Answered step by step

Verified Expert Solution

Question

1 Approved Answer

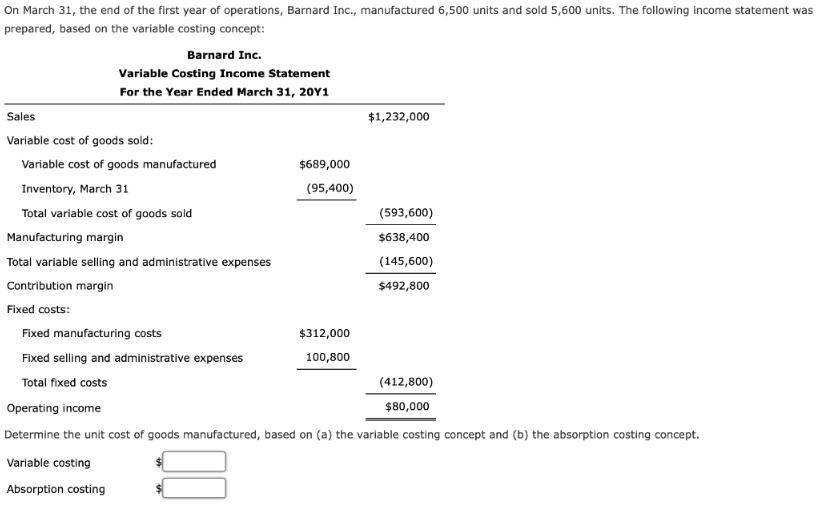

On March 31, the end of the first year of operations, Barnard Inc., manufactured 6,500 units and sold 5,600 units. The following income statement

On March 31, the end of the first year of operations, Barnard Inc., manufactured 6,500 units and sold 5,600 units. The following income statement was prepared, based on the variable costing concept: Barnard Inc. Variable Costing Income Statement For the Year Ended March 31, 20Y1 Sales $1,232,000 Variable cost of goods sold: Variable cost of goods manufactured $689,000 Inventory, March 31 (95,400) Total variable cost of goods sold (593,600) Manufacturing margin $638,400 Total variable selling and administrative expenses (145,600) Contribution margin $492,800 Fixed costs: Fixed manufacturing costs $312,000 Fixed selling and administrative expenses 100,800 Total fixed costs (412,800) Operating income $80,000 Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept. Variable costing Absorption costing

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Particulars Amount Unit Product Cost under Variable Costing 106 Per Unit Unit Product ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started