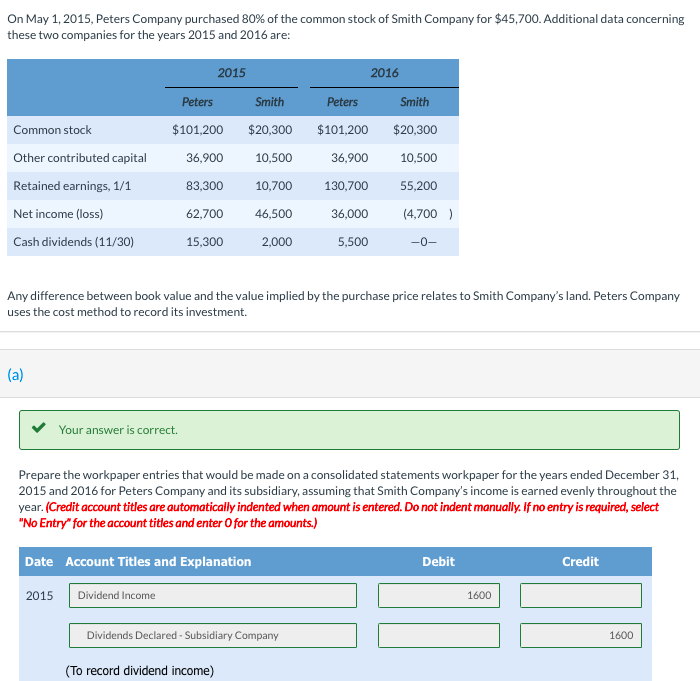

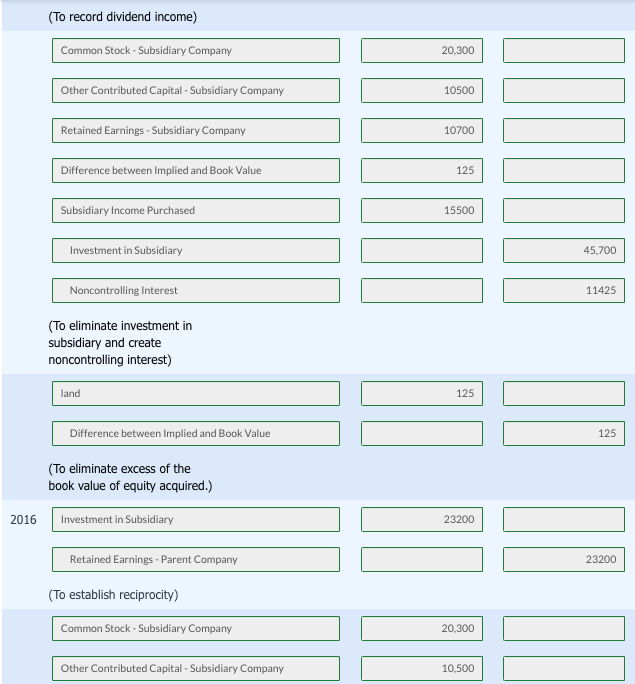

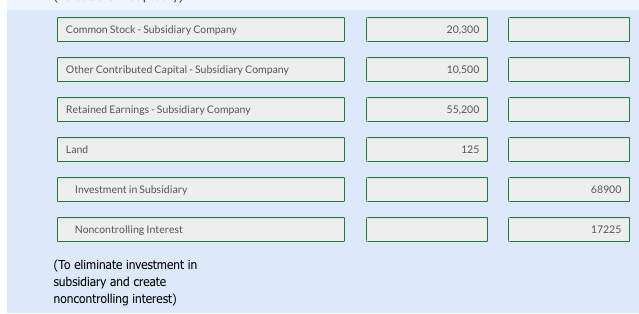

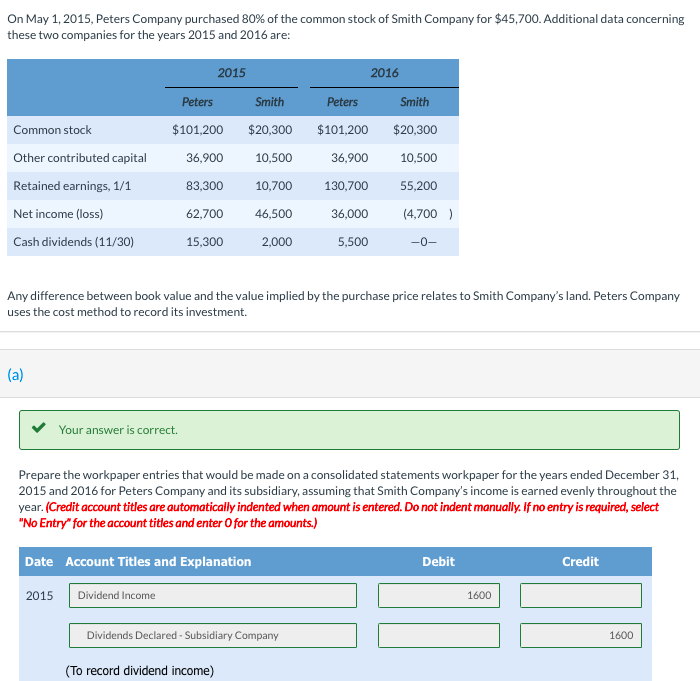

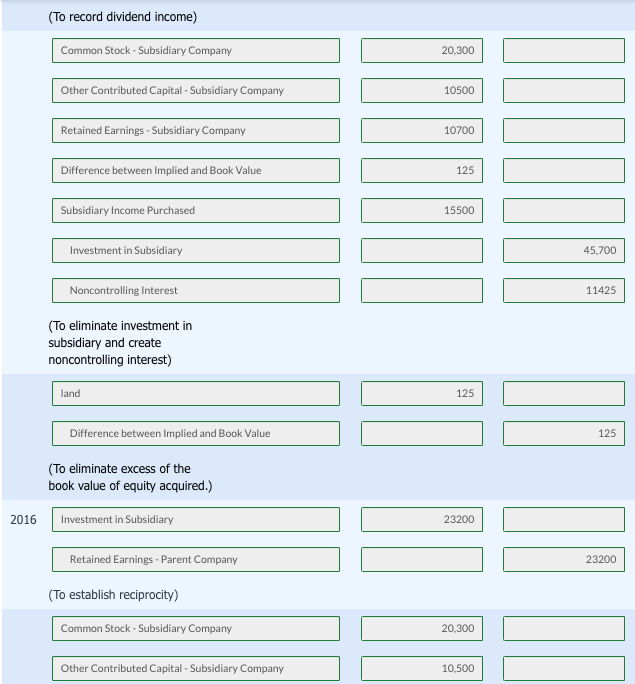

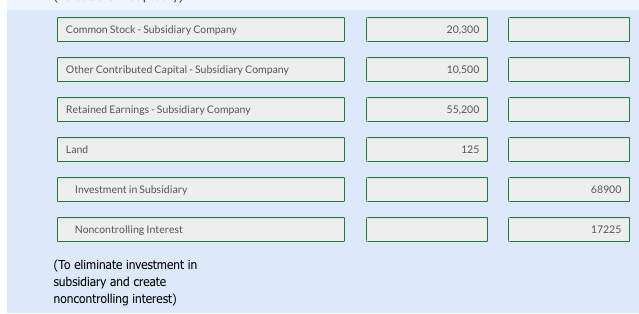

On May 1, 2015, Peters Company purchased 80% of the common stock of Smith Company for $45,700. Additional data concerning these two companies for the years 2015 and 2016 are: 2015 2016 Peters Smith Peters Smith Common stock $101,200 $20,300 $101,200 $20,300 Other contributed capital 36,900 10,500 36,900 10,500 Retained earnings, 1/1 83,300 10,700 130,700 55,200 Net income (loss) 62,700 46,500 36,000 (4,700) Cash dividends (11/30) 15,300 2,000 5,500 -0- Any difference between book value and the value implied by the purchase price relates to Smith Company's land. Peters Company uses the cost method to record its investment. (a) Your answer is correct. Prepare the workpaper entries that would be made on a consolidated statements workpaper for the years ended December 31, 2015 and 2016 for Peters Company and its subsidiary, assuming that Smith Company's income is earned evenly throughout the year. