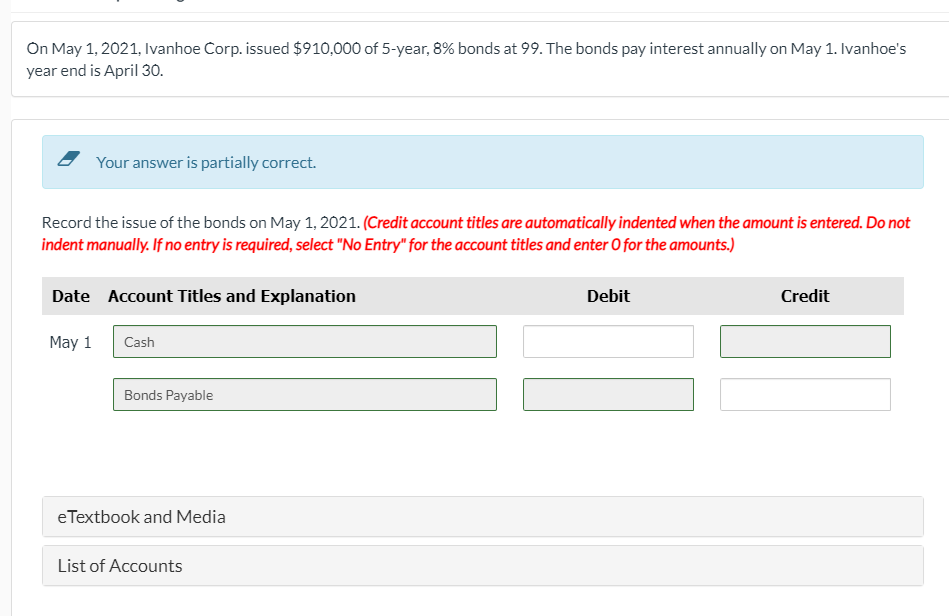

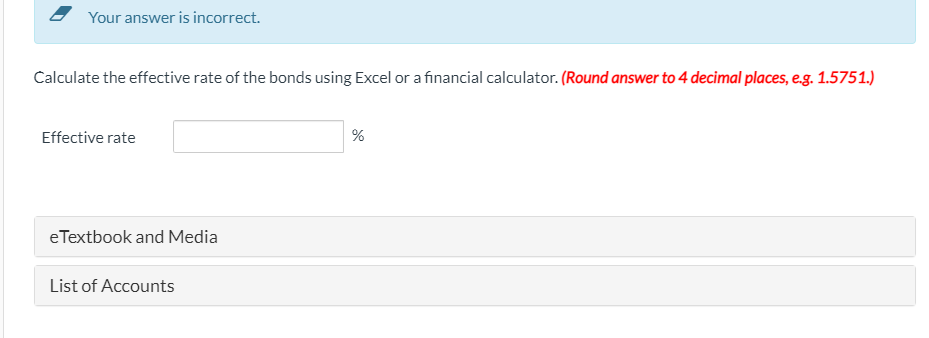

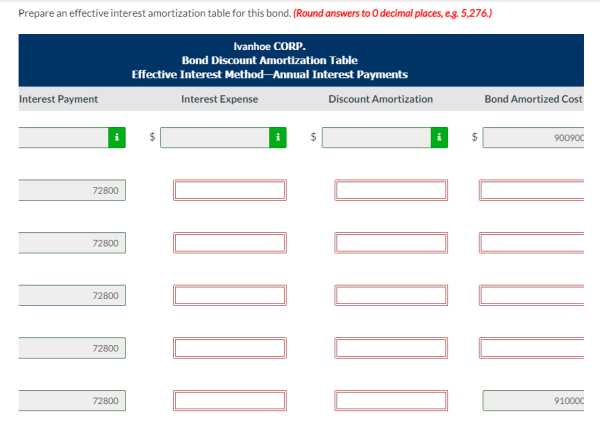

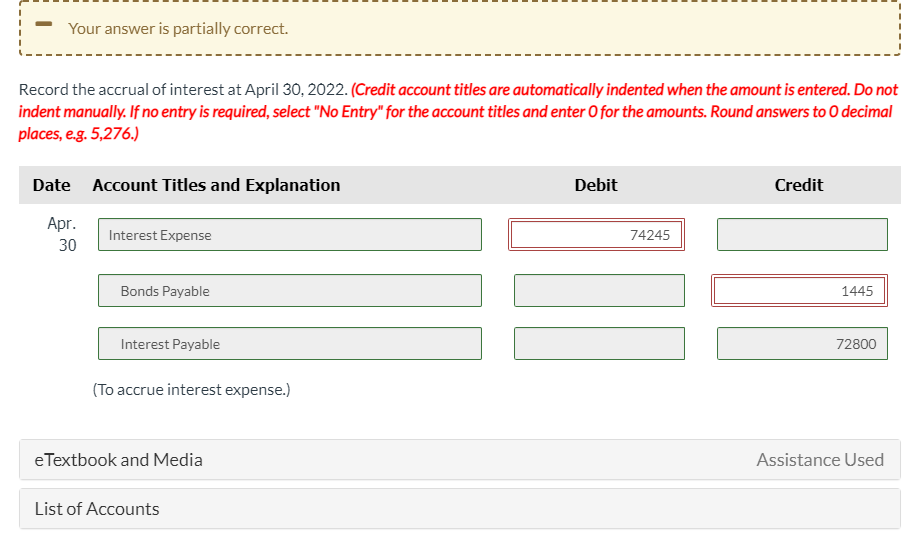

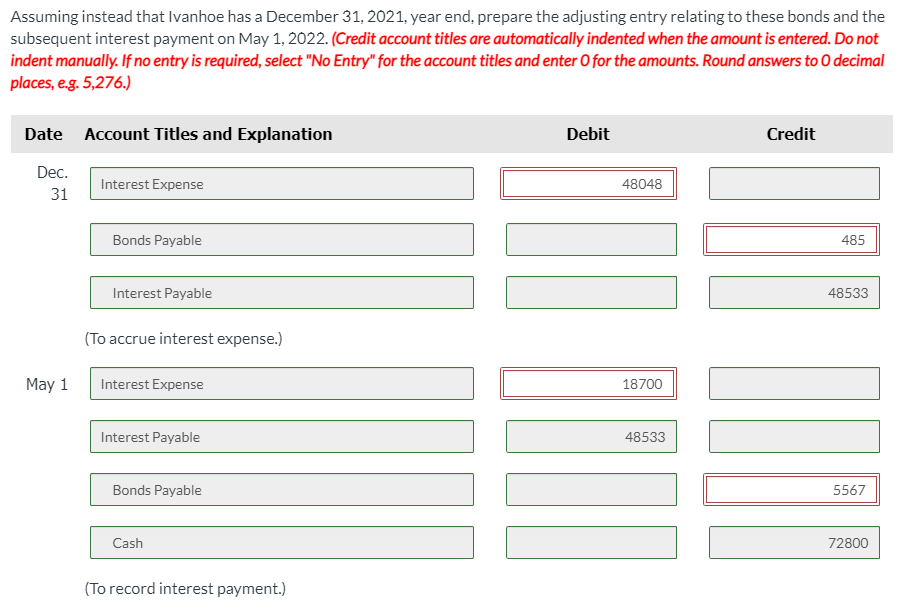

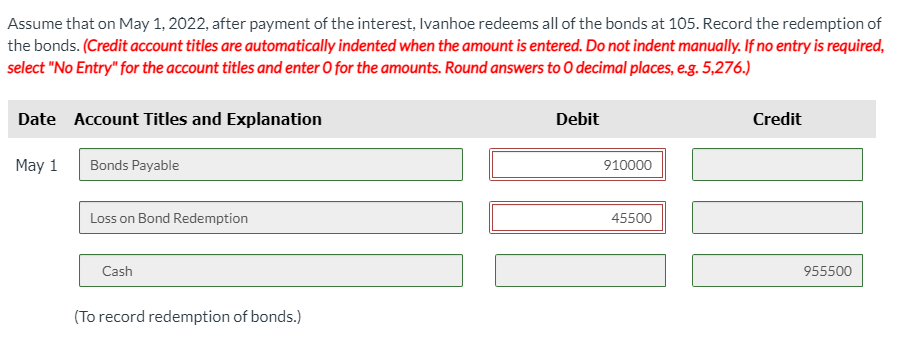

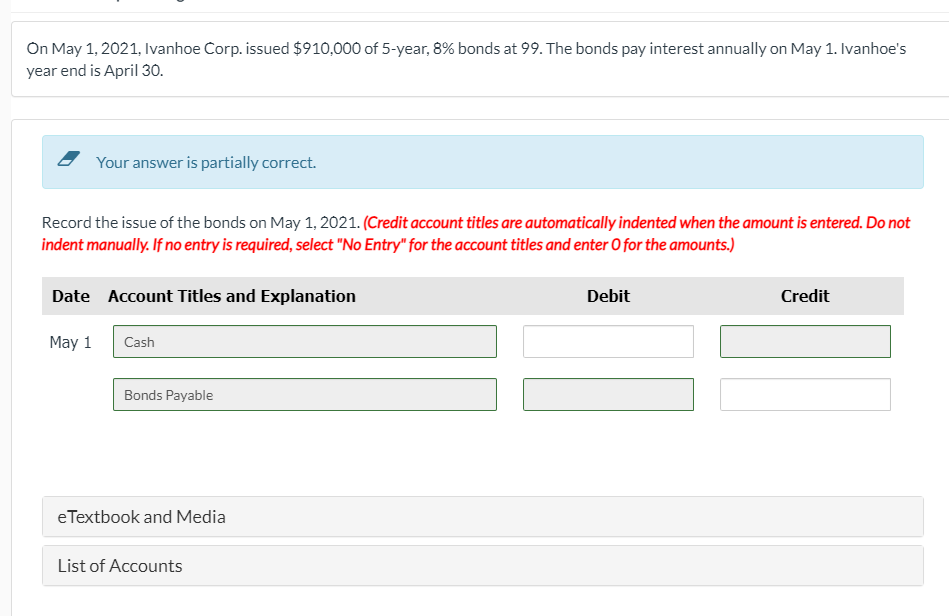

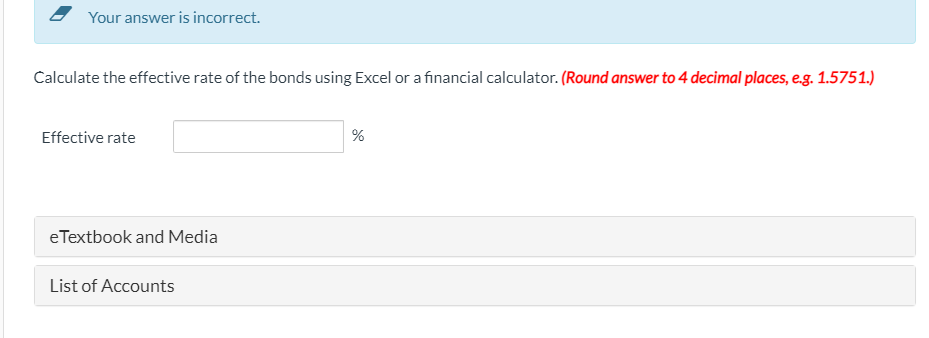

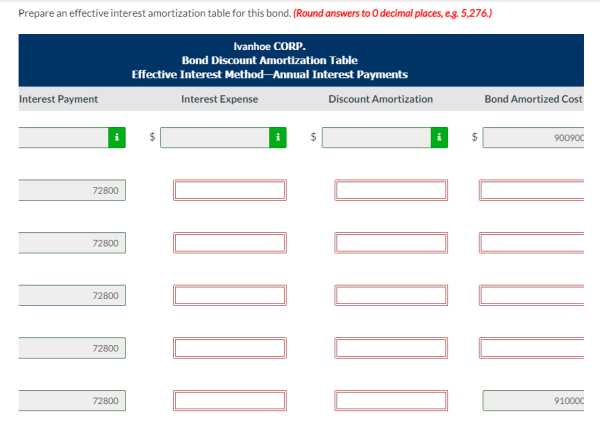

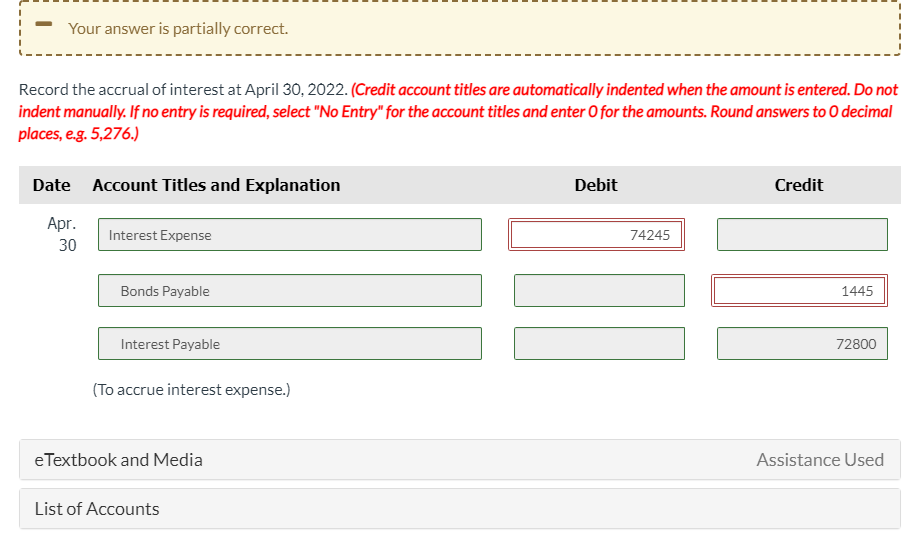

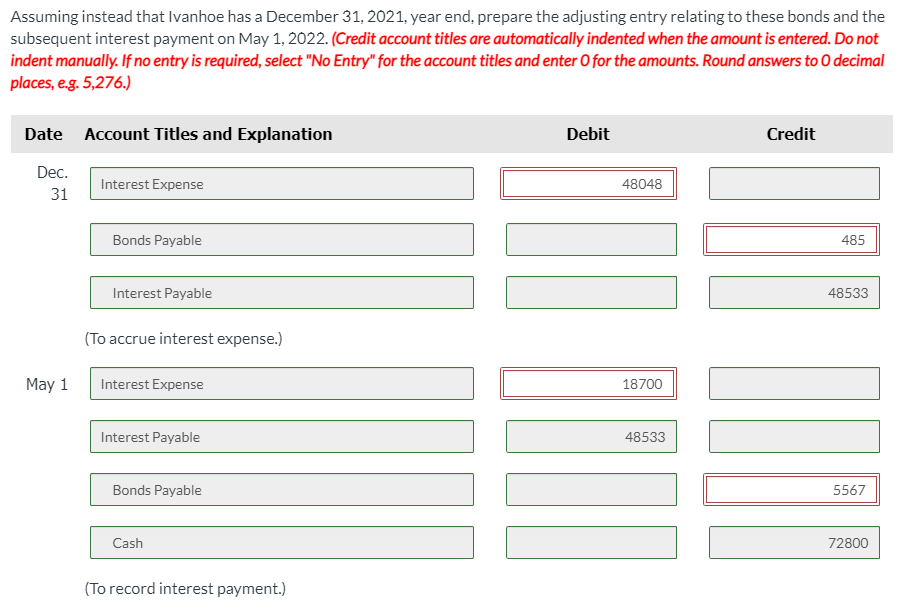

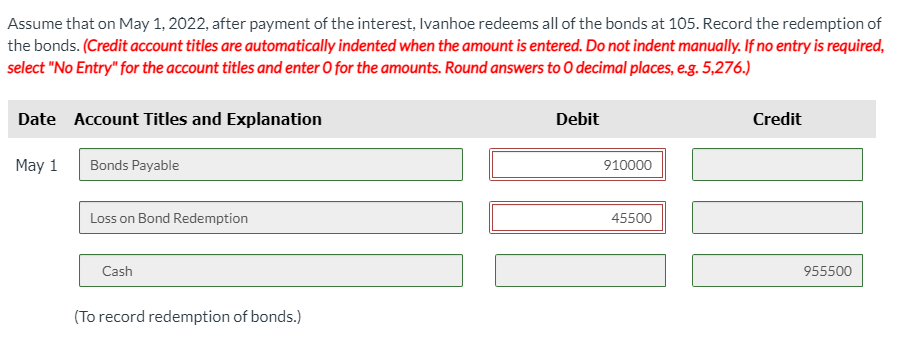

On May 1, 2021, Ivanhoe Corp. issued $910,000 of 5-year, 8% bonds at 99. The bonds pay interest annually on May 1. Ivanhoe's year end is April 30. . Your