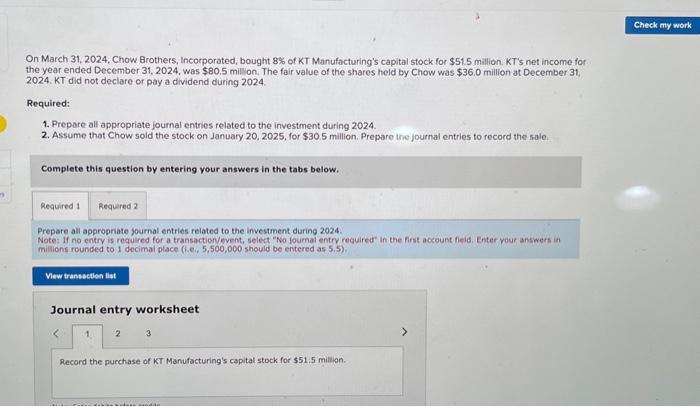

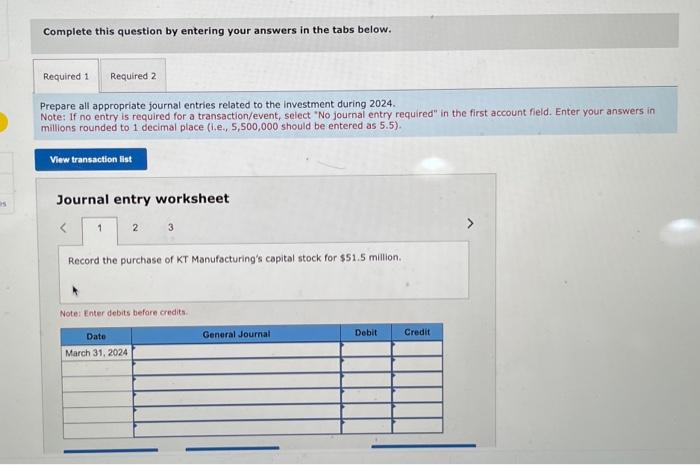

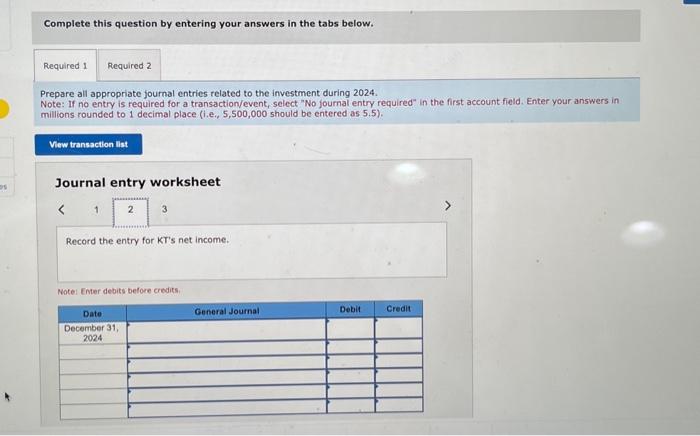

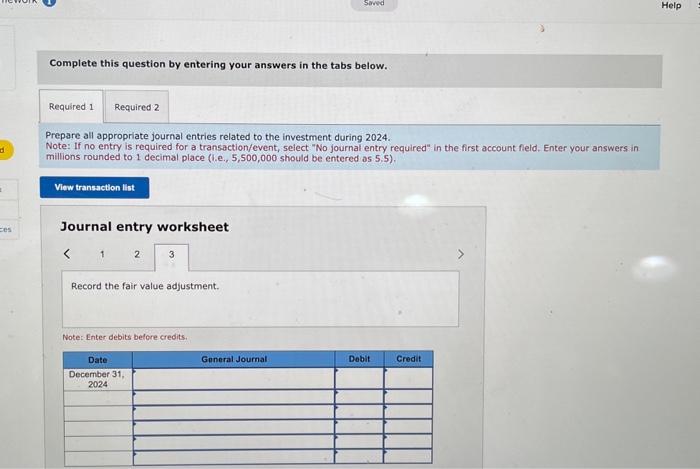

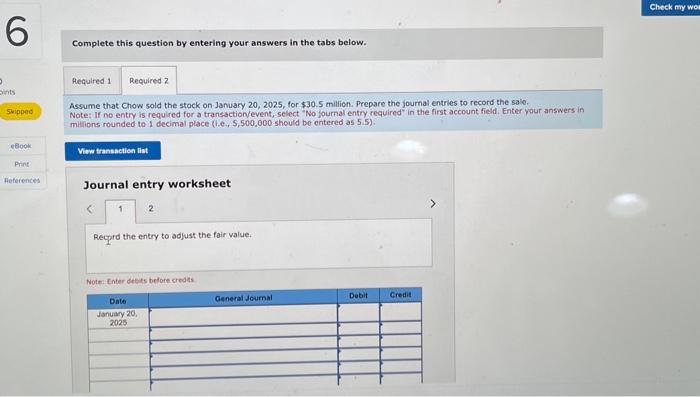

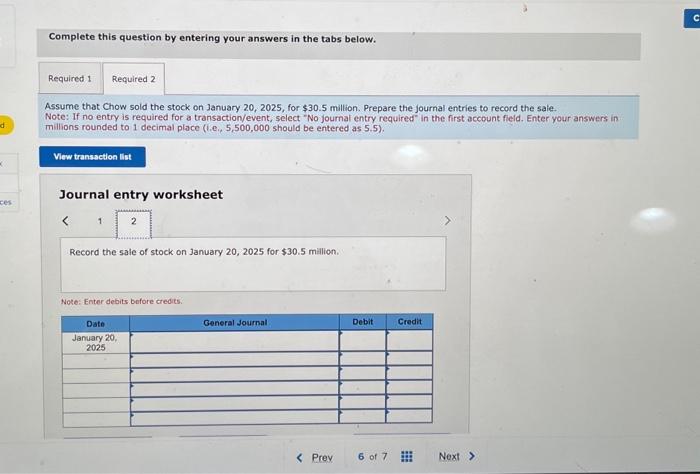

On March 31, 2024, Chow Brothers, Incorporated, bought 8% of KT Manufacturing's capital stock for $51.5 mallion. KT's net income for the year ended December 31,2024 , was $80.5 million. The fair value of the shares held by Chow was $36.0 million at December 31 , 2024. KT did not declare or pay a dividend during 2024. Required: 1. Prepore oll appropriate journal entries related to the investment during 2024. 2. Assume that Chow sold the stock on January 20, 2025, for $30.5 million. Prepare the journal entries to record the sale. Complete this question by entering your answers in the tabs below. Prepare all appropriate fournal entries related to the investment during 2024. Note: If no entry is requlred for a transactionvevent, select "No lournal entry reguired" in the fint accoust field. Enter vour answers in milions rounded to 1 decimal place (h.e., 5,500,000 should be entered as 5,5). Journal entry worksheet 3 Record the purchase of KT Manufacturing's capital stock for $51.5 million. Complete this question by entering your answers in the tabs below. Prepare all appropriate journal entries related to the investment during 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Journal entry worksheet Record the purchase of KT Manufacturing's capital stock for $51.5 million. Note: Enter debits befare credits Complete this question by entering your answers in the tabs below. Prepare