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit 2015 Dividend Income 1600 Dividends Declared - Subsidiary Company 1600 (To record dividend income) (To record dividend income) Common Stock - Subsidiary Company 20,300 Other Contributed Capital - Subsidiary Company 10500 Retained Earnings - Subsidiary Company 10700 Difference between Implied and Book Value 125 Subsidiary Income Purchased 15500 Investment in Subsidiary 45,700 Noncontrolling Interest 11425 (To eliminate investment in subsidiary and create noncontrolling interest) land 125 Difference between Implied and Book Value 125 (To eliminate excess of the book value of equity acquired.) 2016 Investment in Subsidiary 23200 Retained Earnings - Parent Company 23200 (To establish reciprocity) Common Stock - Subsidiary Company 20,300 Other Contributed Capital - Subsidiary Company 10.500 Common Stock - Subsidiary Company 20.300 Other Contributed Capital - Subsidiary Company 10.500 Retained Earnings - Subsidiary Company 55,200 Land 125 Investment in Subsidiary 68900 Noncontrolling Interest 17225 (To eliminate investment in subsidiary and create noncontrolling interest) Calculate controlling interest in consolidated net income and consolidated retained earnings for 2015 and 2016. 2015 2016 Controlling interest in consolidated net income Consolidated Retained Earnings $ $