Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On May 1, 2020, Evergreen Company is entering liquidation. Its balance sheet, prepared using GAAP for a going concern, is as follows: Cash Accounts

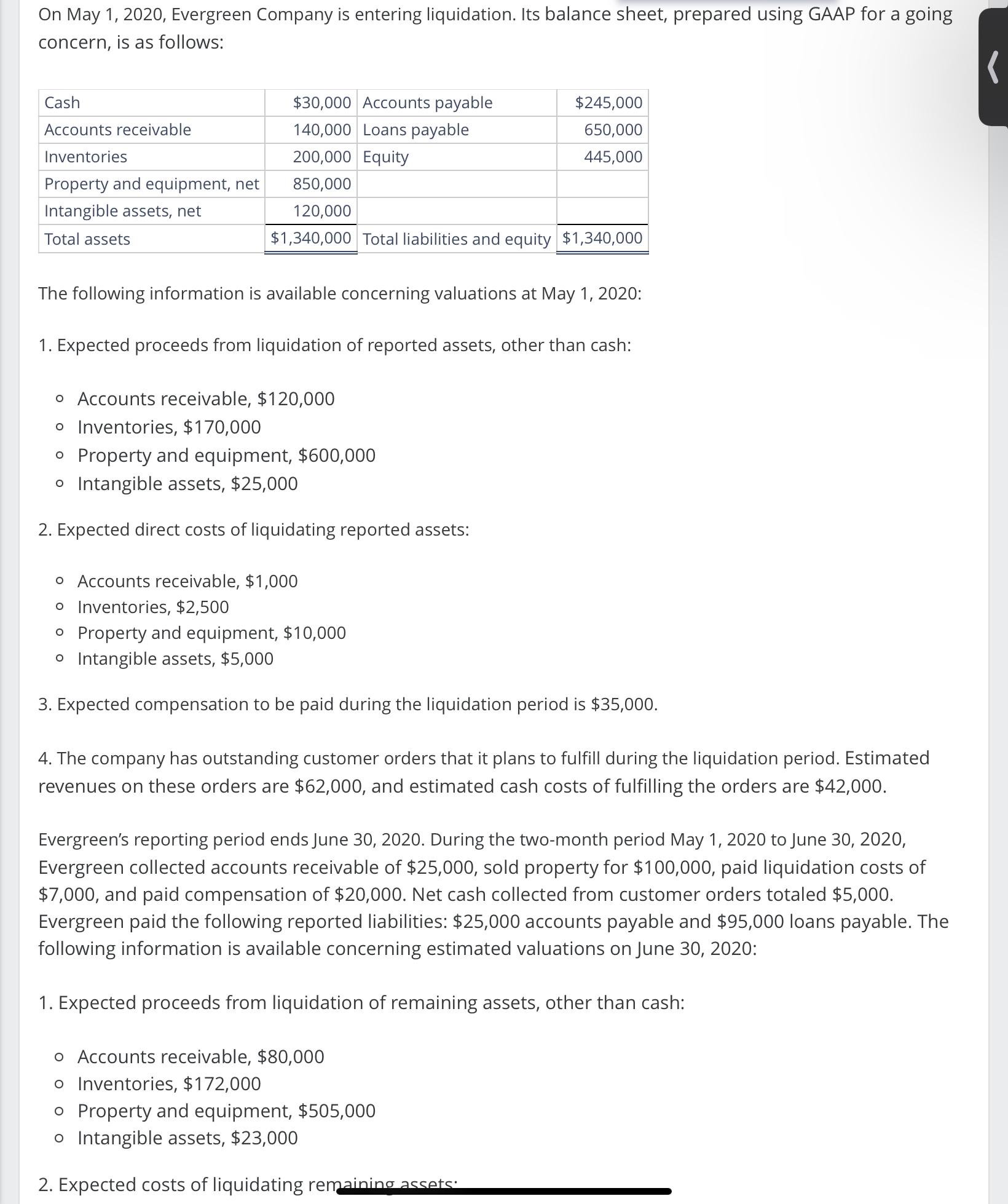

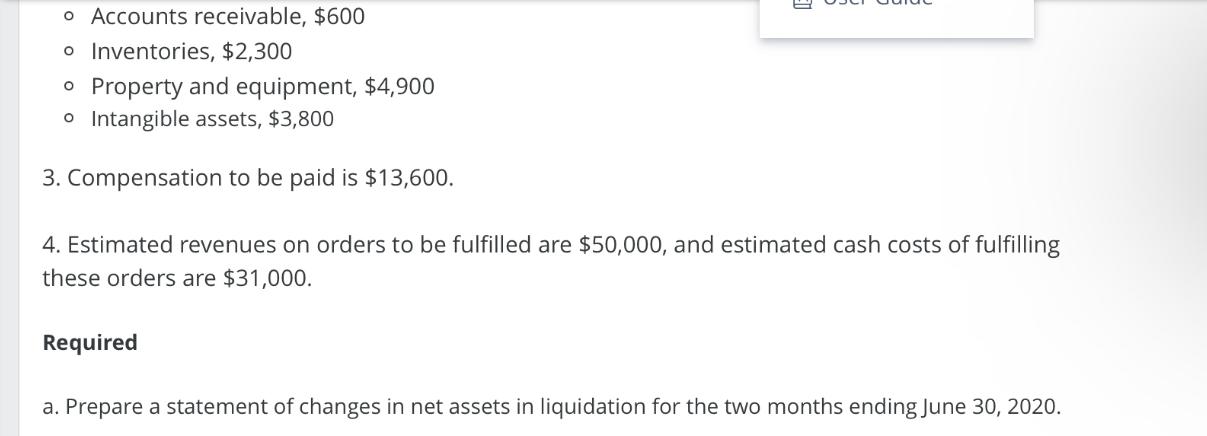

On May 1, 2020, Evergreen Company is entering liquidation. Its balance sheet, prepared using GAAP for a going concern, is as follows: Cash Accounts receivable Inventories Property and equipment, net Intangible assets, net Total assets $30,000 Accounts payable 140,000 Loans payable 200,000 Equity 850,000 120,000 $1,340,000 Total liabilities and equity $1,340,000 The following information is available concerning valuations at May 1, 2020: $245,000 650,000 445,000 1. Expected proceeds from liquidation of reported assets, other than cash: o Accounts receivable, $120,000 o Inventories, $170,000 o Property and equipment, $600,000 o Intangible assets, $25,000 2. Expected direct costs of liquidating reported assets: o Accounts receivable, $1,000 o Inventories, $2,500 o Property and equipment, $10,000 o Intangible assets, $5,000 3. Expected compensation to be paid during the liquidation period is $35,000. 