Question

On March 2, Klaus AG acquired 500 of Max AG's 10,000 outstanding shares with a par value of S10 for $10,000 in cash. Klaus

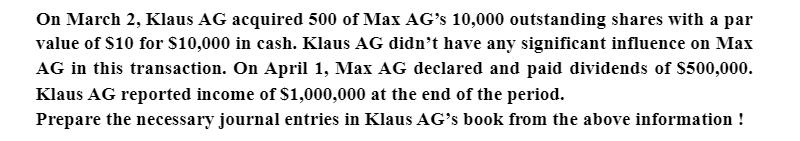

On March 2, Klaus AG acquired 500 of Max AG's 10,000 outstanding shares with a par value of S10 for $10,000 in cash. Klaus AG didn't have any significant influence on Max AG in this transaction. On April 1, Max AG declared and paid dividends of S500,000. Klaus AG reported income of $1,000,000 at the end of the period. Prepare the necessary journal entries in Klaus AG's book from the above information !

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Cost Method Date Account titles Debit Credit March 2 Inve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance A Focused Approach

Authors: Michael C. Ehrhardt, Eugene F. Brigham

4th Edition

1439078084, 978-1439078082

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App