all appropriate journal entries related to the investment during 2024. Note: If no entry is required for a transaction/event, select "No joumal entry required" in the first account field. Enter your ansiwers in millions rounded to 1 decimal place (i.e,, 5,500,000 should be entered as 5.5). Journal entry worksheet Notel Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare all appropriate journal entries related to the investment during 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field, Enter your answers in millions rounded to 1 decimal place (l.e., 5,500,000 should be entered os 5,5). Journal entry worksheet Complete this question by entering your answers in the tabs below. Assume that Chow sold the stock on January 20,2025 , for $30.5 million. Prepare the joumal entries to record the sale. Assume that Chow sold the stock on January 20, 2025, for $30.5 million. Prepare the joumal entries to record the sa e. Note: If no entry is required for a transactionvevent, select "No fournal entry required" in the first account field, Enter your answers in millions rounded to 1 decimal place (l.e., 5,500,000 should be entered as 5.5). Journal entry worksheet Complete this question by entering your answers in the tabs below. Assume that Chow sold the stock on January 20,2025 , for $30.5 million. Prepare the journal entries to record the saie. Note: If no entry is required for a transaction/event, select "No joumal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e, 5,500,000 should be entered as 5.5). Journal entry worksheet Record the sale of stock on January 20,2025 for $30.5 million. Note: Enter debits bofore credies