4. The company has outstanding customer orders that it plans to fulfill during the liquidation period. Estimated revenues on these orders are $62,000, and estimated cash costs of fulfilling the orders are $42,000. Evergreen's reporting period ends June 30, 2020. During the two-month period May 1, 2020 to June 30, 2020, Evergreen collected accounts receivable of $25,000, sold property for $100,000, paid liquidation costs of $7,000, and paid compensation of $20,000. Net cash collected from customer orders totaled $5,000. Evergreen paid the following reported liabilities: $25,000 accounts payable and $95,000 loans payable. The following information is available concerning estimated valuations on June 30, 2020: 1. Expected proceeds from liquidation of remaining assets, other than cash: o Accounts receivable, $80,000 o Inventories, $172,000 o Property and equipment, $505,000 o Intangible assets, $23,000 2. Expected costs of liquidating remaining assets: ( o Accounts receivable, $600 o Inventories, $2,300 o Property and equipment, $4,900 o Intangible assets, $3,800 3. Compensation to be paid is $13,600. 30 4. Estimated revenues on orders to be fulfilled are $50,000, and estimated cash costs of fulfilling these orders are $31,000. Required a. Prepare a statement of changes in net assets in liquidation for the two months ending June 30, 2020. b. Prepare a statement of net assets in liquidation as of June 30, 2020.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started