Question

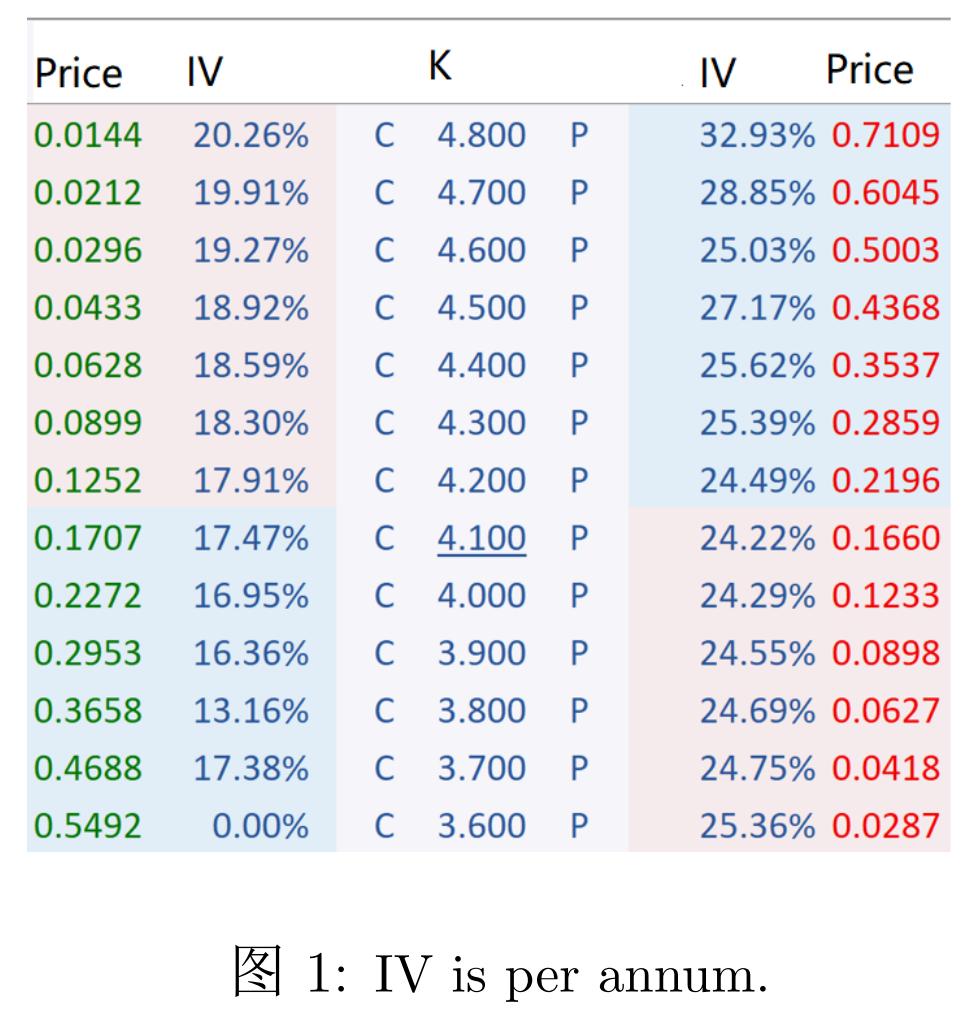

On March 28th 2022, the 300ETF was trading at 4.137. The information about the 2206 300ETF options is given in Figure 1. There are 86

On March 28th 2022, the 300ETF was trading at 4.137. The information about the 2206 300ETF options is given in Figure 1. There are 86 natural days left. Each option contract concerns 10000 shares. Mr. Chen decided to buy a straddle.

(a) Calculate the cost of the straddle (ignore the trading fees). Interpret this cost from the point of view of someone who is selling straddle.

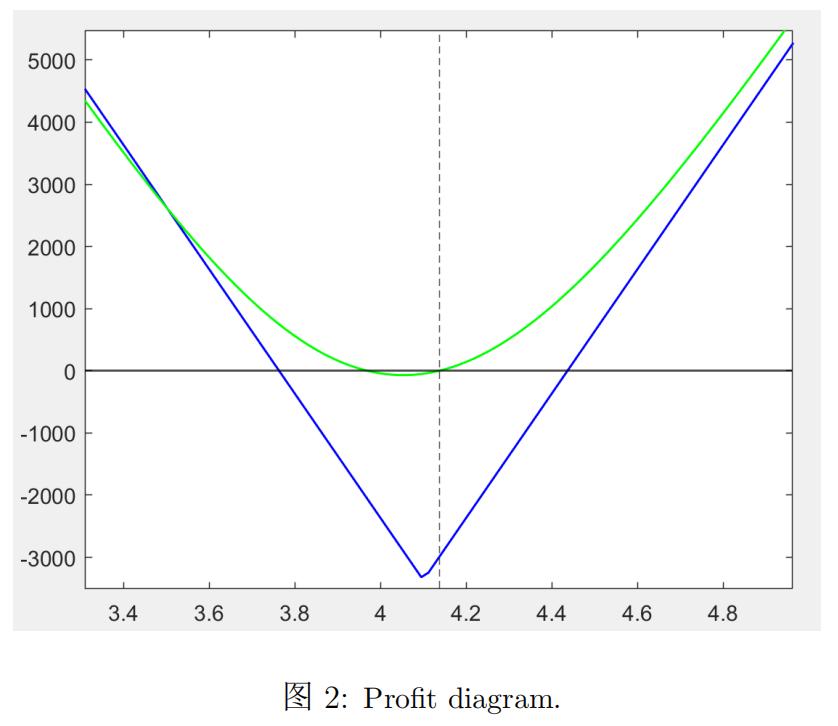

(b) The profifit diagram for Mr. Chen when he opened his straddle is given in Figure 2. Explain the difffference between the two curves in the profifit diagram.

Version:0.9 StartHTML:0000000105 EndHTML:0000003649 StartFragment:0000000141 EndFragment:0000003609

(c) Mr. Chen calculated the following Greek letters for his position. The unit is Yuan.

∆c,p = 68.4,

Γc,p = 32.8,

theta = −19.4,

vega = 156.7.

Interpret these Greek letters. Note that theta should be interpreted with respect to one natural day, while vega should be interpreted with respect to one-percentage point increase in the implied volatility.

Estimate the gain/loss of the position if the underlying moves down by 2%? Ignore the trading fees.

K Price IV 0.0144 20.26% C 4.800 P 0.0212 19.91% C 4.700 P 0.0296 19.27% C 4.600 P 0.0433 18.92% C 4.500 P 0.0628 C 4.400 P 18.59% 0.0899 18.30% C 4.300 P 0.1252 17.91% C 4.200 P 0.1707 17.47% C 4.100 P 0.2272 16.95% C 4.000 P 0.2953 16.36% C 3.900 P 0.3658 13.16% C 3.800 P 0.4688 17.38% C 3.700 P 0.5492 0.00% C 3.600 P IV Price 32.93% 0.7109 28.85% 0.6045 25.03% 0.5003 27.17% 0.4368 25.62% 0.3537 25.39% 0.2859 24.49% 0.2196 24.22% 0.1660 24.29% 0.1233 24.55% 0.0898 24.69% 0.0627 24.75% 0.0418 25.36% 0.0287 1: IV is per annum.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the cost of the straddle we need to add the cost of buying a call option and a put option at the same strike price K In a straddle strategy the investor buys a call and put option with ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started