Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 3, 2020, the Board of Governors of the Federal Reserve System unexpectedly decided to cut interest rates (the Federal Funds Rate) by

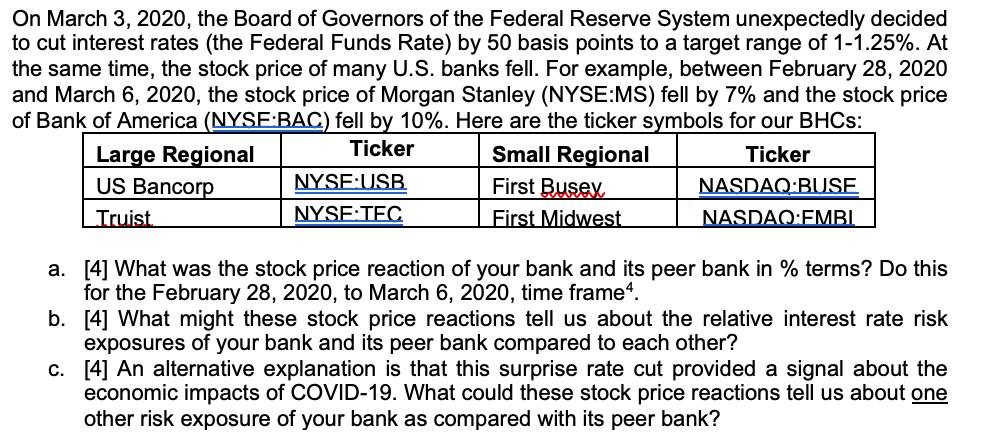

On March 3, 2020, the Board of Governors of the Federal Reserve System unexpectedly decided to cut interest rates (the Federal Funds Rate) by 50 basis points to a target range of 1-1.25%. At the same time, the stock price of many U.S. banks fell. For example, between February 28, 2020 and March 6, 2020, the stock price of Morgan Stanley (NYSE:MS) fell by 7% and the stock price of Bank of America (NYSE:BAC) fell by 10%. Here are the ticker symbols for our BHCS: Ticker Ticker Small Regional First Busey, NASDAQ BUSE First Midwest Large Regional US Bancorp Truist NYSE:USB NYSE:TFC NASDAQ:FMBI a. [4] What was the stock price reaction of your bank and its peer bank in % terms? Do this for the February 28, 2020, to March 6, 2020, time frame. b. [4] What might these stock price reactions tell us about the relative interest rate risk exposures of your bank and its peer bank compared to each other? c. [4] An alternative explanation is that this surprise rate cut provided a signal about the economic impacts of COVID-19. What could these stock price reactions tell us about one other risk exposure of your bank as compared with its peer bank?

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Stock Price Reaction Large Regional Bank US Bancorp NYSE USB Stock price fell by 7 from Feb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started