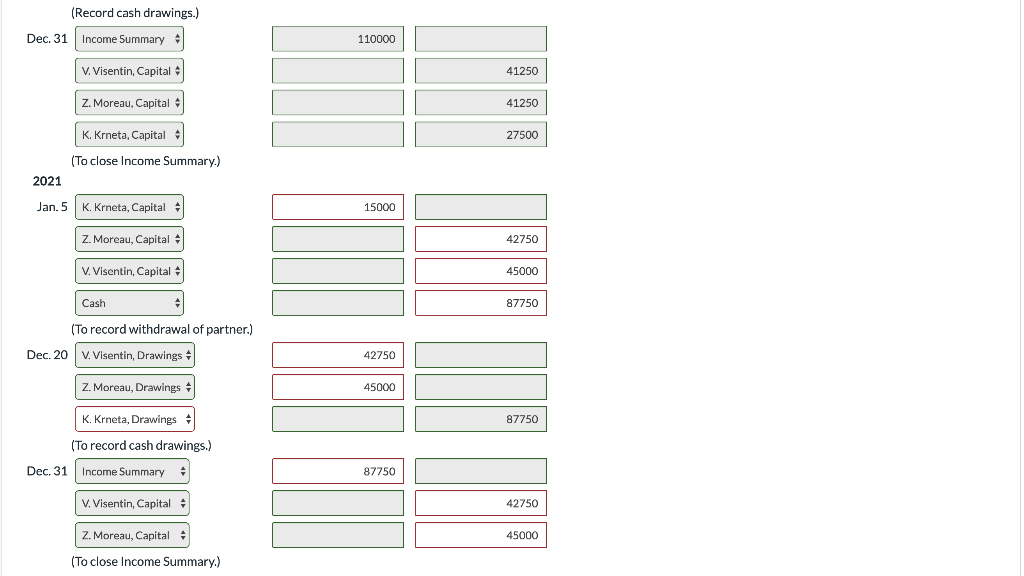

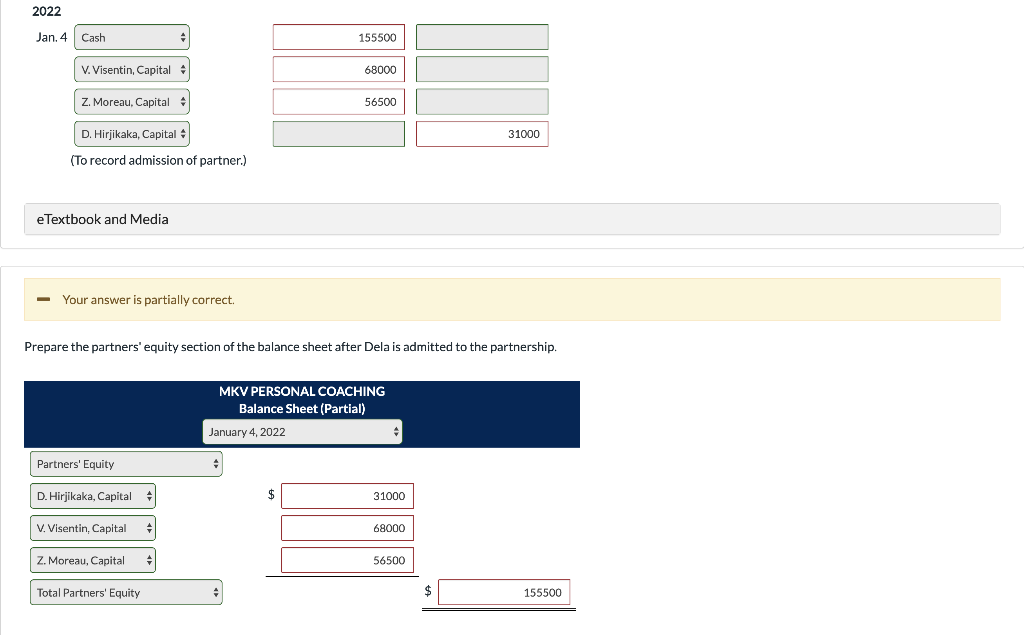

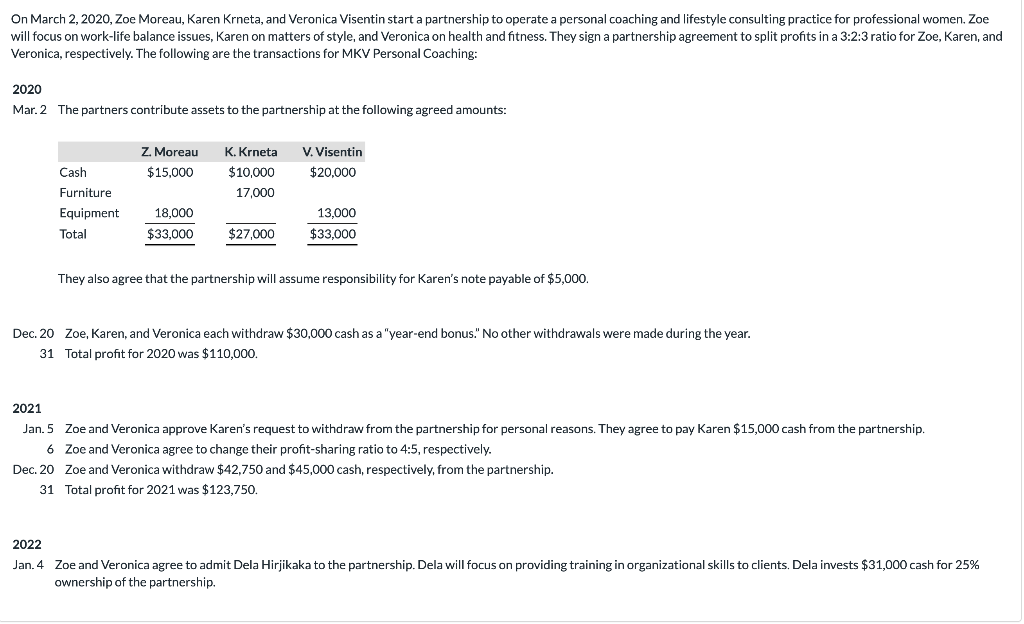

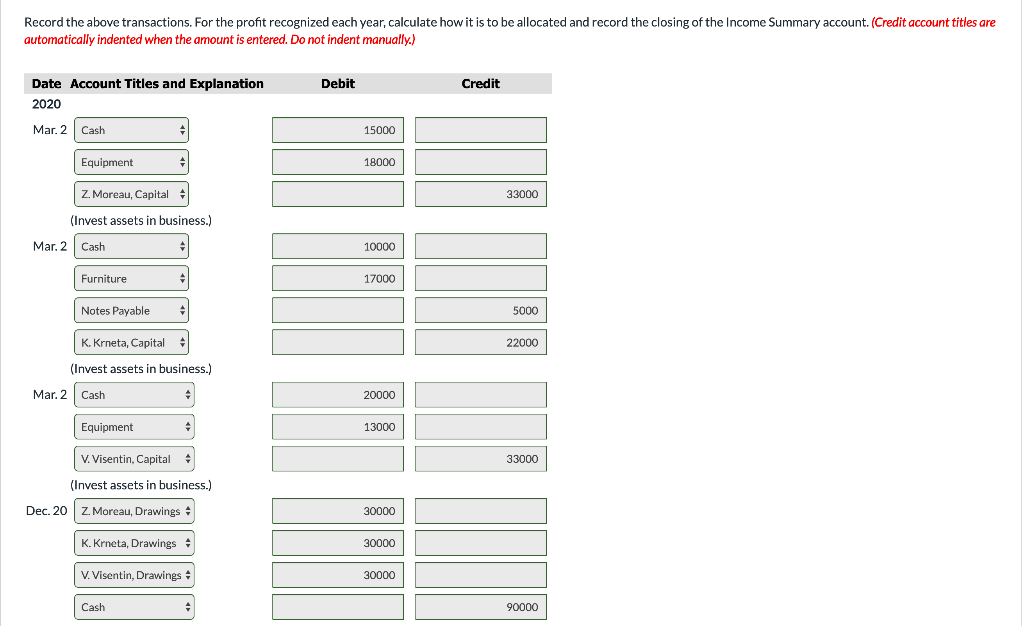

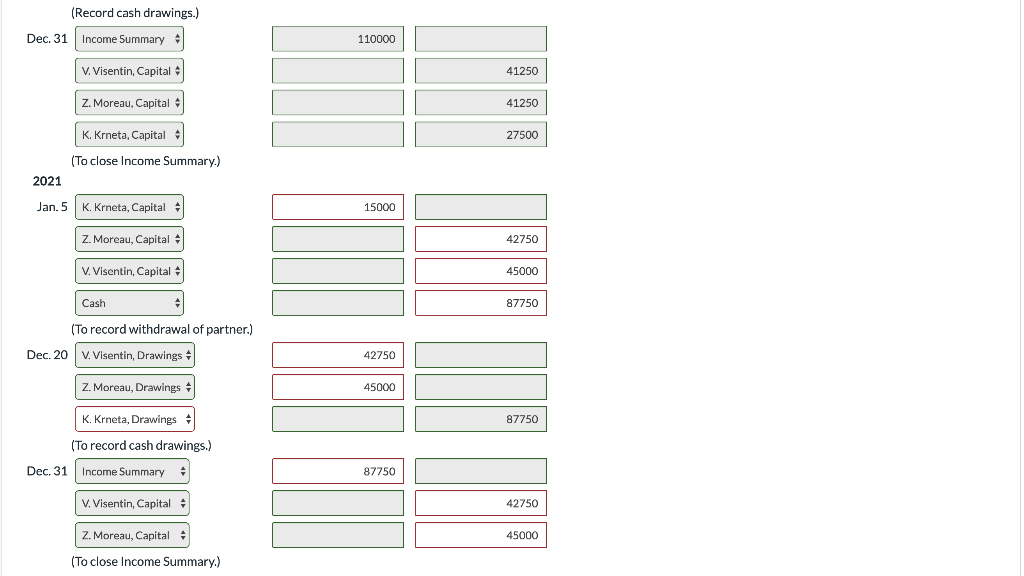

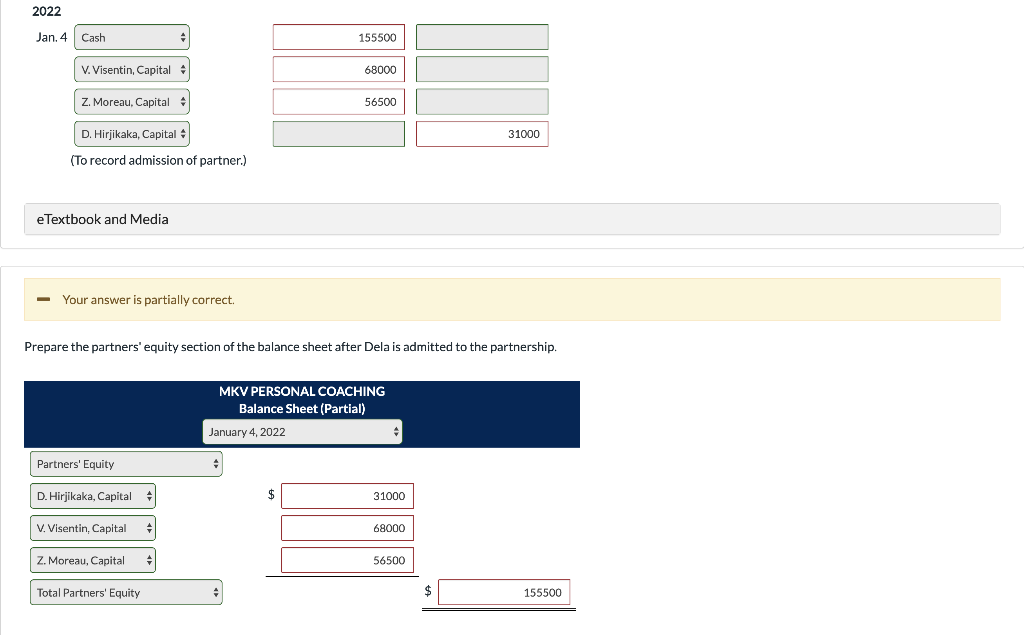

On March 2, 2020, Zoe Moreau, Karen Krneta, and Veronica Visentin start a partnership to operate a personal coaching and lifestyle consulting practice for professional women. Zoe will focus on work-life balance issues, Karen on matters of style, and Veronica on health and fitness. They sign a partnership agreement to split profits in a 3:2:3 ratio for Zoe, Karen, and Veronica, respectively. The following are the transactions for MKV Personal Coaching: 2020 Mar. 2 The partners contribute assets to the partnership at the following agreed amounts: Z. Moreau $15,000 K. Krneta $10,000 17,000 V. Visentin $20,000 Cash Furniture Equipment Total 18,000 13,000 $33,000 $33,000 $27,000 They also agree that the partnership will assume responsibility for Karen's note payable of $5,000. Dec. 20 Zoe, Karen, and Veronica each withdraw $30,000 cash as a "year-end bonus." No other withdrawals were made during the year. 31 Total profit for 2020 was $110,000. 2021 Jan.5 Zoe and Veronica approve Karen's request to withdraw from the partnership for personal reasons. They agree to pay Karen $15,000 cash from the partnership. 6 Zoe and Veronica agree to change their profit-sharing ratio to 4:5, respectively. Dec. 20 Zoe and Veronica withdraw $42,750 and $45,000 cash, respectively, from the partnership. 31 Total profit for 2021 was $123,750. 2022 Jan. 4 Zoe and Veronica agree to admit Dela Hirjikaka to the partnership. Dela will focus on providing training in organizational skills to clients. Dela invests $31,000 cash for 25% ownership of the partnership. Record the above transactions. For the profit recognized each year, calculate how it is to be allocated and record the closing of the Income Summary account. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation 2020 Mar. 2 Cash 15000 Equipment 18000 33000 Z. Moreau, Capital (Invest assets in business.) Mar. 2 Cash 10000 Furniture 17000 Notes Payable 5000 22000 K. Krneta, Capital (Invest assets in business.) Mar. 2 Cash 20000 Equipment 13000 33000 V. Visentin, Capital (Invest assets in business.) Dec. 20 Z. Moreau, Drawings 30000 K. Krneta, Drawings 30000 V. Visentin, Drawings 30000 Cash 90000 (Record cash drawings.) Dec. 31 Income Summary | 110000 V. Visentin, Capital 41250 Z. Moreau, Capital 41250 27500 K. Krneta, Capital (To close Income Summary.) 2021 Jan.5 K. Krneta, Capital 15000 Z. Moreau, Capital 42750 V. Visentin, Capital 45000 Cash 87750 (To record withdrawal of partner.) Dec. 20 V. Visentin, Drawings 42750 Z. Moreau, Drawings 45000 K. Krneta, Drawings 87750 (To record cash drawings.) Dec. 31 Income Summary : 87750 V. Visentin, Capital 42750 45000 Z. Moreau, Capital (To close Income Summary.) 2022 Jan. 4 Cash 155500 V. Visentin, Capital 68000 Z. Moreau, Capital 56500 31000 D. Hirjikaka, Capital (To record admission of partner.) eTextbook and Media - Your answer is partially correct. Prepare the partners' equity section of the balance sheet after Dela is admitted to the partnership. MKV PERSONAL COACHING Balance Sheet (Partial) January 4, 2022 Partners' Equity D. Hirjikaka, Capital - 31000 V. Visentin, Capital 68000 Z. Moreau, Capital 56500 Total Partners' Equity 155500