answer is partially correct. Record the issue of the bonds on May 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit May 1 Cash Bonds Payable e Textbook and Media List of Accounts Your answer is incorrect. Calculate the effective rate of the bonds using Excel or a financial calculator. (Round answer to 4 decimal places, e.g. 1.5751.) Effective rate % eTextbook and Media List of Accounts Prepare an effective interest amortization table for this bond. (Round answers to decimal places, eg. 5,276.) Ivanhoe CORP. Bond Discount Amortization Table Effective Interest MethodAnnual Interest Payments Interest Expense Discount Amortization Interest Payment Bond Amortized Cost 900900 72800 72800 IIIIT. IIII. 72800 72800 72800 91000C Your answer is partially correct. Record the accrual of interest at April 30, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g. 5,276.) Date Account Titles and Explanation Debit Credit Apr. 30 Interest Expense 74245 Bonds Payable 1445 Interest Payable 72800 (To accrue interest expense.) e Textbook and Media Assistance Used List of Accounts Assuming instead that Ivanhoe has a December 31, 2021, year end, prepare the adjusting entry relating to these bonds and the subsequent interest payment on May 1, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts. Round answers to O decimal places, e.g. 5,276.) Date Account Titles and Explanation Debit Credit Dec. 31 Interest Expense 48048 Bonds Payable 485 Interest Payable 48533 (To accrue interest expense.) May 1 Interest Expense 18700 Interest Payable 48533 Bonds Payable 5567 Cash 72800 (To record interest payment.) Assume that on May 1, 2022, after payment of the interest, Ivanhoe redeems all of the bonds at 105. Record the redemption of the bonds. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places, e.g. 5,276.) Date Account Titles and Explanation Debit Credit May 1 Bonds Payable 910000 Loss on Bond Redemption 45500 Cash 955500 (To record redemption of bonds.)